views

Amazon.com, Inc. has briefly crossed the trillion dollar market valuation mark, becoming the second company ever to do so. A rise in Amazon’s share price of Amazon, listed on the Nasdaq stock exchange in the US, took the company past the trillion-dollar mark for the first time—when the stock touched $2,050.50 in morning trading. The company’s value is pegged at $988.43 billion at the time of writing this. But it is perhaps just a matter of time.

Amazon becomes the second company to breach that coveted mark, since Apple became the first ever company to cross the trillion dollar valuation mark in August. At present, Apple is valued at $1.1 trillion.

This is the latest chapter in Amazon’s rapid rise over the past few year. Amazon’s latest surge comes after the company gained 103% in the past twelve months, which added around $520bn in equity value, according to estimates. Incidentally, this is more than the entire market cap of Facebook.com, which currently is valued at $493.17 billion.

The recent strong quarterly numbers add on to the steady growth—Amazon recorded of its first quarterly net income above $2bn. As we headed into 2018, Amazon was valued at around $580 billion. Last month, independent investment research firm D.M. Martins Research believes that Amazon could touch the “$2 trillion in market cap by the end of 2020. Just last month, investment bankers Morgan Stanley have boosted the share price target for Amazon from $1,850 to $2,500 per share, which is a 29 percent change.

It is predicted that Amazon’s high profit margin businesses including Web Services cloud computing, subscriptions and advertising will generate about $45 billion in profit by the year 2020, up from an expected $25 billion profit this year.

Apple became the first trillion dollar company—and it hasn’t looked back since, unlike Amazon falling back below the trillion dollar mark now—came on the back of successive strong quarters and the fact that the iPhone X remained the company's best-selling iPhone for significant periods since its launch last year, contrary to critics who said it was too expensive. The iPhones sold in Q3 2018 had an average selling price pegged at $724—significantly higher than the $606 average selling price for iPhone range in the corresponding quarter in 2017.

Tech giants Microsoft, currently valued at $852.94 billion and Google’s parent company Alphabet Inc., valued at $839.67 billion, are in the race to reach the trillion dollar mark as well.

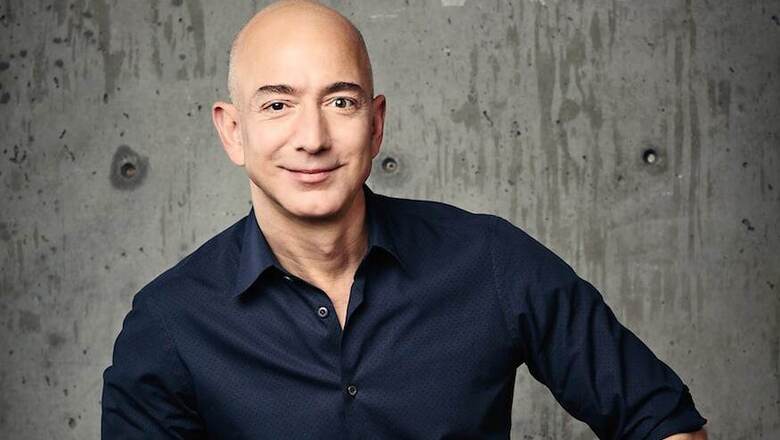

In the midst of all this positive news for Amazon, it should not be forgotten that the company is facing a lot of criticism from the current US administration. Back in July, President Donald Trump retorted to the Washington Post newspaper’s criticism of Trump’s policies, and posted on Twitter, “Amazon Washington Post has gone crazy against me.” Amazon founder Jeff Bezos bought over the Washington Post newspaper in 2013, though the editorial operations have been kept separate from Amazon.

It is perhaps a matter of time before Amazon crosses back over the trillion dollar valuation mark, and stays there.

Also read: As it Turns Out, Premium Positioning Wasn’t a Hurdle in Apple’s Trillion-Dollar Aspirations

Also read: Amazon Could Soon Join Apple in The $1 Trillion Club, And Then it is Race on Again

Comments

0 comment