views

Maximizing Your Chances of Qualifying for the Loan

Find an improved lot. Since a “spec loan” is a loan for a construction project without any committed buyers, it is inherently riskier than many other construction loans. Therefore you’ll maximize your chances of qualifying for the loan if you choose to build on a lot that isn’t completely undeveloped. In other words, the land needs to be “improved.” Raw land, as opposed to improved land, doesn’t have roads, curbs, water or sewer lines, or electric hookups. Improved land is more valuable and more likely to be near urban spaces and centers of population, so it’s more likely you’ll be able to find a buyer for your completed construction project.

Choose a project you can quickly complete. Construction loans are usually short term loans—they last only as long as the length of the project, and the money is paid out in stages rather than all at once. If you’re new to getting loans for spec projects, it’s best to start with projects that can be completed quickly to minimize the lender’s risk. While the construction loan is active, payments are based on the interest for the amount of money disbursed, so payments are typically low in the beginning. When the project ends, the money all comes due at once. The borrower either pays for the balance of the loan immediately, or they get another loan (typically a mortgage loan) to satisfy the balance of the construction loan.

Use the land as equity. Another way to maximize the chances of getting a construction loan is to give the lender equity in the land. In fact, some lenders will even require you to do this. You could use is as the whole down payment, a portion of the down payment, or some combination of the two. By putting the lot up as the down payment, the loan is “secured,” which means the loaned money can be recovered in case of default by seizing the securitized property. Lenders usually won’t credit all of your equity as security. So if you had $100,000 of equity in the land and you wanted to use the value of your equity as a down payment for the construction loan, they might give you a credit for that equity of $80,000.

Bring in partners. Another way to improve your chances of getting approved for a construction loan is to bring partners into the project. Partners can do a few things to help your chances in getting approved for a loan. First, a partner with a better credit history than your own will make the venture more creditworthy. A partner can also help with a down payment. Finally, a partner can improve the asset picture of the people applying for the loan if their debt to asset ratio is stronger than the primary applicant’s. Of course, a partner who is more indebted than the primary applicant can make the financial position look weaker and not stronger. Bringing in a partner will also cut into your profits.

Develop a compelling story. Spec loans are often called “story loans,” and for good reason. Since there isn’t a buyer, the lender is loaning money on a possibility. It’s much more risky. As a matter of course, you need to work harder to sell the idea of the loan to the lender. In order to entice the lender to take the risk, you need to construct a story about the project--where it began, what you want to do with it, and where it will end up. Do what you can to frame the loan as an opportunity rather than a risk. A broker can be very helpful in this area. The location of a project is always a major factor in the strength of an investment in real estate. Since you believe in the location, make the lender believe in the location. Explain why the area’s infrastructure, development patterns, and the specific characteristics of your construction project make this a worthwhile venture. For example, if you have a shortage of rental properties in your area and a college sixty miles away is being consolidated with the local university, those are two factors—an increasing demand and a dwindling supply—that might make your project for a new apartment building a worthwhile venture.

Finding a Lender

Reach out to a broker. A broker can negotiate your options for you, so it is worth getting into contact with one. This can help to simplify the process for you and ensure that everything runs as smoothly as possible.

Talk to a large bank. The largest banks offer advantages in the way of economies of scale. Because they are larger than the other players in the market, they can afford a smaller profit margin than smaller lenders. They can therefore offer lower rates than smaller lenders. Since less money is the best money, these lenders should be the first ones you approach. Nonetheless, the larger lenders tend to be more conservative with respect to construction and development loans than community banks. For example, a 2% margin on $1 million is $20,000. A 5% margin on $250,000 is only $12,500. The larger banks are more conservative for a couple reasons. One, they don’t know as much about a local market as a community bank does. There are always idiosyncratic and hard-to-quantify factors that can make something a good or bad risk, and these are more difficult to identify from afar. Two, even if a larger bank is less leveraged than a smaller bank, the absolute dollar value is still a factor—a $1 billion shortfall is nearly always a bigger deal than a $100,000 shortfall.

Approach a community bank. As mentioned above, a community bank will have greater expertise about a local market than a national bank. They are the primary source of financing for building projects across the US. This expertise can make it easier to sell a community bank on your “story of the loan” than it would a larger bank. In addition, since it’s more difficult for a community bank to make money from massive amounts of smaller home and auto loans, they have to be more aggressive in finding sources of profit. While an older community bank might be able to give you a better rate, new local banks are typically looking more aggressively for opportunities to profit. While they may not be able to lend quite as much, they might be more willing to take a risk where a more established lender doesn’t see the need.

Research non-regulated lenders. Non-regulated lenders (usually called “financial groups” or “investment partners”) can be good sources for funding if banks turn you down. As a matter of course, these lenders usually look for equity in the projects they finance. They are therefore less likely to emphasize your financial position and more likely to emphasize your ability to complete the project and the value of the completed project. While these loans are usually higher interest, they are also usually “non-recourse” loans. A non-recourse loan is a loan that allows the lender to seize the collateral asset but nothing else. Make sure you’ve really boned up on the details of the market before you ask a lender of this type for a loan. One of the ways they estimate a builder’s ability to execute the project is by asking more detailed questions about the local market than more conventional lenders. Pay particular attention to similar types of construction projects underway or scheduled to get underway, the selling prices of similar units in the area, and the prospective demand levels by the time your project will be completed.

See what you can do to put together a group of private investors. Private investors are not institutions at all, but wealthy individuals searching for investment opportunities. As such, it’s difficult to make many generalizations about them. However, you can expect a few things as a matter of course: The story of the loan and your ability to execute the project will probably be more important to this type of lenders than other types of lenders. Private investors are far more likely to charge higher interest rates and/or shares of equity. In addition, loans from private investors are NOT usually non-recourse loans. If you fail to pay back the investors, they can attempt to seize as many of your assets as they need to in order to satisfy the debt.

Applying for the Loan

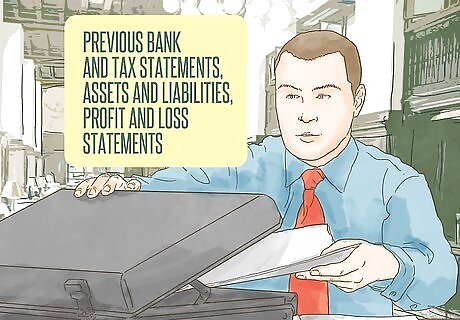

Gather documents about your financial position. Regardless of what level of emphasis the lender puts on your financial position, all of them are going to want to know about it. While certain lenders might ask for more or less, you should expect to provide the following: Your previous two years’ tax statements. Bank statements. A listing of assets and liabilities. Your business’ profit and loss statements.

Collect information about the property. While all of this information won’t apply to a construction project on a raw or minimally improved piece of land, you should present as many of the following as apply: Protective covenants, deed restrictions, and if you own the property, the deed to the land. Income and expense statements, copies of old leases, age of the property, type of construction, and square footage of the unit(s). These would apply to a major renovation on an already existing property. The credentials and the roles of the architect, builder, and construction manager. Blueprints and insurance statements. A budget and list of materials.

Create a work schedule and corresponding draw schedule. The scheduled draws need to correspond to the work being done on the project. For example, the draws need to add up to 100% of the loan, and the amounts of the draw need to make sense in relation to the kind of work that’s being completed. Usually, the first and last draws are smaller than the middle draws. The first draws would cover permitting, closing costs, and the initial stages of construction, such as demolition and laying the foundation. A structure is built from the ground up and the outside in, so framing and roofing would cover the next draws, while interior electric, plumbing, drywall, and trim would come later.

Comments

0 comment