views

New Delhi: The South Indian Co-operative Bank has sunk under a heap of losses worth Rs 104 crore. Its CEO has been arrested and 60,000 depositors have been cheated. Here is the inside story on how money worth Rs 45 crore went to one single family.

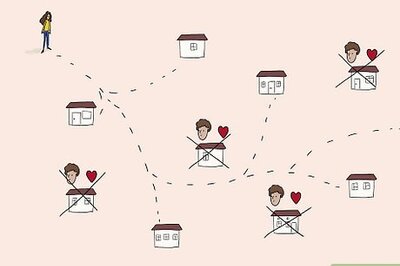

The list of debtors of the south Indian Co-operative Bank is long but what is most astonishing about the debtor's list is that atleast 27 enterprises on the list belong to just one business house - the Kamal Group.

According to the auditor's report, for the financial year which ended 31st March 2005, money was lent to 27 different enterprises of Kamal Group to fund businesses ranging from auto parts sale, photocopying shops and restaurants.

So what is Kamal Group? Owned by the Pandey family, Kamal Group of Industries is consits of various enterprises- Kamal auto stores, Manoj Enterprises, Srikrishna Traders, Aero World Associates, Veg Corner, Mobile World etc. Many of the enterprises are run from one commercial complex in Matunga in central Mumbai.

Owned by the Pandey family, the Kamal Group has been borrowing money from the bank since 2000. By 2005 it owed the bank Rs 45 crore, more than 30 per cent of the entire outstanding dues, making it the largest defaulter.

This large exposure to a single business house is a direct voilation of the RBI norms, as per the auditor?s report.

It doesn?t end there. The auditors also found that the same securities were pledged for different loans. According to the investigating officers of the Mumbai Police just one wing of Gayarti Apartments in Chembur, where the Pandey family lives, was officially mortgaged for many of the loans. The bank also accepted some 'stock-in-trade' or products as 90 per cent of the securities for the loan. What?s more, the stock was not even evaluted at the end of the year.

General Manager of the Kamal Group Rajeev Shukla denies the allegations in the auditor's report and said, "We are a group of 22 different tax paying entities, consisting of 22 different business activities. We have been banking with South Indian Co-operative bank since the past 26 years".

"Our bonafides can be seen by the fact that we have repaid 11 crore rupees in the past year after the bank run on August 9, 2004," he added.

"Since there are disputes between us and the bank being contested in the competent courts of law and the same being sub judice we would'nt like to make any comment on the veracity of the claims. We can only assure you that the loan given to us will never be loss to the bank. We are paying regularly and will clear our dues as fast as possible," he said.

Whether these words translate into money, that remains to be seen.

Comments

0 comment