views

There is some good news in store for cryptocurrency investors who are using the CoinSwitch Kuber platform for buying and selling Bitcoin or crypto coins. The Unified Payments Interface, or UPI, payments option now seem to be enabled for users, allowing them to deposit money into the CoinSwitch account using UPI payment handles. This comes after weeks of trouble for cryptocurrency trading apps, which saw the unavailability of UPI as a money transfer method and limited support from banks in India, which also saw Paytm Bank withdrawing support from apps including CoinSwitch, WazirX and ZebPay. This becomes the second instance of mobile wallets finally joining in the cryptocurrency trading, after CoinDCX has enjoyed support from MobiKwik for money transfers. The addition of UPI payments comes after CoinSwitch made the switch to IDFC Bank for money transfers to the in-app wallet, following Paytm Bank withdrawing banking services support.

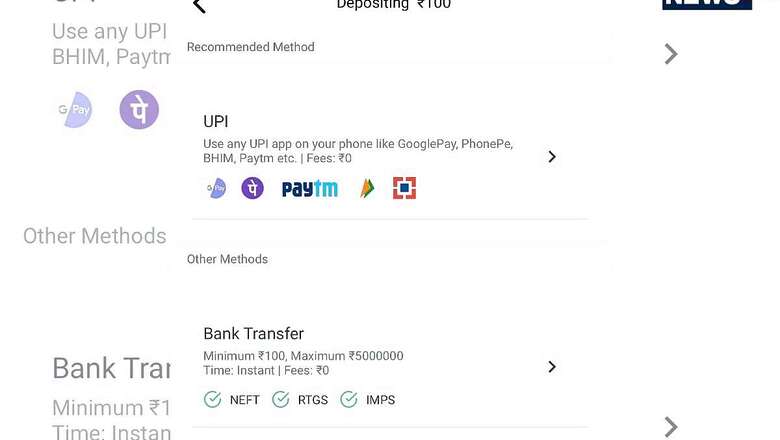

CoinSwitch at this time now offers bank transfer and UPI as methods to add money to the in-app wallet for buying crypto coins. The UPI payment apps that are listed include Google Pay, PhonePe, BHIM and Paytm. The option for showing for us, for instance, on the CoinSwitch app for the Apple iPhone as well as Android phones. If you are to select that option, you’ll be taken to a screen where you will need to enter your UPI ID (this is usually something like 9999999999@okhdfcbank, for instance) after which you’ll be prompted to open the corresponding UPI payment app to accept and complete the payment. You can then return to the CoinSwitch app screen, and the payment receipt status will be updated in a few seconds. The availability of UPI does make things more convenient for users, as compared with bank transfers, which sometimes take a while for the transaction chain to be completed as part of the Immediate Payments System (IMPS), the National Electronic Fund Transfer (NEFT) and Real Time Gross Settlements (RTGS) transfers. Earlier, CoinSwitch which used the Paytm Bank services for money transfers using bank accounts, had to switch to IDFC Bank after Paytm Bank announced that they’ll be withdrawing banking services from cryptocurrency apps. A move that impacted multiple crypto coin trading apps, including WazirX and ZebPay.

Last month, the National Payments Corporation of India, which runs the UPI real-time payments system, had refused to ban cryptocurrency transactions in India. Instead, they have asked banks to make their own guidelines with regards to transactions that involve cryptocurrencies. “The recommended approach for financial institutions would be to craft their strategic responses,” says Vishal Anand Kanvaty, Senior Vice President – Innovation & Product, NPCI, had said at the time. “Financial institution need to focus on collaboration with the ecosystem before they launch any of the use cases. The operational effort to get the ecosystem to accept the new system would be huge and acceptance could be difficult. Hence, financial institutions need to spend effort to convince the ecosystem for a decentralized solution,” he added.

On the regulatory side, the UPI payments being made and received have the verification stamp through the entire chain. For a user to use UPI payments, it’ll always be done from a bank account that is Know Your Customer, or KYC-compliant, often using the biometrics authentication using the Aadhaar card. Secondly, all cryptocurrency apps also require a mandatory KYC check when you sign up for the first time and before you can deposit money into the wallet for buying crypto coins. These are bank to bank transactions, with the entire chain being KYC compliant. CoinSwitch claims to have more than 4 million registered users.

It is reported that the Government intends to set up a panel of cryptocurrency experts as a first step towards regulating cryptocurrency in India. “We are excited that more stakeholders such as governments, policymakers, academics, and investors are paying closer attention to the crypto-economy. We welcome the Government’s potential plan to set up a new panel to study the possibility of regulating cryptocurrencies in India,” said Artur Schaback, Co-Founder and Chief Operating Officer of Paxful, in a statement shared with News18. The numbers by the peer to peer (P2P) trading platform Paxful indicate that as of December 2020, India is the second largest Bitcoin market in Asia. And the sixth biggest market in the world, behind USA, Nigeria, China, Canada and UK. It is expected that the volume of transaction and investment would have increased since. Schaback believes that the new panel looking into regulating cryptocurrencies in India would help provide a fresh perspective and increase the understanding of the technology.

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment