views

X

Expert Source

Alan Mehdiani, CPACertified Public Accountant

Expert Interview. 9 July 2020.

Private companies may need to distribute quarterly or annual financial reports to banks or lenders. Publicly-traded corporations in the US are required to submit audited financial reports to the Securities and Exchange Commission (SEC). If you're a small business owner, you may choose to prepare your own financial reports. However, if your business is large or complex, you'd likely be better off to hire an accountant.[2]

X

Research source

Completing Your Income Statement

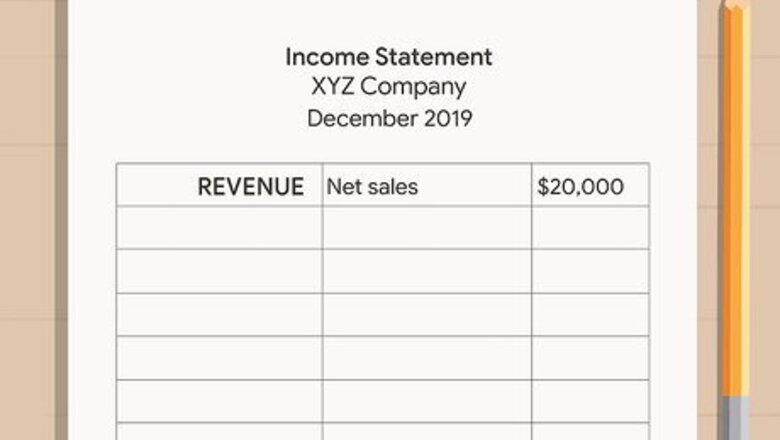

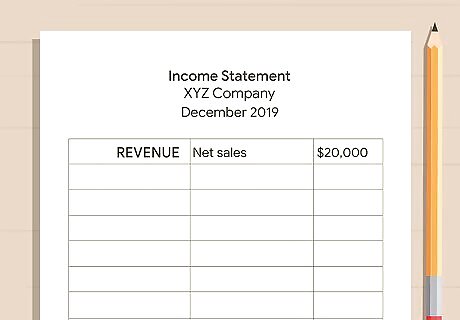

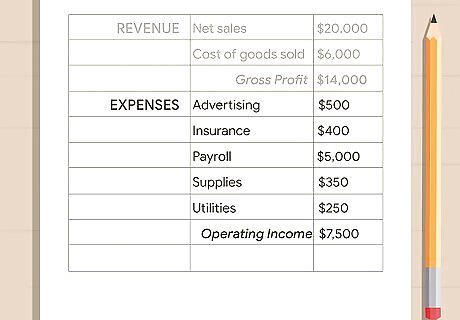

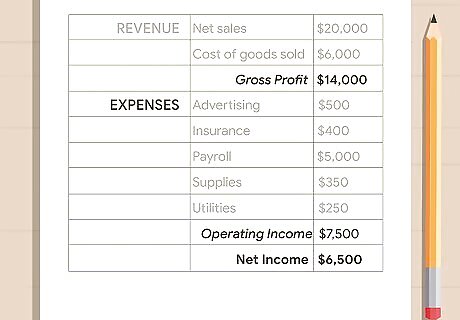

List your income for the period covered by your report. Label your income statement at the top and list the name of your organization and the period the statement covers. Then enter the total amount of income the organization made during the period. If your organization sells both goods and services, you may want to include the income for each separately. Make sure you're listing the gross revenue the organization has earned. You'll deduct expenses to find the organization's net income later on.

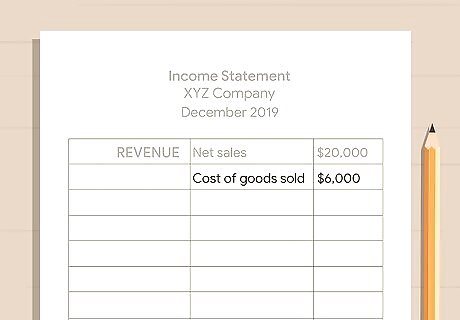

Determine the cost of goods or services you sold. Total the costs associated with the goods or services you sold, including labor, materials, and any overhead expenses for the manufacture of the goods. In a retail business, your cost of goods would typically only be the cost to purchase the items for your inventory. In the service sector, the costs would include labor and supplies used to provide the service you offer.

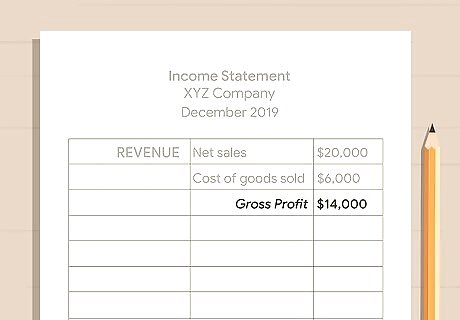

Compute your gross profit. Your gross profit for the period covered by the income statement is the gross revenue minus the direct cost of the goods or services you sold. After you've made this calculation, list the amount in the line below the cost, labeling it "gross profit." For example, if you had $20,000 in revenue for the period and $5,000 in costs, your gross profit would be $15,000. In formatting your income statement, you may want to make the gross profit label and amount bold so that it stands out from the other information. If you're creating a full-color document, list the gross profit in green if it is a positive number. Use red for a negative number or loss. Round your numbers to the nearest whole number, rather than using decimals or fractions of a unit.

Provide an itemized list of expenses over the course of the same period. Common operating expenses include employee wages, rent or mortgage payment, office supplies, transportation expenses, and marketing. If you have a significant number of distinct expenses, organize them into categories to keep your income statement simple. Depreciation of fixed assets, such as equipment, is also included in your organization's expenses for the period. Tax departments typically have depreciation tables that will help you figure out the amount of depreciation for the period covered by your income statement. Accounting software also includes tools to help you calculate depreciation.

Subtract your expenses from your gross profit. Total all of the expenses you listed and enter that amount under the list of expenses, labeling it "total expenses." You may want to make this text bold so that it stands out from the list of expenses. If you're making a full-color income statement, change the color to red. Then, subtract that amount from your gross profit. The result of this equation is your net profit for the period covered by the income statement. Label it and make the text bold so that it stands out from the rest. If you're making a full-color income statement, change the color of the amount to green if it is a positive number or red if it is a negative number.

Drafting a Statement of Retained Earnings

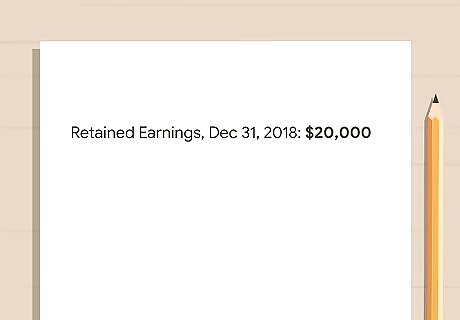

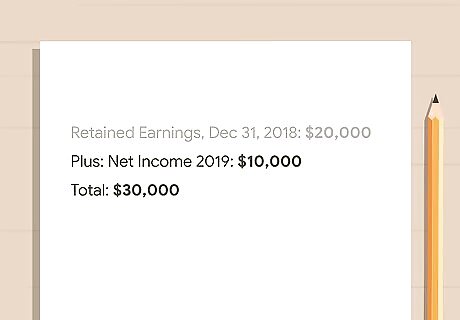

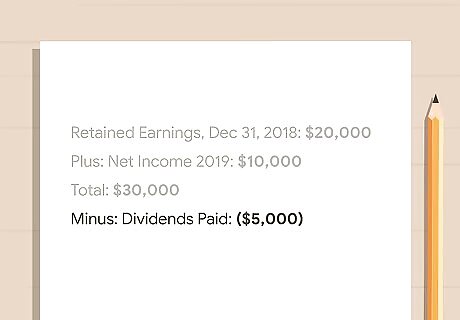

Determine the current retained earnings balance. The organization's retained earnings is the amount of money the company has earned that it has not distributed to equity partners or shareholders. This amount accumulates from the date the organization starts. On your Statement of Retained Earnings, the current retained earnings balance goes on the first line of the statement. To find this amount, look at the organization's previous financial statement. If this is your organization's first financial statement, the amount of retained earnings will likely be 0. If your organization distributes all income to its shareholders or equity partners, the retained earnings balance will be 0. If the organization has a deficit or is "in the red," this balance may be a negative number.

List the net income from your income statement. Below the current retained earnings balance on your statement, provide the net income you calculated on your income statement for the same period. This amount may be a negative number if your organization did not produce a net profit. On a full-color Statement of Retained Earnings, you typically would change the font color so that positive amounts are green and negative amounts are red. If you're not drafting a full-color statement, place parentheses around the amount to show that it is negative.

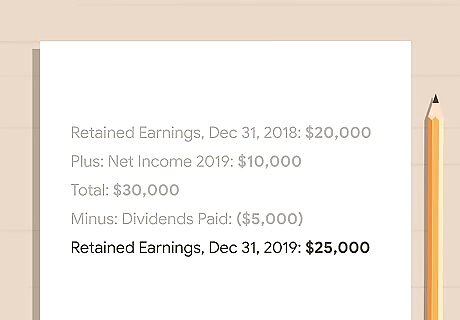

Subtract any income distributed to shareholders or equity partners. If any of the net income was distributed to shareholders or equity partners, it doesn't count as retained income. On the other hand, if no income was distributed, the entire amount of net income would be added to the retained earnings. Include a line on your statement that provides the amount of income distributed to shareholders or equity partners. Put the amount in parentheses or change the font color to red to indicate that this amount is subtracted from the net income. For example, suppose your company had a net income of $20,000 for the period covered by your financial report. Of that amount, $10,000 was distributed to your company's equity partners. That means your company retained earnings of $10,000.

Calculate the updated amount of retained earnings. After you subtract the amount of income you distributed to shareholders or equity partners, add the remaining net income for the period to the total retained earnings balance. Report this amount on the final line of your Statement of Retained Earnings. For example, if your company had $300,000 in retained earnings and you retained $10,000 of the net income earned over the period covered by your financial report, your company would now have $310,000 in retained earnings.

Creating a Balance Sheet

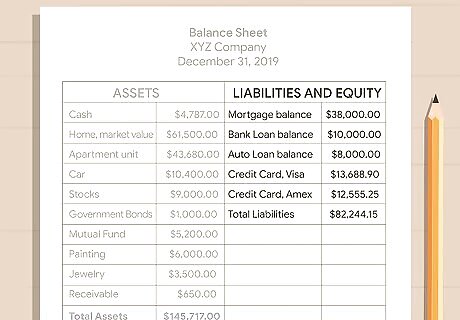

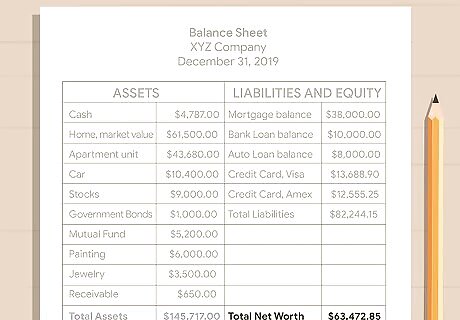

Format your page into two columns. Most balance sheets provide a snapshot of your organization's assets on one side of the page and its liabilities and equity on the other. While you can also put the assets on the top and the liabilities and equity on the bottom, having them side by side makes it easier to see the balance. Using two columns also gives you plenty of room to itemize in each category, so you don't have to use more than one page. At the top of the page, across both columns, label the sheet as a "Balance Sheet" with the name of your organization and the dates for the period the balance sheet covers. Your word-processing or spreadsheet program may have a balance sheet template that will make formatting easier.

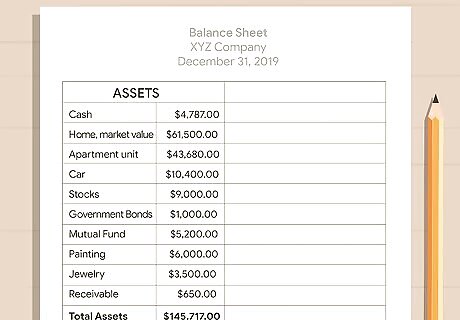

List assets in the left column. Anything your organization owns is an asset. Assets are typically classified into current assets, fixed assets, and investments. A balance sheet may also have a miscellaneous category for "other assets" or intangible assets, such as intellectual property rights. Current assets include things such as cash, accounts receivable, inventory, and supplies. Fixed assets, on the other hand, are things such as real estate, equipment, and anything else that can be used for more than a year. For current assets, the value is typically fairly easy to determine. For fixed assets, you may need to check the organization's last tax return to find a value. The value of fixed assets decreases each year with depreciation.

Place liabilities and equity in the right column. Like assets, liabilities are divided into current liabilities and fixed liabilities. The equity the owners have in the organization also goes into this column. Current liabilities include things such as accounts payable, short-term loans, or business credit accounts. Fixed liabilities are liabilities that cannot be resolved in a year, such as mortgages, long-term loans, or employee pension plans. To calculate the owner's equity, you'll need to know how much they've contributed in capital, including the total amount of any stock in the company, as well as the amount of earnings retained by the company. You can get this information from your Income Statement and Statement of Retained Earnings.

Total assets and liabilities to balance the books. When you've completed your balance sheets, the total value of the organization's assets should be the same as the total value of the organization's liabilities. If the two don't balance, go back and look over the values you've entered to find the mistake. In particular, review the values you used for the owner's equity. The owner's equity should always equal the total value of the organization's assets minus the total value of the organization's liabilities. If your totals don't balance, you may need to adjust the owner's equity until they do, provided all of your other values are correct.

Writing a Statement of Cash Flows

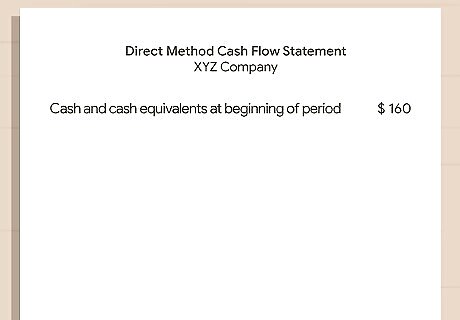

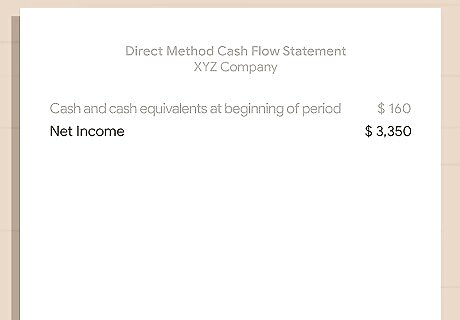

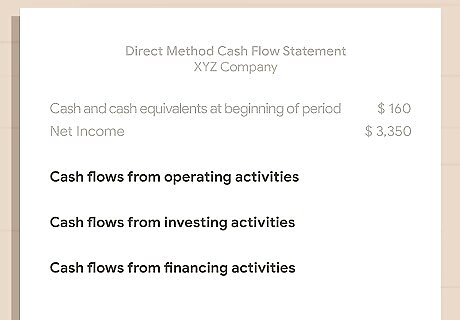

Determine the organization's cash balance at the end of the previous period. The cash balance you started with at the beginning of the period covered by your financial report is the starting point for your Statement of Cash Flows. Enter this amount on the first line of your statement. Typically, you can get this number from the organization's previous financial report. If this is the first financial report for the organization, you'll have to calculate the starting cash by totaling the organization's cash on hand. "Cash" includes not just currency, but also anything that can be converted to cash in less than a year (known as "cash equivalents"). Cash equivalents include the value of savings accounts, money market funds, or similar accounts the organization owns.

List the net income from your income statement. Go back to your income statement and find the amount of net profit your organization made during the period covered by your financial report. List this amount below your starting cash balance. For the purposes of your Statement of Cash Flows, it doesn't matter how much of the net income, if any, was distributed to shareholders or equity partners.

Group your cash flows into 3 categories. Generally, all of the cash flows reported in your statement fall into 3 broad categories: operating activities, investing activities, and financing activities. From there, you can list specific cash flows directly in each of those categories. However, most organizations track changes more indirectly, by adjusting the net income based on changes to the accounts represented by each of the categories. Operating activities include depreciation of assets, accounts payable, and accounts receivable Investing activities include buying and selling capital equipment, business or website development, and buying marketable securities Financing activities include issuing and redeeming debt, issuing and retiring stock, and paying dividends on stock or distributing income to equity partners

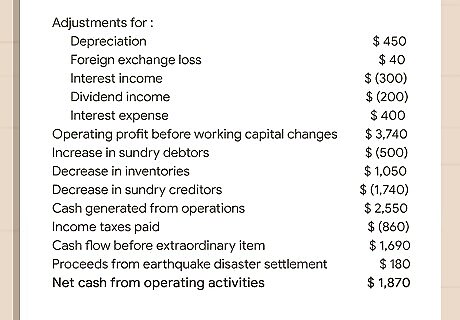

Adjust the net income to find the cash provided by operating activities. If the organization has assets, such as equipment, that will be used for more than a year, the depreciation in those assets is added back to the cash balance. Subtract the balance of your accounts receivable from your cash balance, then add the balance of your accounts payable. The result is the net cash provided to your organization by operating activities. In accounts receivable and accounts payable, add any amount that occurred during the period covered by your financial report, regardless of whether or not money has exchanged hands. You may have other accounts, such as taxes or payroll, that you would need to adjust income for as well. Taxes or payroll that are owed but have not yet been paid would be added to your cash balance just like the accounts payable balance was.

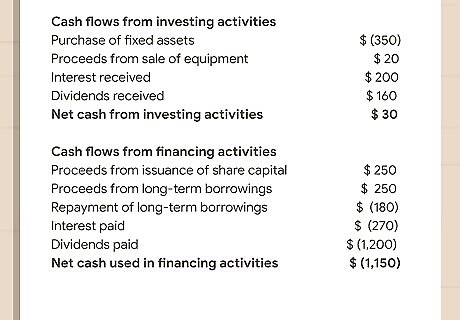

Repeat the same process for investment and financing activities. Purchases are deducted from your cash balance, while any sales would be added to your cash balance. List these items individually, then total to arrive at your net cash provided by investment activities and your net cash provided by financing activities. Indicate a loss or deficit for the period covered by your financial report by either placing the amount in parentheses or changing the font color to red (for full-color reports). If your net cash is a loss or deficit, type "used for" rather than "provided by." For example, if your net cash from financing activities is a $2,400 loss, you would label this amount "net cash used for financing activities."

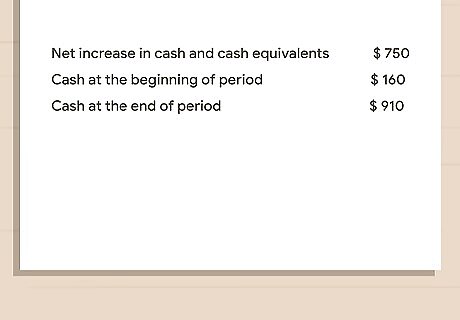

Calculate the cash at the end of the period. Take the net cash numbers for each of the 3 categories and add or subtract them from the cash balance the organization had at the beginning of the term covered by the report. The result of this calculation is your organization's new cash balance. Compare your Statement of Cash Flows to your Income Statement. If there is a significant difference between the profits reported and the net cash flow generated, you may want to figure out why. For example, if your organization is relatively new and requires large capital investments, those investments would not appear on your Income Statement all at once.

Comments

0 comment