views

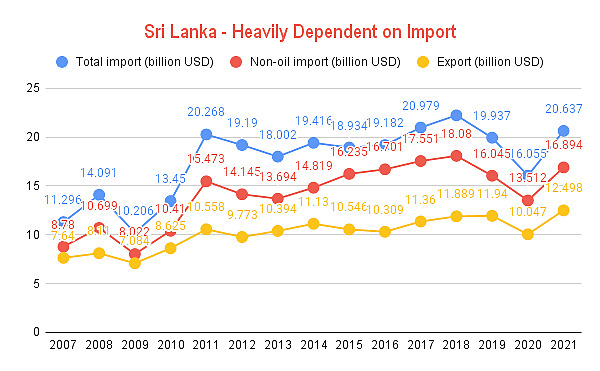

Sri Lanka is a heavily import-dependent economy. It imports almost everything that an economy and a society need, from food and vegetables to consumer goods like medical and pharmaceutical supplies, machines, vehicles, home appliances, telecom devices, and clothing to intermediate goods like crude oil and fertilisers, and investment goods like building materials and transport goods.

Being an import-dependent country means it should always have enough foreign exchange reserves or the currency, in most cases the US dollar, to meet its targets, and to get into trade agreements with other countries. In the case of Sri Lanka, it is not the case anymore and the situation on the ground has become so grave that people were forced to come to the streets against the ruling government to depose it.

What led to this?

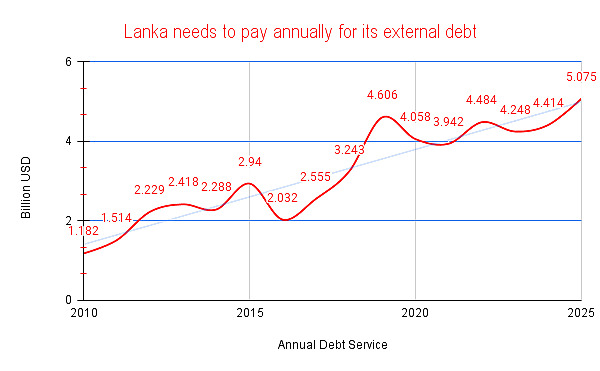

It was an interplay of three factors: the Covid-related slowdown, depleting foreign exchange reserves, and Sri Lanka’s increasing debt service annually (interest + part of the principal amount) to meet its massive external debt of $51 billion.

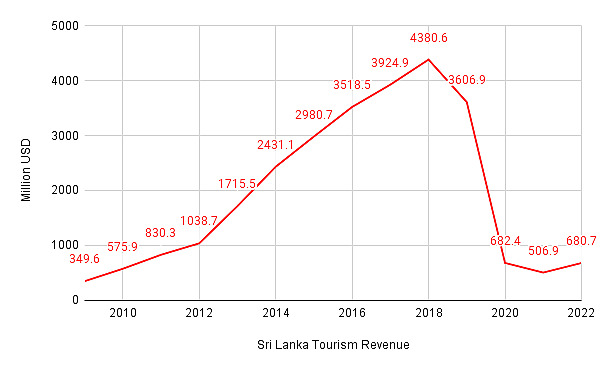

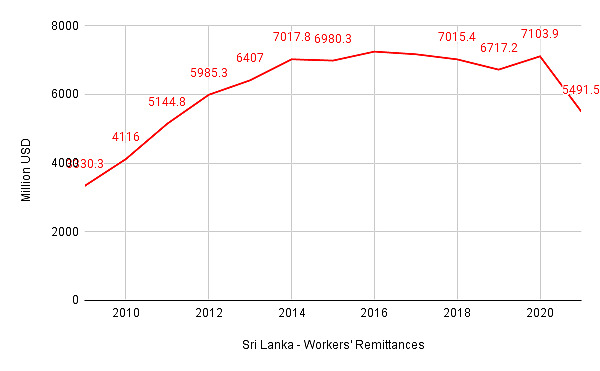

A small island nation of 2.21 crore people, Sri Lanka largely depends on revenue obtained from tourism, workers’ remittances from abroad, agricultural export like tea, and industrial export like garments and textiles. While Sri Lanka saw an increase in its overall export in 2021 compared to 2020, at 24.39%, from $10.047 billion to $12.498 billion, the massive decline in the other two major revenue sources from tourism and remittances posed a serious threat.

Statistical data obtained from the Central Bank of Sri Lanka (CBSL) clearly shows the gap between Sri Lanka’s export and import, around $8 billion in 2021. In fact, if we see the average data on imports and exports from 2007, the country’s import figure comes out to be $7.48 billion higher than the export figure. On average, Sri Lanka annually imported materials worth $17.70 billion against exports worth $10.12 billion.

When seen in the context of the massive external debt Sri Lanka has and its declining foreign exchange reserves, this trade deficit figure is a key point behind the ruin of the country’s economic and sociopolitical structure.

No funds to import, even for a day

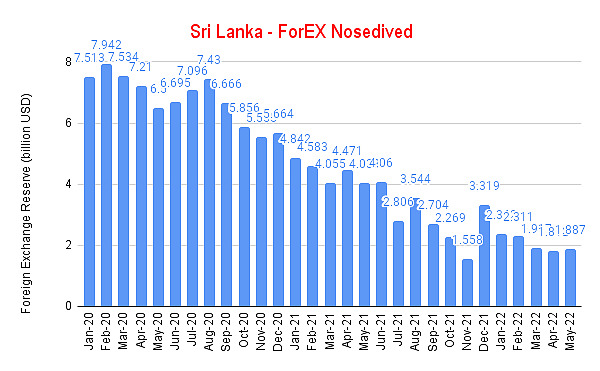

The country was in a comfortable position when it managed its foreign exchange reserves of around $7 billion to $8 billion, but the usable foreign exchange reserve, around just $50 million in May, was not even worth one day of import. As per the official data available from the CBSL, Sri Lanka’s imports in April 2022 were worth $1.699 billion, i.e., $56 million a day.

The chart shows Sri Lanka’s foreign exchange reserves nosediving with the Covid pandemic. This was in the range of $7 billion till August 2020 but saw a gradual decline afterwards owing to three factors. First, tourism stopped with Covid restrictions and thus the money being generated from it. Next, the Covid retractions also hit the flow of annual remittances towards Sri Lanka’s foreign exchange reserves. And third, is the increasing debt service annually that Sri Lanka needs to meet against its huge external debt of $51 billion.

Tourism

Tourism in Sri Lanka was recovering from the devastating Easter Sunday bombing in Colombo in April 2019 that killed over 250 people, when the pandemic put the brakes on it. After the Sri Lankan civil war ended in 2009, the tourism revenue in the island nation, for the first time, hit the mark of $1 billion in 2012 and since then and before the pandemic, the sector was around $33 billion for the country, or on an average around $4.1 billion a year. That came down to about $600 million a year after the pandemic hit.

Remittances

Remittances are a big input for Sri Lanka’s currency reserve. According to the government data available from 2009, the country has earned $107.250 billion or an average of $7.66 billion a year through remittances. The country has been getting remittances of around $9 billion annually since 2014 except for a gap in 2017 and 2021, but last year’s gap hit hard. Sri Lanka’s foreign exchange got remittances worth $9.123 billion in 2020 which came down to $7.512 billion in 2021 and saw a further decline in the first five months of this year, with just $1.335 billion received so far.

Debt servicing

Depleting revenue from tourism and a significant decline in remittances could not hold the country together even if it performed better in the trade sector with increased export figures, as it had to pay over $4 billion a year towards debt servicing.

Sri Lanka was paying around $4 billion as debt service from 2019. It slightly came down to $3.9 billion in 2021 but in the next four years, from 2022 onwards, the country has to pay $18.221 billion as debt service, that on average comes out to $4.55 billion a year.

Script of default written 2 years ago

A global pandemic meant Sri Lanka lost the lifeline it was surviving on in the first half of 2020. Covid restrictions affected its financials badly, hitting its capacity as a purchaser in the global market. Since August 2020, its foreign exchange reserves were coming down by, on average, 6% every month, and hitting the nadir of a $50 million usable foreign currency was expected.

The equations were totally against the country. Its ruling establishment had to import food items, fuel, and other essential goods like medicines but doing that meant depletion of its existing reserve stock that was not seeing any significant addition. Its ruling establishment had to pay over $4 billion annually as debt service as well. That again means depletion of the existing foreign exchange stock.

Hence, Sri Lanka’s future imports as well as the annual debt payment were expected to face defaults. The country defaulted on the debt payment for the very first time in its history in May 2022. The absolute default on the import front followed with people paying astronomically high prices for the limited quantity of food items, gas, fuel, pharmaceuticals, and other basic needs of life available.

Read all the Latest News, Breaking News, watch Top Videos and Live TV here.

Comments

0 comment