TAX

Form 26AS Online: How To Download Your Tax Credit Statement?

Form 26AS can be accessed online through the Income Tax Department's website by logging in to your account.

Govt Specifies Retail Sale Price Based GST Cess Rate for Pan Masala, Tobacco

This is a departure from the earlier regime that imposed cess, over and above the 28 per cent Goods and Services Tax (GST) rate on ad-valorem basis

GST Collections In March 2023 Jump 13% YoY To Rs 1.60 Lakh Crore; Second-Highest Revenue Ever

It is for the fourth time in the current financial year that the gross GST collection has crossed the Rs 1.5 lakh crore mark

Income Tax: 3 Exemptions Under New Tax Regime That You Must Know

It is important to note that if a taxpayer chooses the new tax regime, they will not be able to claim deductions such as Section 80C, Section 80D, and others.

Income Tax Return Documents List: What Do You Need To File ITR-1 Sahaj?

ITR-1 Sahaj form can be filed by a resident individual

Opting for New Income Tax Regime 2023? Know 3 Tax Deductions That You Can Claim

Finance Minister Nirmala Sitharaman in her Budget 2023 has focused on making this tax regime more attractive

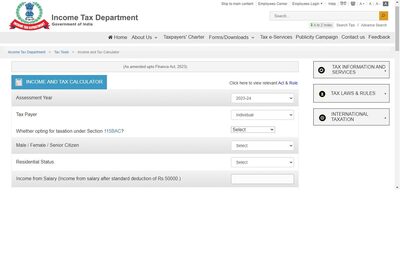

New Income Tax Regime vs Old Regime, Which One Should You Choose In FY24?

Though the new tax regime will now become the default tax regime in 2023-24, taxpayers will have choice to opt for the old tax regime also

Charge Up Tax Collection Drive: CBDT, CBIC Chiefs Tell Teams

The tax department has stepped up revenue augmentation measures ahead of the Union Budget.

Income Tax Rules: CBDT Issues Guidelines on Deduction of Tax at Source; Know Details Here

Finance Act 2022 inserted a new section 194R in the Income-tax Act, 1961, which was notified during the Budget speech of finance minister Nirmala Sitharaman earlier this year.

GST Likely To Increase Further On Some Items To Correct Duty Inversion: Report

Recently, pre-packaged and pre-labelled retail packs, including curd, lassi and butter milk, were brought under GST, effective July 18

ITR Filing AY 2022-23 Last Date Extension Latest Updates: All You Need to Know

As per the Income Tax website, a total of 4,09,49,663 have been filed till July 28. Out of these, 2,41,15,777 verified ITRs have been processed.

GST Rate Hike on Daily Essential Items from July 18; What Will Get Costlier?

Following the 47th GST council meet held last month, the government decided to revise the Goods and Services Tax on a number of items and services.

Big Decision For Small Online Players: No Need For GST Registration If Sales Are Below Rs 20 Lakh

Exemption will only be for those having an annual turnover of up to Rs 20 lakh and those not making any inter-state taxable supply

ITR: Earning Below Taxable Limit? Still have to File Income Tax Return in These Cases

Income Tax Filing FY22: The CBDT earlier mentioned the additional conditions where it is compulsory to file income tax returns even when the individual's income is less than basic exemption limit.

Income Tax: Last Date to Pay First Advance Tax Today; Calculation, What Happens if You Miss

According to Section 208 of Income Tax Act, a taxpayer needs to pay advance tax if his or her tax liability is Rs 10,000 or more in a year. What is advance tax, how to calculate and what happens if you miss the deadline, know here

PAN, Aadhaar Rule Changes for Cash Withdrawals, Deposits from Today; New Income Tax Rule

It is now mandatory to quote Permanent Account Number (PAN) or Aadhaar for cash withdrawal or deposit of Rs 20 lakh or more in a financial year. All you need to know about new income tax rule, effective from today