views

New Income Tax Regime Vs Old Regime, Budget 2023: The government in the Budget 2023 has announced income tax relief for individual taxpayers, especially salaried individuals. The changes are related to the new tax regime only, while the old tax regime remains the same as now. Though the new tax regime will now become the default tax regime in 2023-24, taxpayers will still have the choice to opt for the old one. Here’s a quick guide for you to decide on which tax regime to opt for in 2023-24 as per your income:

Without Any Savings, Investments And Deductions

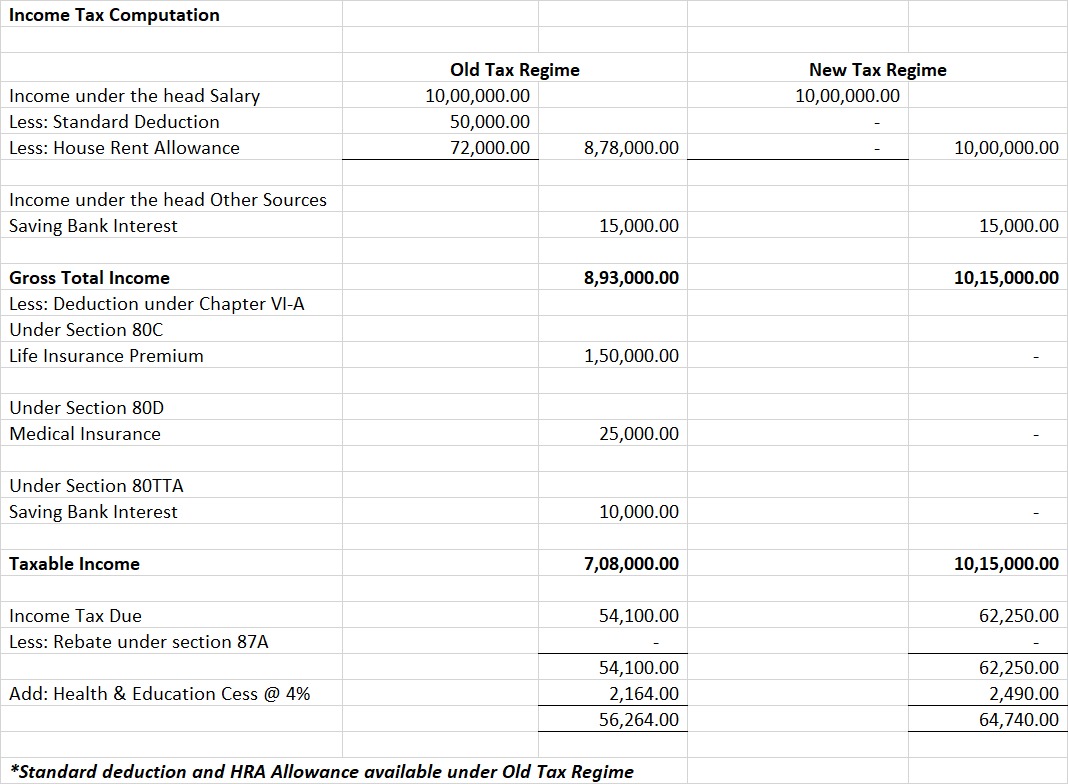

If you have no savings and investments, then this calculation is for you. If you are earning Rs 10 lakh in a year, your total tax liability, including 4 per cent higher education cess (HEC), under the old tax regime will be about Rs 78,000, without any deductions claim. However, under the new tax regime, your tax liability will be Rs 62,400.

Income — FY24 Old Tax Regime — FY24 New Tax Regime

- Rs 10 lakh — Rs 1,06,600 — Rs 62,400

- Rs 15 lakh — Rs 2,57,400 — Rs 1,56,000

- Rs 20 lakh — Rs 4,29,000 — Rs 2,95,600

So, if taxpayers claim deductions and exemption claims less than Rs 3.75 lakh annually, it would be advised to opt for the new income tax regime and pay less tax than they give in the old regime, according to a PTI report quoting a senior finance ministry official.

With Savings, Investments And Deductions

“Though without any savings, investments and deductions, the new tax regime seems beneficial; the old tax regime can be attractive if you make use of savings, investments and deductions,” an independent tax professional told news18.com.

If you are earning Rs 10 lakh in a year and claim deductions available under Section 80C, 80D and 80CCD of the Income Tax Act, 1961, your total tax liability, including 4 per cent higher education cess (HEC), under the old tax regime can be as low as Rs 49,400, which is very much lower than Rs 62,400 under the new tax regime.

Income — FY24 Old Tax Regime — FY24 New Tax Regime

- Rs 10 lakh — Rs 49,400 — Rs 62,400

- Rs 15 lakh — Rs 1,71,600 — Rs 1,56,000

- Rs 20 lakh — Rs 3,27,600 — Rs 2,95,600.

This calculation has considered full deductions under Section 80C (Rs 1.5 lakh), 80D (Rs 75,000) and 80CCD (Rs 50,000). It does not include profession tax, which can be levied up to Rs 2,500 a year.

Section 80C relates to basic investments like PPF, EPF, LIC premium and ELSS. 80D relates to premium on medical insurance. Section 80CCD relates to NPS contribution. Apart from these, there are other Sections CCC, TTA, GG,E, etc, that can also be claimed.

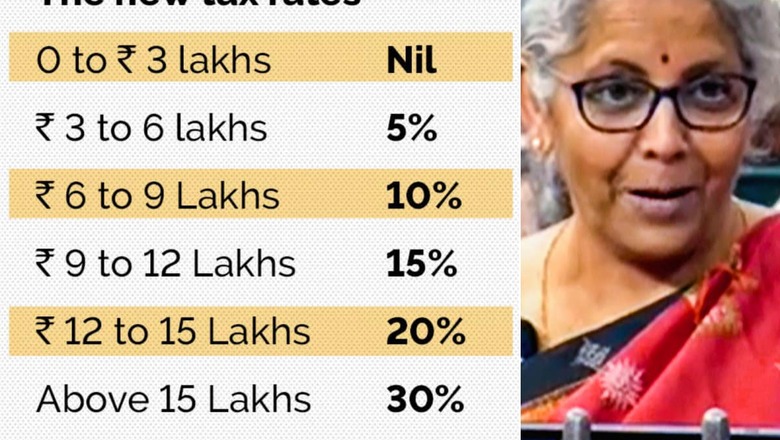

Finance Minister Nirmala Sitharaman in the Budget 2023 on Wednesday announced that those who are earning up to Rs 7 lakh will not have to pay any income tax. In the Budget, the income tax exemption limit has been increased by Rs 50,000 to Rs 3 lakh, and the rebate has been increased from Rs 5 lakh to Rs 7 lakh. Apart from this, a standard deduction of Rs 50,000, which was available for the old regime, has also been extended to those opting for the new regime.

Read all the Latest Business News here

Comments

0 comment