views

Income Tax India Calculator Online: The income tax deadline is approaching fast, and it will end on July 31. After the deadline, ITR filing will attract penalty. While filing the ITR, taxpayers need to choose between the new income tax regime and old income tax regime. Taxpayers choose it based on their tax benefits. Here is how you can calculate income tax online using the official income tax India calculator:

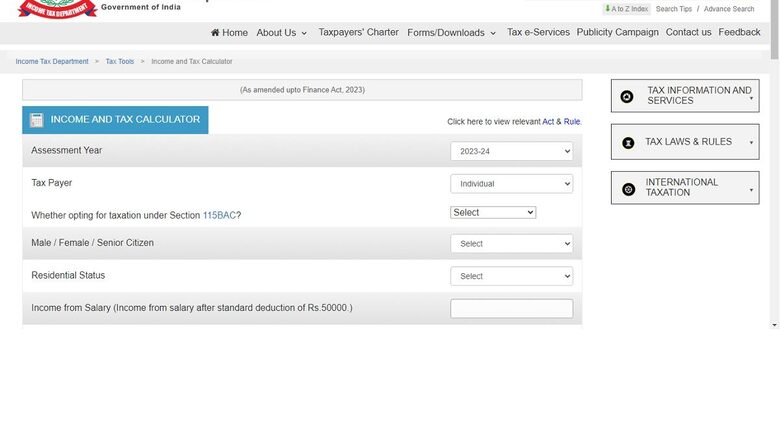

Income Tax India Calculator

To calculate income tax, you can use the official tax calculator — income tax India calculator.

In the calculator, you just need to fill in your income and deduction details to check your income tax liability. The first column will ask ‘Assessment Year’. The current assessment year is 2023-24. The second column will ask ‘Tax Payer’. You need to choose the option based on your income source. If you are an individual, select ‘Individual’. After that, the third option will ask you ‘Whether opting for taxation under Section 115BAC?’. If you choose ‘Yes’, it means you are opting ‘new tax regime’. If you choose ‘No’, it means you have opted for the old tax regime.

Accordingly, fill in your income details in the calculator to calculate income tax.

Notably, if you choose the new tax regime, no deductions can be claimed to reduce the tax liability. Annual income up to Rs 5 lakh under the income tax regime was tax-free in the financial year 2023-24. It has now increased to 7 lakh now. Income above this limit will attract tax on the entire income, except the exemption limit of Rs 2.50 lakh.

Under the old tax regime, income up to Rs 2.50 lakh is exempt. However, if your income is above this level but you have an investment in tax-free instruments, that can be claimed to reduce tax liability.

It depends on the level of income and type of investments which regime will suit you. This can also be checked on the income tax India calculator.

In the last financial year 2022-23, the old tax regime was a default regime. Those wanting to opt for the new tax regime needed to specifically choose it. This year 2023-24, the new tax regime has become the default tax regime. However, it will be shown in the ITR next year.

In the current assessment year, about 4.75 crore ITRs have been filed so far. Out of these, nearly 4.23 crore ITRs have been approved and around 2.54 crore verified ITRs have been processed.

Comments

0 comment