TAX

Tata Steel Arm TCIL Gets Rs 40 Cr Tax Penalty Notice

"The said demand order is presently pending appeal before the Commissioner of Commercial taxes, Ranchi,” Tata Steel said in a regulatory filing.

GST Collection In September Jumps 10% YoY To Rs 1.63 Lakh Crore; Check Details

GST collection in September 2023: It is for the fourth time that the gross GST collection has crossed Rs 1.60 lakh crore mark in FY 2023-24

How The Revamped Income Tax Website Benefits Taxpayers? Know All Details Here

The revamped income tax website offers comprehensive access to Direct Tax laws, alongside various other Allied Acts, Rules, Income Tax Circulars, and Notifications.

Income Tax Department Gets Revamped Website: CBDT Launches User-Friendly Interface

The revamped website has been redesigned with a mobile-responsive layout.

GST E-Invoicing: Unveiling the Role of Private IRPs

The introduction of private invoice registration portals for GST e-invoicing was aimed at building infrastructure and support for expanding the coverage of e-invoicing mandates

ITR Trends: 15% Taxpayers Test Waters With New Tax Regime, 85% Opt Old With Deductions

50% of Clear users claimed 80D for tax deductions on medical insurance, while 20% utilised 80CCD(1B) for tax deductions on NPS self-contributions.

Income Tax Return 2023 Deadline Missed? You Have THESE Options Now

Penalty on Late Filing of ITR: Taxpayers can now file a belated ITR till December 31 with late fees and an interest penalty, here are income tax rules for belated ITRs

5.83 Cr Income Tax Returns Filed For FY23, Check Latest IT Dept Data

ITR Filing Data: 10.39 lakh ITRs have been filed upto 1 pm on July 30 & 3.04 lakh ITRs have been filed in the last 1 hour.

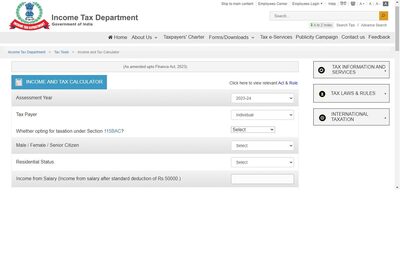

Income Tax Calculator Online: Compare Your Tax Liability Under New Regime Vs Old Regime

Income Tax India Calculator Online: In the current assessment year 2023-24, about 4.75 crore ITRs have been filed so far

Income Tax Day: Have You Checked AIS App Before ITR Filing? Here's How It May Help You

AIS App: The taxpayer has the option and the facility to provide feedback on the information displayed in the app.

Income Tax Due Dates In July: ITR Filing, TDS And TCS, Check All Details Here

Income Tax Return Filing: Timely filing of tax returns also enables taxpayers to evade swiftly accumulating penalties and interest charges.

ITR E-Filing Portal Resumes After Brief Halt Due To Upkeep Activity

The income e-filing portal was not available temporarily till 11.30 am today due to upkeep activity

GST Collections Jump 12% YoY to Rs 1.57 Lakh Crore In May 2023

The government has settled Rs 35,369 crore to CGST and Rs 29,769 crore to SGST from IGST

Aadhaar-PAN Link, Advance Tax, TDS Challan: These 5 Dates In June You Can't Miss

Income Tax Dates: Having knowledge of the important dates pertaining to taxation is essential for taxpayers in order to prevent penalties.

Mastering Online Income Tax Return Filing: Step-by-Step Guide For Easy ITR Filing

ITR Filing: Remember to keep a copy of all the documents and maintain records for future reference.

Filing ITR AY24 On Your Own? A Senior Income Tax Expert Suggests This

You need to submit your ITR on time to avoid last-minute rush; and online or offline ITR is not a selection by random choice but depends on your situation