views

Pakistan’s gravy train has stopped. There are no more free lunches available, not from the Saudis, or Emiratis or even the Americans and Europeans – the Chinese never gave anything for free anyway, only the Pakistanis never quite realised it. Pakistan’s economy is on the verge of becoming a Sri Lanka, only much worse. Default is staring Pakistan in the face. The time for denial is over.

All the assumptions and delusions – Pakistan is too important, too dangerous, too big to fail; or “our friends will come to our rescue” – fell flat. Former finance minister Ishaq Dar who is a chartered accountant pretending to be a Nobel Prize-winning economist added to the confusion by insisting that Pakistan didn’t need to give in to the IMF. He argued that IMF will have to listen to Pakistan and accept its position. Others argued that Pakistan could negotiate its way out of trouble. Alas, this balloon was also punctured.

The message to Pakistan is clear: they have to start paying their own bills and the era of living off and blowing other people’s money is over. The choice is between reform (which in the short to medium term means greater impoverishment) or get ruined (which means defaulting and then suffering the horrendous consequences that will follow). There will be a temptation to take the third option, one that Pakistan has exercised multiple times in the past: take a few painful measures, tide over the immediate crisis, and hope that everything works out just fine. The only problem is that this is a palliative which only kicks the can down the road and makes the next crisis even worse and more difficult to tackle than the previous one.

ALSO READ | Imran Khan May Be Gone But Whichever Way You Cut it, Pakistan is in Deep Trouble

The IMF Wake-up Call

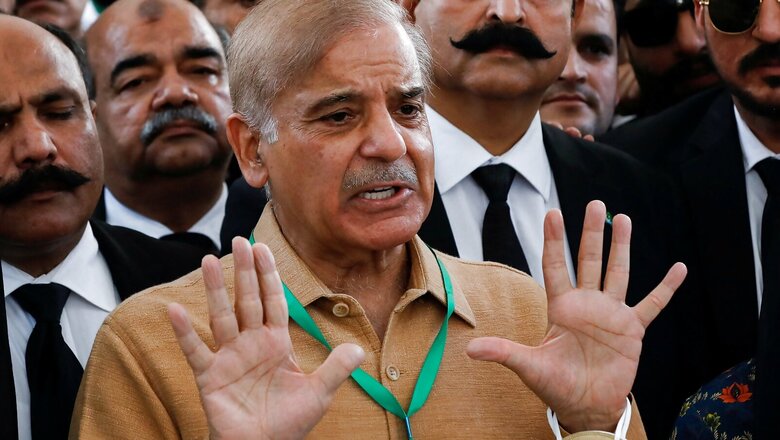

The wake-up call for Pakistan came after the IMF called off the talks and refused to restore the Enhanced Funding Facility programme until Pakistan took certain prior actions – ending fuel subsidies (which the Shehbaz Sharif government had been resisting for political reasons – Imran Khan was breathing down their neck and they didn’t want to give him any stick to beat them with); hiking power tariffs, raising taxes. With foreign exchange reserves down to a level where they provided an import cover of just over a month, Pakistan’s options were running out.

Even the forex reserves of around $10 billion which Pakistan had were all borrowed. The Saudis refused to bail them out until they were in an IMF programme. Likewise with the UAE. The Chinese too were miffed with their ‘Iron Brother’ who had defaulted on payments due on the China-Pakistan Economic Corridor (CPEC) projects. They didn’t seem inclined to opening their purse-strings and give yet another bailout on which Pakistan was banking upon. The Americans were ready to engage but didn’t offer any monetary assistance. They weren’t going to block any IMF programme but were also not ready to lean on the IMF to cut any slack for the Pakistanis.

It was soon as clear as daylight that without an IMF programme, an economic meltdown was inevitable. The Saudis would pull out $3 billion which they had lent Pakistan last year. The debt repayments due around June and July would virtually wipe out rest of the entire reserves. With a monthly import bill of around $6 billion, Pakistan would have no choice but to default.

The markets were already very nervous. The stock market was crashing. The Rupee was collapsing. It fell from around 181 to 202 against US Dollar in a matter of weeks. There was speculation that the Rupee could breach the 220-225-mark if the government delayed meeting the prior actions demanded by the IMF, which has been uncharacteristically tough in insisting that Pakistan stick to the assurances it had given and take the actions it had promised.

Pakistan Needs Deep Economic Surgery

The restoration of the IMF fund will, however, only buy some time and stave off the immediate crisis, not solve the deep structural problems that dog the Pakistan economy and have made it unsustainable and unviable. According to a recent report, Pakistan is a unique case where if the country grows at more than 3 per cent per annum it will suffer a serious balance of payments crisis. In most other countries, higher growth makes it easier to take care of balance of payments. But not in Pakistan. Compounding the problem is the fact that the entire economy is driven by just consumption. The 6 per cent GDP growth rate that Pakistanis are tom-toming is entirely consumption-driven. The investment rate is a measly 15 per cent; the saving rate is an abysmal 12 per cent.

The economy has been living off debt which is doubling almost every five years. But the growth rate is anaemic, which means the debt is becoming unsustainable. In the financial year 2019-20, almost 80 per cent of the federal government’s revenue went into debt servicing. There is now a buzz that in the next budget, almost the entire federal government revenue will be consumed by debt servicing. This means defence expenditure, pensions, running the civilian government, subsidies, development expenditure will all be debt-financed. The problem is that with a tax-GDP ratio of just around 9 per cent, Pakistan doesn’t have the resources.

Meanwhile, industry is becoming uncompetitive because of the extremely high cost of borrowing – inter-bank interest rates are already around 13.75 per cent which means banks are lending at around 15-16 per cent. The competitiveness of industry is further compromised by the high power tariffs and high fuel costs, which are likely to go up significantly in the near future. The base power tariff is expected to be around Rs 24 a unit. The peak rate could be in the 30s. Fuel subsidies will have to end which means another massive spike in fuel prices over and above the 20 per cent hike announced last week. All this will fuel inflation which is already around 14 per cent. Food inflation is estimated around 25 per cent and will also go up with the withdrawal of subsidies on fuel and other goods.

In order to fix things, Pakistan will have to go beyond just the extremely painful adjustment process; it will have to undertake deep economic surgery to restore the economy and put it on a sustainable track. But that’s among the most difficult and complicated things that any government can do, more so in an uncertain political climate. On the one hand, the opposition in the form of the demagogue Imran Khan is making life difficult for the government and weaponising economic reforms for pushing its politics; on the other hand there is the military establishment which is incapable of addressing the economic woes but also unwilling to give the civilians a free hand lest it hits the military’s corporate interests.

Besides the political economy, there is the problem of overhauling the economic system. For instance, the entire structure is built on concessions, tax breaks, hidden subsidies, patronage and what have you, which are given to trade and industry. According to some estimates, this amounts to a mammoth Rs 1.3 trillion every year. But withdrawing them will mean throwing industry into the deep and creating massive disruption and dislocation in the process. The economic and political fallout of this is not something that a political or even a military regime can handle easily.

Clearly, Pakistan is facing almost an existential crisis and there are no easy answers out of the predicament it finds itself in. Reform will mean contraction of the economy, greater economic distress, inflation, unemployment, unrest; default will mean all of the above and worse. Tinkering around will mean a worse crisis in another year or two. Pakistan is going to enter into an extremely turbulent phase. This is an opportunity for India, provided she knows what she wants and doesn’t hasten into seeking some kind of a deal to save Pakistan from itself.

ALSO READ | Time is on India’s Side, Should Not Jump the Gun in Reaching Out to Shehbaz Sharif

Sushant Sareen is a Senior Fellow at the Observer Research Foundation. The views expressed in this article are those of the author and do not represent the stand of this publication.

Read all the Latest Opinions here

Comments

0 comment