views

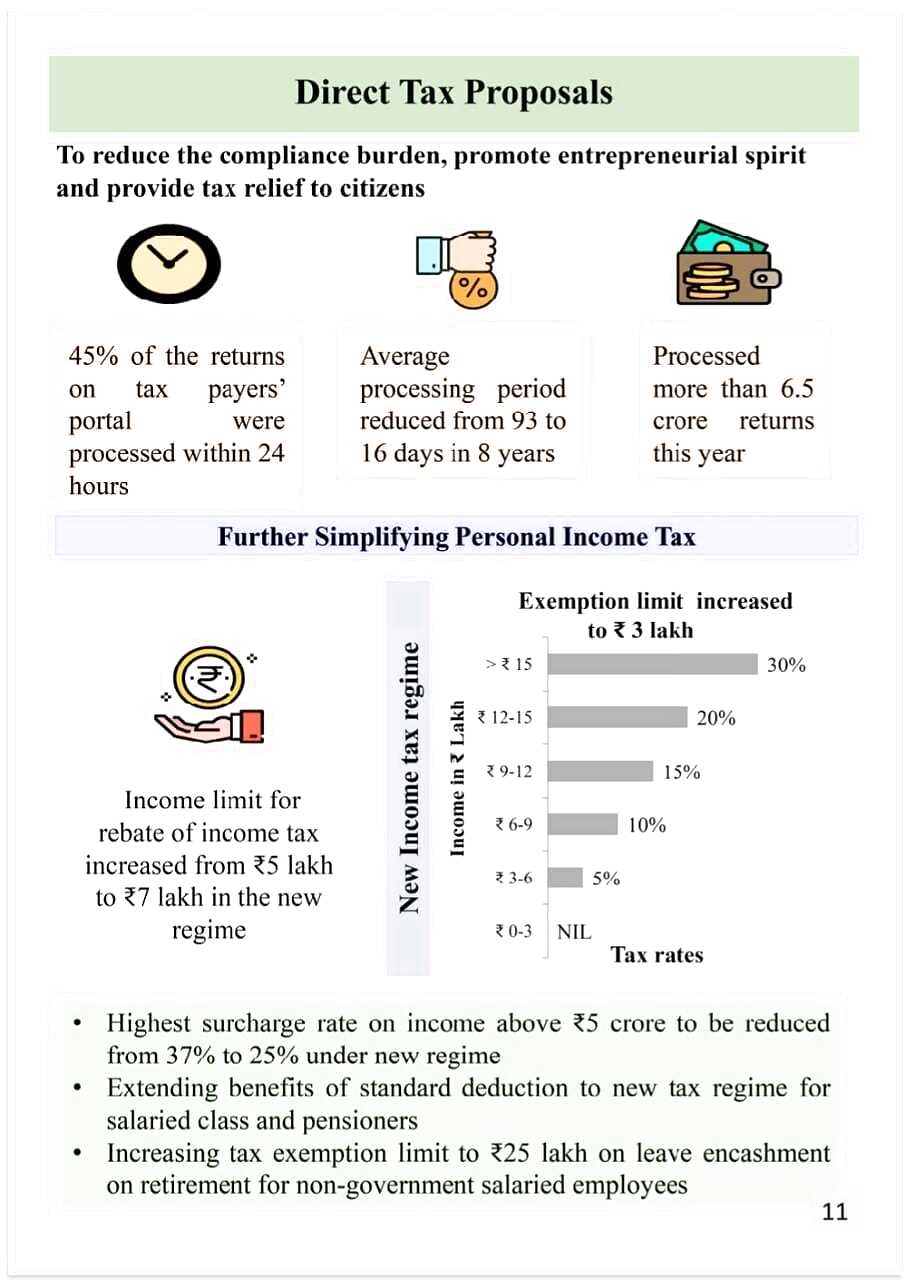

Budget 2023: Finance minister Nirmala Sitharaman has announced changes in the new regime of personal income tax. Govt proposed to increase the income tax rebate limit from Rs 5 lakh to Rs 7 lakh in new tax regime.

Resident individual with total income up to Rs 5 lakh do not pay any tax due to rebate under both old and new regime. The rebate for the resident individual under the new regime has been raised to Rs 7 lakh.

Standard deduction of Rs 50,000 to salaried individual, and deduction from family pension up to Rs 15,000, is currently allowed only under the old regime. It is proposed to allow these two deductions under the new regime also.

Personal income tax under new regime are:

- 0 to Rs 3 lakhs – Nil

- Rs 3 to 6 lakhs – 5%

- Rs 6 to 9 Lakhs – 10%

- Rs 9 to 12 Lakhs – 15%

- Rs 12 to 15 Lakhs – 20%

- Above 15 Lakhs – 30%

Any individual willing to be taxed under this new regime can opt to be taxed under the old regime. For those person having income under the head ‘profit and gains of business or profession’ and having opted for old regime can revoke that option only once and after that they will continue to be taxed under the new regime. For those not having income under the head ‘profit and gains of business or profession, option for old regime may be exercised in each year.

Govt has also proposed to make new tax structure as default tax option. Also, highest surcharge rate from 37% has been reduced to 25 % in new tax regime.

An individual with income of Rs 15 lakh will have to pay Rs 1.5 lakh tax, down from Rs 1.87 lakh under new tax structure.

Read all the Latest Business News here

Comments

0 comment