views

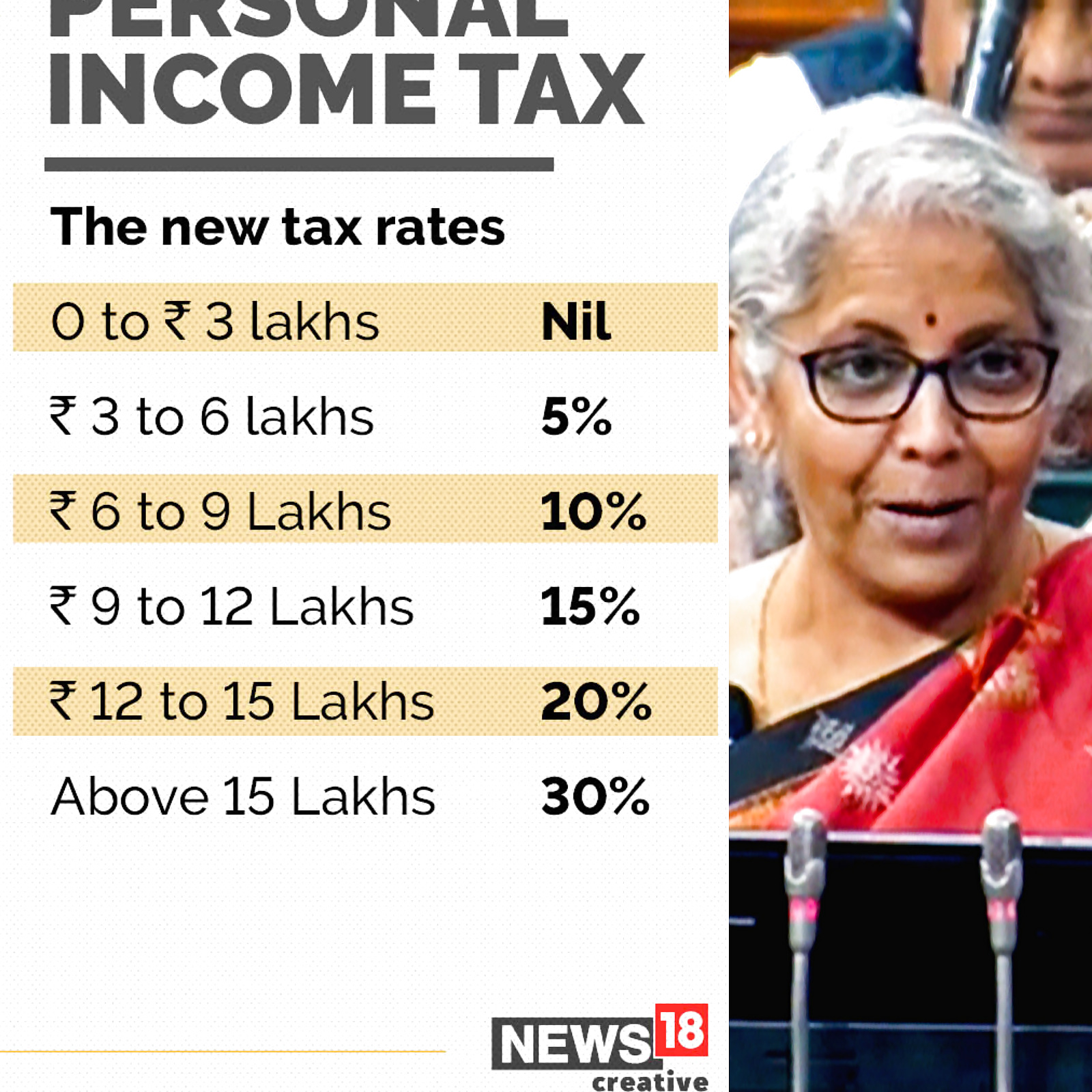

Income Tax Calculation After Budget 2023: Finance Minister Nirmala Sitharaman on Wednesday made five major announcements on personal income tax to benefit the middle class, especially salaried individuals, in the Union Budget 2023-24. She said those who are earning up to Rs 7 lakh will not have to pay any income tax. However, experts said that in case of Rs 10 rupee increase above Rs 7 lakh, income tax will be calculated on the whole income. However, the exemption of Rs 3 lakh and a standard deduction of Rs 52,500 will be adjusted while calculating the tax.

Income Tax Exemption Vs Rebate

Finance Minister Nirmala Sitharaman on Wednesday announced a ‘rebate’ of up to Rs 7 lakh, not the ‘exemption’. You must know the difference between the two. Under the rebate, a limit is fixed up to which the income is tax-free under Section 87A of the Income Tax Act, 1961. However, if the annual income exceeds the limit, tax on the whole income tax is to be paid.

A Delhi-based chartered accountant, while giving an example, said that the income tax rebate now will be given on an annual income of up to Rs 7 lakh in 2023-24. In this case, if an individual is earning an annual income of Rs 7 lakh during the financial year, his or her whole income will be tax-free. However, if the annual income increases even by Rs 10, the income tax on the whole Rs 7,00,010 will be considered for income tax calculation. Income tax on this income will have to be paid after adjusting the exemption of Rs 3 lakh and standard deductions.

How Much Income Tax Do You Need To Pay On Rs 7,00,010 Income?

Maneet Pal Singh, partner at I.P. Pasricha & Co, said, “In case assessee’s income is Rs 7,00,001, then as per the provisions of Section 288A, taxable income will be rounded off to Rs 7,00,000 and accordingly rebate under Section 87A shall be available and tax liability will be NIL.”

However, he added that considering assessee’s income is Rs 7,00,010, the tax liability would be Rs 26,001.

Providing relief to individual taxpayers, Finance Minister Nirmala Sitharaman on Wednesday raised the income tax exemption limit by Rs 50,000 to Rs 3 lakh, apart from increasing the income tax rebate from Rs 5 lakh to Rs 7 lakh. Apart from this, a standard deduction of Rs 50,000, which was available for the old regime, has also been extended to those opting for the new regime.

“My third proposal is for the salaried class and the pensioners, including family pensioners, for whom I propose to extend the benefit of the standard deduction to the new tax regime. Each salaried person with an income of Rs 15.5 lakh or more will thus stand to benefit by Rs 52,500.” Sitharaman said in the Budget Speech on Wednesday.

Read all the Latest Business News and Budget Live Updates here

Comments

0 comment