views

The date July 31 always rings a bell in a taxpayer’s mind. It’s around this time of the year when individuals are seen rushing to file income tax returns (ITRs) at the last minute. The last week of July, especially, brings along mayhem as people are seen compiling endless documents, struggling to find suitable forms and looking fanatically for chartered accountants for help.

But most of us don’t know that not every taxpayer in India has to file return by July 31. In fact, the deadline for filing ITRs is different for different categories of taxpayers. So, check important income-tax return filing due dates for FY 2018-19 (AY 2019-20) before hitting the panic button:

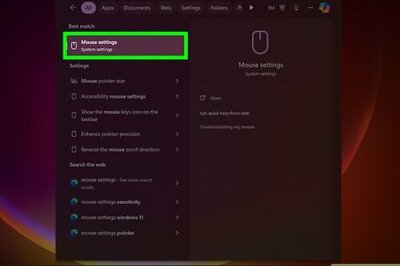

- For individuals, HUF (Hindu Undivided Family), BoI (Body of individuals), AoP (Association of Persons) whose books of account are not required, the due date is July 31, 2019.

- For businesses whose books of account are not required to be audited, the due date is July 31, 2019.

- For businesses whose books of account require an audit, the due date is September 30, 2019.

- For assesses who are required to furnish report under section 92E, the due date is November 30, 2019. The Section 92E of the Income Tax Act, 1961, requires a report to be issued by a chartered accountant (CA) wherever there are cross-border transactions between two associated enterprises.

However, it is important to remember that the dates presented above are just due dates, but returns can be filed even after these dates with interest. The actual last date to file ITR is one year from the end of relevant assessment year. For instance, the due date of income tax return for FY 2018-19 might be July 31, 2019, but this return can be filed until 31 March 2020. It is because one year for the AY 2019-20 gets over on March 31, 2020.

Comments

0 comment