views

New Delhi: A day after the results for Delhi municipal body elections were announced, a group of home buyers gathered in Noida holding lit candle in one hand and placard in the other. They had put down money for residential apartments which the property developer hadn’t delivered yet. Such protests have become a common thing in big cities across the country.

The new Real Estate (Regulation and Development) Act 2016 (RERA), which came into effect on May Day this year, is meant to prevent such issues by empowering consumers and regulating India’s vast real estate market.

Before delving into why real estate is proving to be so difficult to regulate, here are some salient features of the law:

- It regulates transactions between buyers and promoters of residential real estate projects by establishing Real Estate Regulatory Authorities (RERAs) in the states

- Promoters cannot book or offer residential real estate projects for sale without registering them with the RERAs. Real estate agents also need to register

- On registration, the promoter must upload details of the project on the website of the RERA, including the site and layout plan and the schedule for completion of the real estate project

- 70% of the amount collected from buyers for a project must be maintained in a separate escrow account and be used for construction of that project. A state government can alter this amount to less than 70%

The problem is that while RERA has been in the making for several years, 13 years to be precise, at the Union level, land in India is a state subject.

What complicates the issue further is that land and real estate are among the biggest generators of ‘black money’ and state governments will face pressure from the real estate lobby to water down the law.

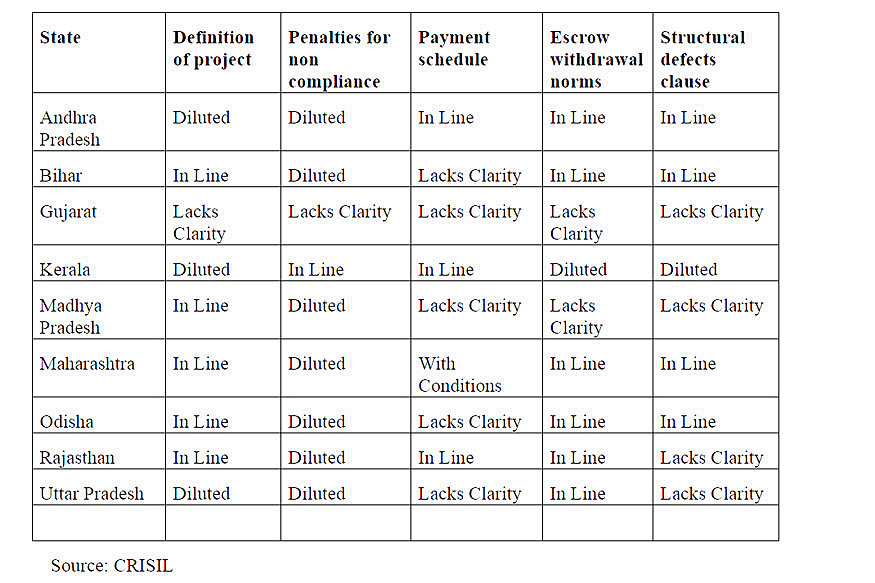

A research, released note by CRISIL last week, says that most states have missed the RERA deadline and many of those who have met it have watered down the crucial provisions, making it almost ineffective.

Only nine states and six union territories have notified their respective RERA rules.

Comments

0 comment