views

How safe is Venmo?

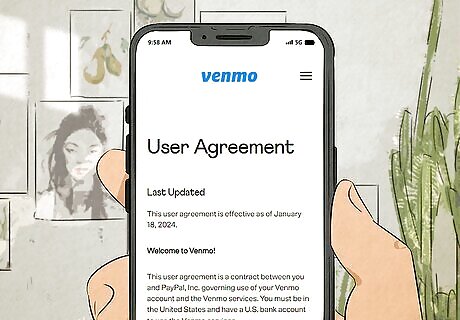

Venmo is a safe and secure place for your financial information. Through a combination of encryption and secure servers, Venmo has created a safe platform that can reliably manage your financial information. As secure as it is, though, Venmo isn’t (and shouldn’t be used as) a replacement for your bank. The Federal Deposit Insurance Corporation (FDIC) only insures deposits at banks and saving associations. While the FDIC protects Venmo money that’s received through a direct deposit or remote check, it won’t safeguard standard money transfers through the app.

Venmo can be risky if you don’t watch out for scammers. Venmo scams come in all shapes and sizes—from listings on Facebook Marketplace to romance scams, criminals have come up with all sorts of ways to hack, lie, and steal their way into your bank account. As secure as Venmo’s platform is, it can’t always stop scammers in their tracks.

Is it safe to display my Venmo name online?

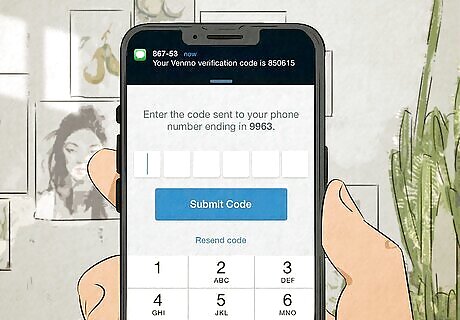

It should be safe, but always use caution when sharing your Venmo name. When it comes to the internet (especially apps and services that contain your financial info), the less info you have on display, the better. That said, Venmo has security measures to help keep your account more secure, like a built-in 2-Factor Authentication (2FA) system that forces you to verify your login through an additional measure, like receiving a code over text. If you’re running a business, consider creating a business profile. This will be attached to your current Venmo profile as a separate entity.

Common Venmo Scams

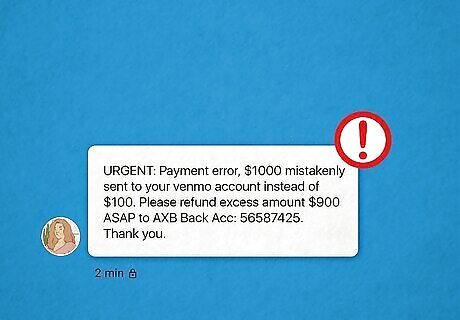

Accidental payment Some scammers will randomly send you money and then expect you to send a new payment over to make up for their mistake. Solution: Contact Venmo and let them clear things up.

Borrowing your phone A scammer might approach you and ask if they can use your phone to look up directions. Once they receive your phone, they access your Venmo account and transfer away your money. Solution: Never give your phone to someone you don’t know. If they truly need navigational help, you can pull up directions independently and help guide them that way.

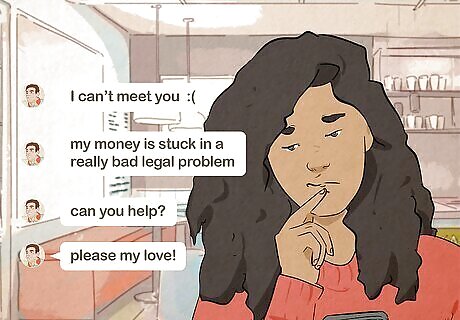

Catfishing The scammer strikes up an online relationship, giving excuses on why they can’t meet up. Eventually, they’ll ask for you to send them money (possibly to help them with some type of emergency). Solution: Thoroughly research the person’s profile to make sure you aren’t being catfished. Never send money to a person who refuses to call, meet up, or make significant contact with you.

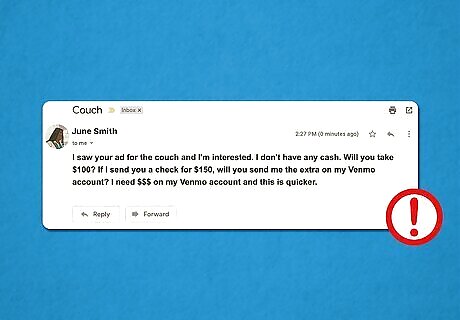

Check payments The scammer mails you a seemingly legitimate check, which they ask you to deposit and pay back to them on Venmo. While the check clears at first, it eventually bounces, leaving you on the hook. Solution: Don’t accept checks from anyone on Venmo, especially if you don’t know them well.

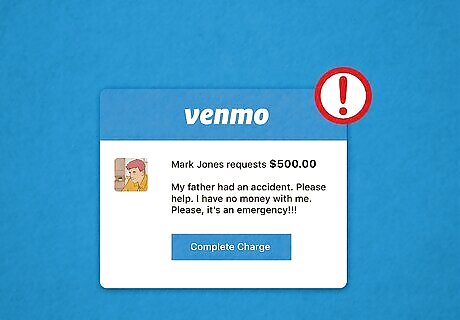

Fake emergency A scammer takes on the identity of someone you care about (e.g., a sibling, grandparent, close friend, etc.) and pretends to experience some type of emergency or accident. They contact you with this guise in the hope that you’ll Venmo them some money. Solution: Assume that the request is fake until you’ve had a chance to contact the person independently.

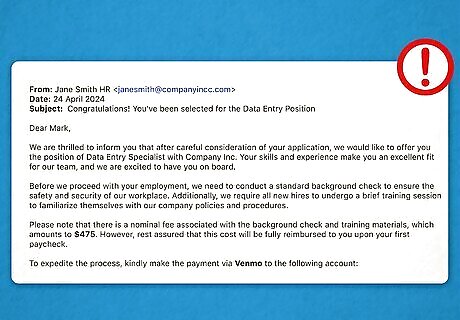

Fake job posting A scammer creates an online job posting, interviews and accepts applicants, and then requests payment for getting the “employees” onboarded with the fake company. Solution: Never work at any place that demands payment upfront.

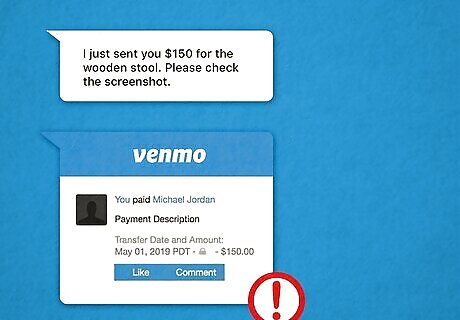

Fake payment receipt When you’re selling something online, a scammer might claim to have sent you payment over Venmo (with a screenshot included as evidence), or they might claim to use a delayed payment feature, which doesn’t actually exist. Solution: Confirm that the payment is your Venmo account before sending the item.

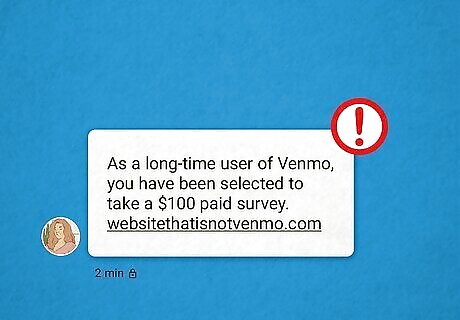

Fake prizes A scammer texts or emails you explaining that you’re the winner of a cash reward from Venmo. To claim it, you need to click/tap on a compromised link or provide sensitive account information. Solution: Confirm if someone from Venmo really is contacting you. Venmo only ever contacts users from official channels: @Venmo and @VenmoSupport on X/Twitter, @Venmo on Facebook and Instagram, and emails ending with the @venmo.com domain.

Fake tech support You call the customer helpline for a well-established company (seemingly) but are eventually told that you need to Venmo a certain amount of money to a random account for technical help. Solution: Go on the company’s website to confirm what their customer support number is. Legitimate customer support won’t request or expect payment.

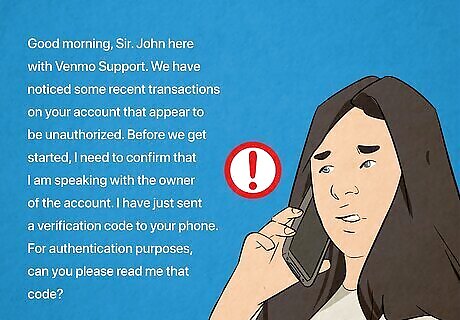

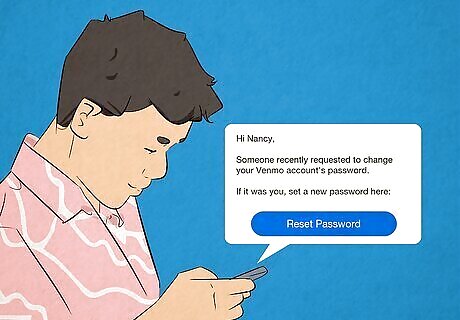

Fake Venmo support agent A scammer moonlights as a Venmo support employee in an attempt to collect a verification code from you. Solution: Don’t give any verification codes out to anyone you don’t know. The “verification code” they want is Venmo’s 2FA code that’s actually keeping your account safe.

Overpayment The scammer sends you a large amount of money, only to ask for you to refund some of it back independently. The money they originally sent was fraudulent and will quickly be removed from your account—but you’ll be on the hook for what you sent to the scammer. Solution: Get in touch with Venmo to confirm if a refund request is legitimate or not.

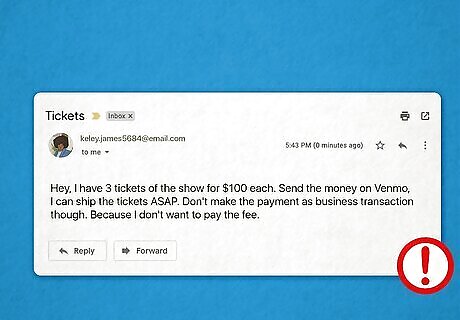

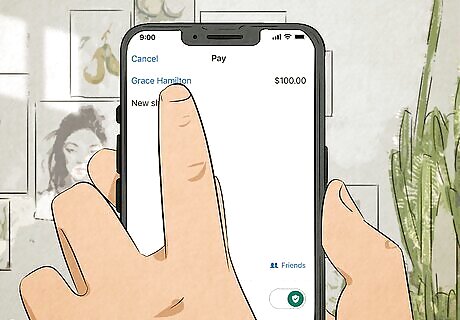

Popular item scam A scammer might ask for payment ahead of time, only to never ship out the item they’re listing. Solution: Whenever you purchase an item on Venmo (from a personal profile), flag the transaction as a purchase, which grants you Venmo Purchase Protection. If you end up scammed, Venmo will reimburse you.

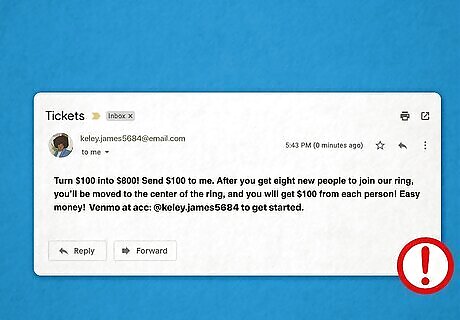

Pyramid schemes A scammer tries to convince you to invest in what essentially is a “get rich quick” scheme—you give them a small amount of money ($50), and they give you a large amount ($500) later. In actuality, the scammer pockets your money and never sends you anything. Solution: Ignore anyone who claims they can get you a lot of money in a short period.

What to Do if You’re Scammed

Reach out to Venmo Support. Open your Venmo app and head to the “Get Help” section of your settings. Tap “Contact Us” followed by “Email Us” or “Chat with Us.” You can also call the Venmo support number at 812-4430, or fill out a contact form on their website. Go into as much detail as possible about how you were scammed.

Remove sensitive info from your account and change your password. If someone compromised your account, changing your password is the best way to protect your account from other intruders. While Venmo (and your bank) tackle the scam, it’s also a good idea to disconnect your bank details from your profile.

Get in touch with your bank. Go into detail about how you were scammed and ask if you can get your money back. While you’re at it, see if your bank can keep an eye on your account for any fraudulent activity. Let them know which debit cards and account numbers were linked with your Venmo, too—in some cases, your bank might temporarily shut them down.

Report the scam to the proper authorities. If you’re a victim of fraud, report the crime here; if the scammer is attempting to steal your identity, visit this site. If your credit card was compromised in a Venmo scam, alert Equifax, Experian, and TransUnion about it. While touching base with these 3 credit bureaus, ask if they can freeze your credit report while the scam gets sorted out.

How to Stay Safe on Venmo

Only use Venmo with people you know well. Exchanging money with a trusted friend or loved one all but guarantees that your transaction will go smoothly. If you’re giving/receiving money from someone you don’t know as well, make sure they seem completely trustworthy before giving them your Venmo.

Choose a secure password. Replace any easy-to-guess passwords (like “password”) with passcodes that are at least 8-10 characters long and filled with different symbols and letter cases. The longer and more complex your password is, the trickier it will be for a scammer to guess. Keep personal info out of your password that can be easily guessed, like your birthday. It can help to sprinkle basic emojis (like :) or :P ) in your passwords to make them memorable and tough to crack.

Transfer your Venmo funds to the bank right away. Scammers can’t steal what isn’t in your account, so it’s a good idea to move your Venmo balance to your bank as soon as you possibly can.

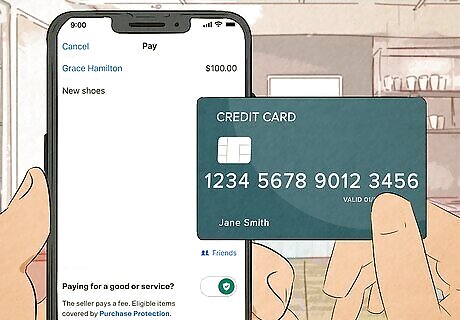

Make Venmo payments with a credit card. In the US, credit card companies can’t hold customers liable for more than $50 if fraud is committed with your credit card (and some companies don’t hold customers liable at all). Debit cards, on the other hand, have scaling liability depending on how long it takes the customer to report a lost or stolen card. Waiting longer than 2 days makes you liable for $50, while waiting longer than 60 days makes you liable for $500. Essentially, you have a little more legal recourse if you’ve linked a credit card to your Venmo.

Stick with cash or check for bigger purchases. The more money you funnel through Venmo, the more you stand to lose in an interaction with a scammer. Any legitimate seller/buyer will be willing to use a more traditional payment method for big-ticket items. Let’s say you see someone selling a brand-new TV on Facebook Marketplace that typically retails for $900. It would be best to offer payment in cash or check rather than sending a Venmo payment.

Confirm that your payments go to the correct recipients. Check your Venmo account periodically after sending a payment on Venmo to make sure that your money has gone to the proper place. If you notice anything funky on your account, contact Venmo right away.

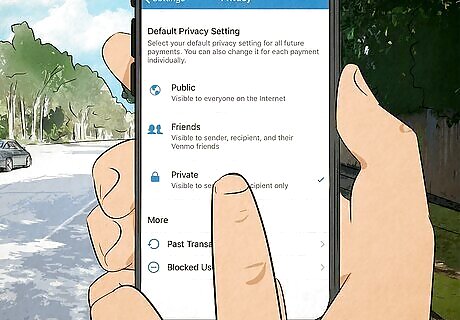

Tighten up your Venmo privacy settings. Head to the “Settings” area of your Venmo and tap on the “Privacy” menu. Make sure that your Privacy settings are switched to “Friends” or “Private” rather than “Public,” which Venmo sets accounts to automatically.

Don’t post personal info about yourself online. When it comes to any digital platform (including Venmo), privacy is your best friend. Putting your personal information online leaves you vulnerable to identity theft, doxxing, fraud, and other negative circumstances.

Venmo vs. Other Platforms

Venmo isn’t as transparent about data collection as other companies. Venmo, like Zelle and Cash App, tends to collect user data like geolocation info and profile pictures. Venmo goes the extra mile, though, by holding onto your social media connections as well as your banking login.

Venmo could be clearer about what they do with your data. Establishments like Zelle, Apple Cash, and Cash App outline how they only hand user data over to governmental or law enforcement personnel. Apple Cash is also transparent about giving user data away to third parties. Zelle and Venmo are much less clear about what they do with collected user data.

Comments

0 comment