views

X

Expert Source

Keila Hill-Trawick, CPACertified Public Accountant

Expert Interview. 30 July 2020.

You can read a tax return transcript by comparing the transcript descriptions with a blank return to locate specific lines.[2]

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

Comparing a Transcript to a Return

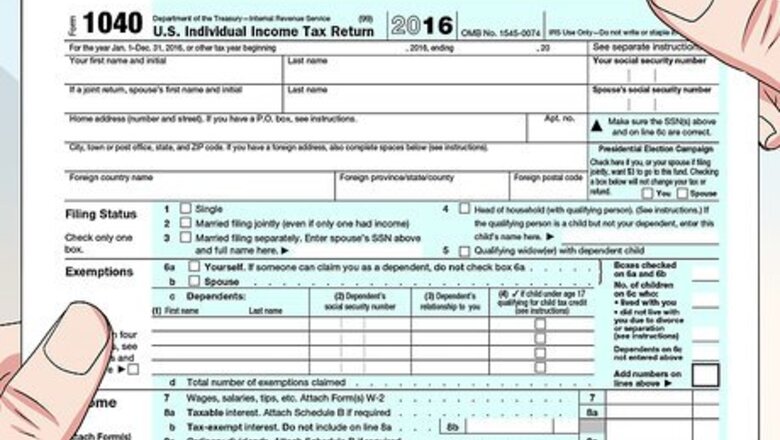

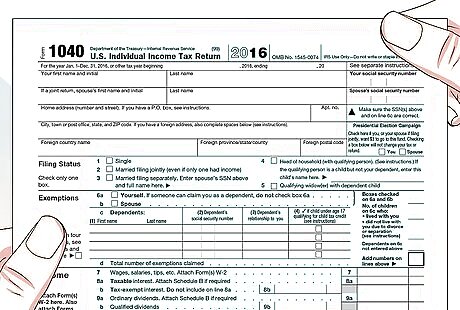

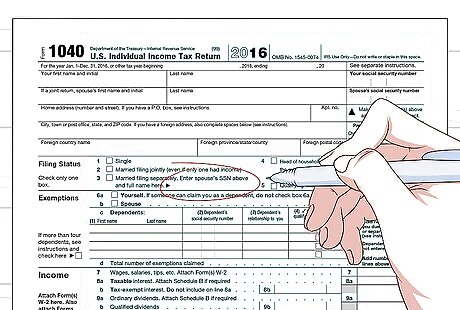

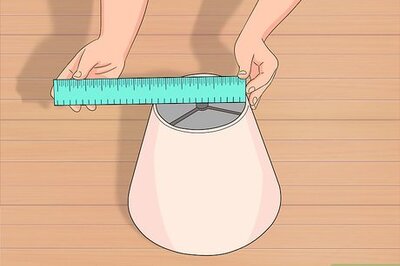

Get a copy of a blank return. Specific line numbers aren't included on a transcript. If you need to know what figures you entered on specific lines, start with a copy of a blank return. You can download a copy of a blank return on the IRS website at https://www.irs.gov/. Click on the "Forms & Instructions" tab, then click the form you need from the drop-down. Choose the same form as the one you filed. If you're not sure which form you filed, look at the top of your transcript, beside the words "Form number."

Mark the line numbers you need. Check the blank return to find the lines that include the data you need. Along with the line number will be a description of the data to be entered on that line. The description of the data you entered in that line may be the section heading for a group of lines, or it may be on the line itself.

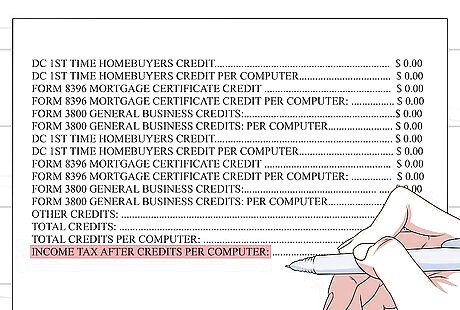

Match the same description on the transcript. Since your tax return transcript doesn't include the line numbers for the data, you have to use the description to find the data you need. Look for words on the transcript that are the same, or similar to, the words on the blank return. For example, if you're looking for the amount you entered on Line 4, this amount is your adjusted gross income. On your transcript, it will be listed as "adjusted gross income" under "adjustments to income." Your transcript may have two lines for the same description. The second line will end with the words "per computer." This reflects adjustments made by the IRS to the amount you entered on your return. Use those numbers, since they reflect the IRS's records most accurately.

Choosing the Right Type of Transcript

Ask your lender what data is required for applications. Tax transcripts are most frequently used to validate your tax filing status and past income if you're applying for a student loan, small business loan, or mortgage. You need to know exactly what figures are needed, and for what years, so you can make sure you order the right type of transcripts from the IRS.

Compare the types of transcripts available. The IRS offers several different types of transcripts for free. Since it may take some time for you to receive your transcripts, make sure the type you order has the information you need. A tax return transcript includes most of the information you provided on your tax returns. This type of transcript is sufficient for most financial transactions, such as loans and mortgages, that require tax information. Of the different types of transcripts, the tax return transcript is the most straightforward and easiest to understand. In contrast, the tax account transcript includes all transactions on your tax account (both by you and by the IRS), and frequently lists codes and abbreviations that are difficult to decipher.

Request a record of account transcript if you filed an amended return. A tax return transcript only includes the information provided in your original return. If you filed an amended return, that information will not be included on the tax return transcript. A record of account transcript combines an account transcript and a tax return transcript, so you have all the tax return information along with all transactions on your tax account, such as amendments, that were filed after your original return was filed.

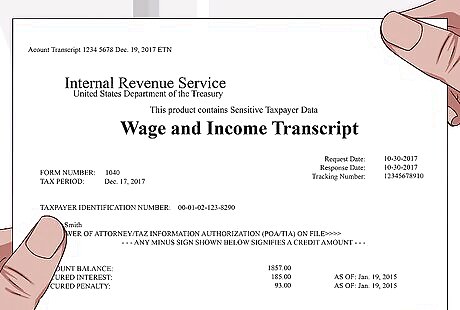

Use a wages and income transcript for older returns. You can only get tax return, record of account, or tax account transcripts going back 3 years. However, you can request a wages and income transcript going back 10 years. This transcript won't have any information about your tax filing status, or taxes you owed or paid, but it will have all of your income. This transcript is appropriate if you need to verify basic income and employer information.

Correcting an Inaccurate Transcript

Consult a tax professional. If you suspect there are errors on your tax return transcript, a CPA or tax professional can help you get to the bottom of the problem. Transcripts are complex and can be difficult to understand on your own, so you may misread something as incorrect. Look for an accounting professional who has specific education on tax and has experience reading and interpreting tax transcripts.

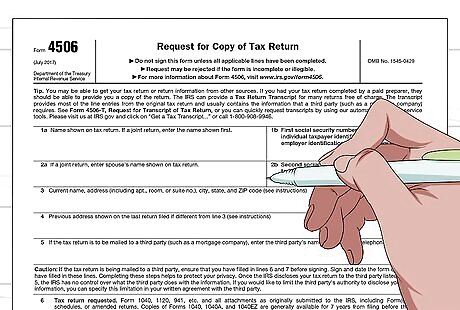

Order a photocopy of your actual return. If you think you've found an error on your transcript, compare the data listed on your transcript to the figures you entered on your actual return. If you no longer have copies of your returns, you can order a photocopy from the IRS. You can download Form 4506 from the IRS's website at https://www.irs.gov/pub/irs-pdf/f4506.pdf. Fill out this form and mail it to the correct address listed in the instructions along with your fee. The IRS charges $50 for each return you request. It may take over 2 months for you to receive the copies you requested.

Look for the phrase "per computer" on your transcript. Sometimes the IRS changes the figures you reported on your return. It may be a suspected error, or because the information you submitted was incomplete. If figures are changed, the new figure used by the IRS will be followed on your transcript by the words "per computer." These changes may indicate an error on your return, or they may represent an error on the part of the IRS. Read through your original returns to see if there are any issues. If necessary, you can file an amended return to adjust for any discrepancies.

Contact the IRS to report inaccurate information. If the transcript doesn't match up with your actual return, or if it contains information that is unfamiliar to you, let the IRS know about the problem as soon as possible by calling 1-800-829-1040.

Comments

0 comment