views

So why not learn to make the best decision, or at least a good one every time? While making a decision based on your "gut instinct" often works, occasionally a simple quantitative scoring system can provide additional insights and can help you overcome an emotional decision that you will later be unable to justify logically.

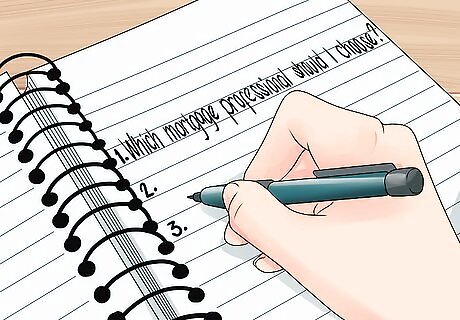

This method will help you quantify your values and make fast decisions between alternatives. It applies to everything from "which mortgage professional should I choose?" to "which car should I buy?".

Write three questions you’re trying to decide. Our example will be "Which mortgage professional should I choose?"

Write up five or six "must-have qualities". For example: Integrity (What he/she says is consistent with what he/she does), Professional Knowledge and Expertise (Makes Recommendations consistent with what I value), Quality of Communication (Helps me understand quickly), Accessibility (I can reach them when I need them), Competitive Pricing (Rates and Costs are amongst the best in the marketplace), and Reliability of recommendations (Shows me that live market data is consistent with recommendations so I can make a timely decision to choose them).

Rate the importance of each of these qualities on a scale of 1 to 10 in terms of how important each is to you. (If reliability is far more important than anything, it gets a 10, if Competitive Pricing is the second most important but really not nearly as important as reliability you might give it a 5 or 6, and so on.)

List your options. (Bank Loan Officer, Realtor Referred, my current Loan Broker, etc.).

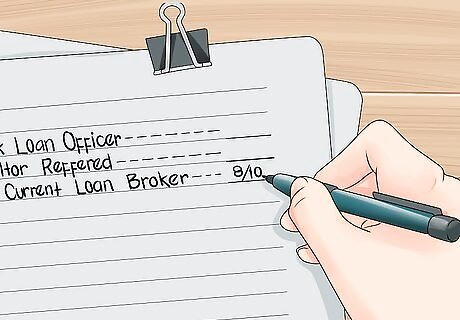

Rate each option on a scale of 1 to 10 for each quality you put down for that option. (If your current Loan Broker rates are good with you, give them an 8, but if you think they are average, give them a 5.) This is a subjective scale, so it’s up to you to score it as honestly as possible to make the best decision by the end of this process.

Compute scores for each option by multiplying the quality score you gave your option with your target quality score, the one you created in Step 3. (For example, your Loan Broker scores 56 in Integrity: 8 [the importance of Integrity] x 7 [how well you rate them in that area]).

Sum up the scores for each quality for a total score for that option. Compute a separate score for each option.

Decide on a target score.

Divide each option’s total score by your target score and multiply by 100 to get a percentage score. The option with the highest score (compared to your target) is your best choice.

Comments

0 comment