views

Doing Your Research

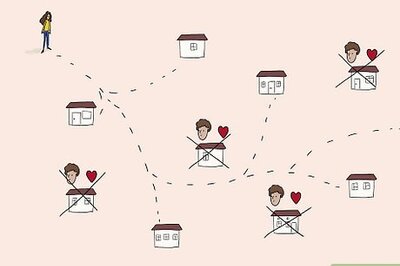

Make sure that leasing a car is the right option for you. When you lease a car, you make a small down payment (typically less than 20% of the car's retail price) and then make smaller monthly payments until the term of the lease is up. When the term is up, you hand the keys — and the car — back to the dealer. There are both drawbacks and advantages to leasing. The drawbacks: You don't own the car when the lease term is up. Leasing several cars over a long period of time is more expensive than investing in a single car. You may have to pay fees if you go over the number of miles on your contract; inflict damage or cause wear on the car's interior, exterior, or driving performance; trade in the car before your lease term is up. The advantages: You can drive a car whose retail price you can't afford. If you don't hold onto your cars for a long time, leasing can ultimately save you more money.

In addition to a down payment, figure out how much you can pay monthly for a lease agreement. If the car that you've been driving in your dream is, on average, $250 dollars over your monthly maximum, it probably won't make sense to go into debt in order to finance the car. So hammer out a budget, stick to it, and find out what options you have based on your available money.

Find the car of your dreams (or the car of your current dream). Identify the car or cars that you want to commit to. If you don't have a firm idea of what kind of car you want, including options, color, and interior, among others, a salesman is going to try to convince you to upgrade based on what he wants to sell, not what you want to buy. Reduce your overall costs by choosing cars that have great gas mileage, good safety features, low maintenance costs, and time-tested dependability. Just because you can lease a Mercedes Benz doesn't mean you should ignore the Honda. Talk with your insurance agent about models that will keep your insurance premium low. If your insurance currently covers a 2004 GM, but you're thinking of upgrading to a Jaguar, your insurance premiums aren't going anywhere but north. Understand your insurance responsibilities. You will pay for the insurance on the car even if the leasing company says they supply it. In that case, the monthly payment is rolled into your lease payment.

Take any interesting cars for a test drive. Go to the dealer with no intention of leasing — in fact, don't mention yet that you're planning on leasing — and instead take one car you have in sight out for a test drive. Pay attention to how the car makes you feel, and how it performs under limited pressure. The following aspects will make the most difference when the time comes for you to use your vehicle on an ongoing basis.: Head and legroom Seating Visibility (especially blind spots) Engine power Handling Controls

Secure financing, if necessary, from a bank or credit union before you go to the dealer. If you anticipate needing to secure financing for a down payment on your vehicle and don't have the cash ready, go to a bank or credit union to get the financing. Don't get financing at the dealership. Too often, this results in bad deals for the customer and great deals for the dealership.

Getting the Best Lease Deal

Negotiate the final purchase price first. The leasing option you get on your car will depend on the negotiated purchase price. The lower the total price of the car, the lower the payment, even with leasing. It's best to have this hammered down first, and in writing, so that the salesperson cannot step back and try to hoodwink you once you get down to the nitty gritty details. Know about the invoice price of the car. The invoice price is the price the dealer paid for the car. While it's not reasonable to expect to negotiate a price at or lower than the invoice, it's a good general area to shoot for. Your final negotiated price should be somewhere between the invoice and the suggested retail price. Walk away if the salesperson brings a four-square worksheet into the negotiation. A four-square worksheet is a sleight-of-hand trick the dealership uses to confuse the buyer about their options. Some dealers work with it extensively. If your salesperson brings one out, tell him that you won't continue negotiating until it's been put away.

Once a final purchase price has been agreed upon and put in writing, negotiate the leasing terms. The bigger your initial down payment, the lower your monthly payments will be. At the same time, you may be able to get a deal with no down payment and a relatively low monthly payment, according to US News best lease deals of 2013. Know what your total "capitalized cost" will be. Your capitalized cost is a fancy terms for the negotiated price of the vehicle, plus the acquisition cost, plus the destination fee. This is the money you'll be paying, not including the monthly payments, in order to lease the car. Factor in any "capitalized cost reductions." Capitalized cost reduction is any cash down payment, trade-in credit, or rebate that reduces your total capitalized cost.

Walk away if you think something is fishy, or suspect you're being taken advantage of. Dealerships are hard places to feel like both parties have actually gotten what they wanted. Too often, the customer feels a sour taste in his or her mouth after they learn of "fees" and "adjustments" that are tacked on to the final cap cost. If you're not afraid to walk away from the dealership, the dealer is forced to bargain with you — the honest way. You're telling them that you're a straight shooter, and you won't tolerate any tricks or nonsense.

Know the relationship between a car's residual value and monthly payments. The vehicle’s residual value is the value of the car after you've finished leasing it; it's useful if you decide to buy the car after your lease is up. You'd think you'd want a low residual value on your car after your lease is up. Say your car is worth $20,000, and the residual value is worth $10,000 after a 3-year lease. That means that you can buy the car for $10,000 after three years. Great, right? Not always. If you the residual is $10,000 after three years, that means you use up $10,000 of the car's value during those three years. That means your average monthly payment, divided by 36 months, is $277 plus interest and fees. What if your residual is $13,000 after three years? That means you use up $7,000 of the car's value, setting your average monthly payment at $194. Higher residuals mean lower monthly fees, although lower residuals mean you can buy the car for less once the lease is done.

Don't get so obsessed with the monthly payment number that you forget about fees. Dealerships are smart; they'll dangle the magical monthly payment number in front of your eyes, and then pack on fees toward the end of the negotiation, often raising the capitalized cost significantly. After haggling with you for an hour or two, the dealer knows that it seems wasteful for you to derail the negotiation over one $300 fee here, another $75 fee there, and one $650 fee for good measure. They'll use this psychological understanding to their advantage. Don't let them. Dealerships often levy a fee for turning in a leased car and not leasing another car from the same dealership. This is sometimes called a disposition fee. Dealerships also levy a fee for deciding to buy the car after the term of the lease has ended. This is sometimes called a purchase fee. These fees and surcharges are generally negotiable. Remember, the dealer is betting that you're attached to the car enough to eat the fees, even if they're noxious. If you're willing to walk away, the dealer loses much of their power.

Check for any rebates associated with the car. Go to the manufacturer's website directly and look for rebates associated with leasing the car. These rebates are typically applied to the down payment of the car, although they sometimes help lower the residual cost of the vehicle. Be aware that some dealers will misinform you that certain rebates don't apply to leasing arrangements. Don't believe them at their word; certain rebates are specifically designed for leasing arrangements.

Look over the lease agreement. Discuss your financial liability for periodic maintenance and repairs. If you do not understand something, ask for complete clarification. In the end, you are signing a legal document and will be held responsible for what it says. Sign the leasing document if all is agreeable. Realize that you will easily lose an average of half the value of the car to depreciation when the leasing period is over.

Enjoy your beautiful, new car. Make all of your payments on time and pay strict attention to mileage clauses, or this will change what happens when you turn in the car at the end of the lease.

Comments

0 comment