views

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

Each type of application has specific requirements for information and documentation.

Obtaining a Social Security Number

Understand social security numbers (SSN). Since its adoption as the de facto national identification number, the SSN has become by far the most commonly-used type of Taxpayer Identification Number. SSNs are issued to all U.S. citizens, permanent residents, and some temporary working residents. Usually, if you're employed in the United States, you have a SSN.

Obtain an application for a SSN. The Social Security Administration (SSA) is a government agency that handles applications for new SSNs. Most citizens of the United States and individuals who are legally permitted to work in the United States are eligible for a Social Security number. To obtain a SSN, you need to submit one of two SSA applications. If you're inside the U.S., you'll need to fill out Form SS-5. If you're outside the U.S., you'll need to fill out Form SS-5-FS. Note that both forms are titled "Application for a Social Security Card", which can be somewhat confusing. You can obtain these SSN applications several ways, including: Calling 800-772-1213 Visiting your local Social Security office Downloading and printing an application from the SSA website at www.socialsecurity.gov/forms/ss-5.pdf or www.socialsecurity.gov/forms/ss-5fs.pdf Be sure to print the form only on 8-1/2” x 11” or A4 white paper.

Complete the application form. Unless you are typing the form, legibly handwrite your entries on the form using only blue or black ink. Instructions should accompany the form, but you should be able to follow the guidelines in the following steps.

Provide basic identity information. Sections 1-5 include basic information such as name, birthplace, and citizenship status. Fill out sections 1-5 with the following information: Section 1: On the first line, write the applicant’s first, middle, and last name as it should appear on the Social Security card and account. If the applicant’s name is different than it was at birth, enter the applicant’s first, middle, and last name at birth on the second line. If the applicant has used any other names than these two, list those names on the third line. Section 2: Enter any previous SSN the applicant has had. Leave this section blank if the applicant has never had another SSN. Section 3: Write the applicant’s birthplace, including the full city and US state for US-born applicants or the city and foreign country for applicants born in other countries. Section 4: Write the applicant’s date of birth in MM/DD/YYYY format (2-digit month, 2-digit day, 4-digit year). For example, January 1, 1970, would be written as 01/01/1970. Section 5: Check the box that indicates the applicant’s citizenship status. If you are checking “Legal Alien Not Allowed to Work” or “Other”, contact the Social Security Administration at 800-772-1213 to verify that the applicant is eligible for a Social Security Number. You will need additional documentation from a US governmental agency explaining your need and eligibility for a Social Security number. For example, the applicant may have to provide a letter written by an authorized agent of the governmental agency that provides you with this eligibility or need. A Social Security representative can give you more direction about obtaining this documentation based on your particular situation.

Provide demographic and family information. Sections 6-10 ask for information about the applicant’s race, gender, and parentage. Fill out the information as follows: Sections 6 and 7: These demographic sections are completely voluntary, so you can leave them blank if you wish. If you choose to answer either or both sections, check whether the applicant identifies as Hispanic or Latino and which race(s) the applicant claims to be. Section 8: Select the applicant’s gender as male or female. Section 9: Provide the applicant’s mother’s information. Write the applicant’s mother’s full name at her time of birth on the first line. Enter the applicant’s mother’s SSN on the second line. If that number is unknown, leave this portion blank, and check “Unknown”. Section 10: Provide the applicant’s father’s information. Write the applicant’s father’s full name at his time of birth on the first line. Enter the applicant’s father’s SSN on the second line. If that number is unknown, leave this portion blank, and check “Unknown”.

Enter SSN application history and contact information. Sections 11-16 require information about past applications for Social Security numbers as well as current contact information. Provide the following information: Section 11: Check “yes” if the applicant has ever submitted a Social Security number application in the past. If he has not, or if you don’t know, check the appropriate block and skip to section 14. Section 12: If the applicant already has a SSN, write the full name of that person as shown on that person’s Social Security card. Leave this section blank if you checked “No” or “Don’t Know” in section 11. Section 13: If the applicant has a Social Security number and that account shows a different date of birth than the one on this application, write the date of birth listed in the other account in MM/DD/YYYY format. Leave this section blank if you checked “No” or “Don’t Know” in section 11. Section 14: Write the date that you complete and sign the form in MM/DD/YYYY format. Section 15: Write the telephone number (with area code) at which you can be reached during the day. Section 16: Write your full mailing address with no abbreviations. (For example, write “Street” instead of “St.”)

Sign the application. In section 17 of the application, sign your name. If you are the applicant, your signature should match your name in section 1. If you cannot sign your name, place your mark and have 2 people witness it. The person signing or marking the form is swearing that all of the information on the form or the attachments is true and correct to the best of that person’s knowledge. Lying on the form or enclosing fake documents can subject the person signing the form to criminal sanctions, including for perjury. In section 18, choose your relationship to the applicant. If you are not the applicant or the applicant’s parent or legal guardian, check “Other” and write your relationship on the line provided. You should not make any marks on the form below sections 17 and 18.

Gather your attachments. With either Form SS-5 or Form SS-5-FS, you will need to prove your identity, age, and US citizenship or immigration status. If you are preparing the application for someone else, you will also need to prove your identity and show that you have the authority to apply on that person’s behalf. You will need to have original documents or documents that have been certified by the custodian of record. These certified records usually include a raised seal from the record keeper’s office. Be sure to specify that you need certified records when you obtain a copies from the organization or agency that keeps the records, such as the Office of Vital Statistics. If you have difficulty obtaining these documents, contact your local US Social Security office, US Embassy or consulate, or Veteran’s Affairs Regional Office. If you are mailing your application, these official documents will be returned to you.

Provide documented evidence of age: The preferred document is an original or certified birth certificate. You can usually obtain this from the Office of Vital Statistics in the state in which you were born. Other acceptable records include a US hospital record of your birth that was created at the time of birth, a religious record established before the age of five which shows your age or date of birth, a passport, or a final adoption decree that states that birth information was taken from the original birth certificate.

Provide evidence of identity: These documents must be current and unexpired. If a document does not have an expiration date, it is generally accepted if it was issued within the past two years for adults or four years for children. Most acceptable documents must show your legal name, biographical information (such as date of birth, age, or parents’ names), and/or physical information (such as a photograph or description). Common documents used include a US driver’s license, a US state-issued non-driver identity card, or a US Passport. If you are not a US citizen, you must provide your current US immigration document(s), your foreign passport, foreign driver’s license or foreign ID card with biographical information or photograph. Documents issued in the US are preferred, but an apostille may be required for foreign documents (see the ITIN/ATIN sections below).

Provide evidence of US Citizenship or Immigration status. The preferred documents to show US citizenship are a US birth certificate or US passport, but other common documents are Consular Report of Birth, Certificate of Citizenship, or Certificate of Naturalization. For evidence of immigration status, you must provide your current, unexpired immigration documents issued by the Department of Homeland Security, such as your Form I-551, I-94, or I-766. International students or exchange visitors will likely need to prove proof of authorization to work. If you do not have that authorization, you will need to provide proof of a valid non-work reason to need a Social Security number.

Go for an interview at the Social Security office. If the applicant is over 12 years of age, you must apply in person at your local Social Security office and submit to an interview. The interviewer can ask you any question deemed relevant to your eligibility for a Social Security number or any prior applications or issuance of a Social Security number. You may be asked to provide documents, such as proof of living overseas, school records, or tax records, that show you do not have a Social Security number. This is at the sole discretion of the interviewer, if s/he feels evidence is necessary. If you are unable to satisfy the interviewer at the time of the interview, you will be allowed the opportunity to submit these documents at a later time, after discussing the type of documents the interviewer would deem acceptable in your case. If you are outside the US (using form ss-5fs), you can present yourself and your documents to the Citizen Services Office of your nearest US Embassy or consulate or to your nearest Veteran’s Affairs Regional Office. If you are associated with the military, you may be able to present yourself and your original documents to the Post Adjutant or the appropriate Personnel Office.

Mail the application if applicable. If the applicant is under the age of 12 at the time of application, you can mail the documents to any Social Security office (except the Social Security Administration in Baltimore, Maryland), US Embassy or consulate, or the VARO in Milan. It is strongly suggested that you use a trackable mail type and provide an additional shipping label for return shipping via trackable means with your application. Most countries provide international trackable shipping services, but the return shipping label may not be valid if shipping outside of that country. Private international shipping companies that provide trackable shipping services include DHL, FedEx, UPS, and others.

Check your mail. Once all of the documentation is received by the Social Security Administration, and the interview is complete (if required), your SSN should be issued, and your card should be mailed to you within two weeks.

Appeal a denial decision. If your application is denied, you will receive a letter in the mail instead of a Social Security card. Follow the instructions given in the letter you receive stating why your application was denied to appeal the decision.

Obtaining an Employer Identification Number

Understand the Employer Identification Number (EIN). An EIN is the corporate equivalent of the SSN. Any business or individual who has to pay withholding tax on employees or that or files a separate tax return from that of its owners is issued an EIN. This includes any business or individual who pays employees, corporations, partnerships, LLCs, and other business entities. The EIN is sometimes referred to as a Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number.

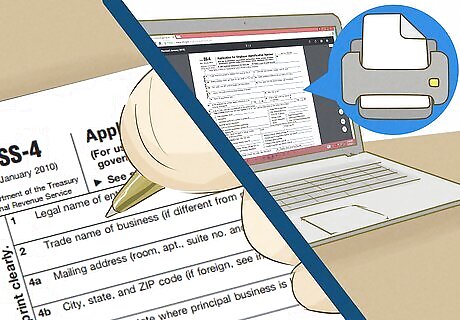

Obtain an EIN application. A single form, Form SS-4, must be completed to obtain an EIN. By far the easiest way to complete this application is by applying online at https://sa.www4.irs.gov/modiein/individual/index.jsp. Completing the form online is quick, free, and allows you to immediately obtain your EIN following the interview-style application. International applicants need to call 267-941-1099 (note that this is not a toll-free number). If you prefer not to disclose information online, you can also apply several other ways. After you can find the most current version of the form at www.irs.gov/uac/Form-ss-4,-application-for-employer-identification-number-(EIN), you can download and print the application. Then send it in by doing one of the following: Mailing the application to appropriate IRS address. By faxing the application to the relevant state fax number.

Complete the form. Complete the EIN form online or by downloading and printing it. If filling out the form by hand, be sure to use blue or black ink. The form should guide you through completing each section, but the following steps can assist you in providing the proper information.

Provide the name of the business owner. Write the full legal name of the entity in box 1. If the business is owned by one person and does not have articles filed with the Secretary of State organizing it as something other than a sole proprietorship, this will be the full legal name of the owner. If the business has organizing documents, this will be the full legal name of the business as stated on those documents. If the business goes by a name different than the name in box 1, put that name in box 2. Otherwise, leave box 2 blank. For example, if John Smith is the sole owner of John’s Johns, but he has not organized as an LLC, corporation or other legal entity, he would put John Smith in box 1 and John’s Johns in box 2. But, if John Smith had registered his business as an LLC with the Secretary of State, he would put John’s Johns, LLC, in box 1 and leave box 2 blank.

Provide current contact information. Write the name of the person to whom any correspondence should be addressed in box 3, and provide the full mailing address of the business in boxes 4a and 4b. If the address is in a foreign country, you must include the full address, including the country (not abbreviated). Write the full (home) mailing address of the person named in box 3 in boxes 5a and 5b. If the address is in a foreign country, you must include the full address, including the country (not abbreviated). Write the county and state in which the principal place of business is located in box 6. Do not abbreviate.

Provide relevant tax information. Write the full name of the person or entity which will be ultimately responsible for this tax entity in box 7a and enter their tax ID number in box 7b. If the entity is a US limited liability company or similar foreign company, check “Yes” in box 8a, enter the number of members who own the LLC in box 8b, and check whether the LLC was organized in the US in box 8c. Otherwise, check “No” in box 8a and leave boxes 8b and 8c blank. Choose the entity that applies to the business and include any special information requested in box 9a. If you are unsure of the entity, review the instructions (http://www.irs.gov/pub/irs-pdf/iss4.pdf, around page 3) for a description of each choice. If the business is organized as a corporation, write the state and/or foreign country in which the Articles of Incorporation were filed in the boxes for 9b. If the corporation was organized in the US, leave the “Foreign country” portion blank.

Fill in general information about the company. Choose the reason you are applying for the EIN in box 10 and enter the additional information (if any) on the appropriate line. Descriptions of the purposes can be found in the instructions around page 4. Enter the date you opened or acquired the business or the entity came into existence in the US in its current form. Enter the month your accounting books are closed in box 12. If you are unsure of this, consult your accountant.

Provide employee information. Enter the number of employees you expect to employ during the next 12 months. Enter these employees under the appropriate heading for agricultural (farm), household, or other employees. If you anticipate employees, but not in all categories, enter 0 (zero) in the category you do not expect to employ. If you don’t expect to have any employees, leave the entire box blank. If you expect your employment tax liability to be $1,000 or less in a calendar year, you can check the small box in box 14, and only pay employment taxes once a year. This will generally be the case if you pay $4,000 or less in wages in a calendar year. If you do not qualify to check this box, you must pay employment taxes quarterly on Form 941. Enter the date you began or will begin paying wages in the US in box 15 in month, day, year format. If you pay or will be paying income to a nonresident alien, enter that date.

Describe your business activity in more detail. Check the option that best describes the principal activity of your business in box 16. A description of each option can be found around page 5 of the instructions. Place additional details about your business in box 17. For instance, if you checked construction, describe whether you are a general contractor or a specific subcontractor, residential or commercial construction, etc. If the business has ever applied for and received an EIN in the past, check “Yes” and write the previous EIN in the space provided in box 18. If not, check “No” and leave the remainder of the box blank.

Identify outside parties who have access to company information. If you want a different party (other than the business owner) to receive your EIN and /or answer any questions the IRS may have regarding this form. Enter that person’s name, address, telephone and fax numbers (with area codes) in the spaces provided. If you do not want another person to handle these things, leave this section blank.

Finish the form. Print your name, title, and telephone number with area code in the next to last line on the form. Then sign your legal signature, put the date, and enter your fax number with area code in the last line. By signing the form, you swear that the information entered is true and correct to the best of your knowledge. Knowingly providing false information can subject you to criminal sanctions including perjury.

Submit the form. If you are not doing the abbreviated online form, you can submit the form by mail, fax, or telephone. There is no charge for this application. Inside the US, you can call 1-800-829-4933 between 7:00 a.m. and 10:00 p.m. local time. Outside the US, you must call 1-267-941-1099. Your EIN will likely be issued before you complete the phone call. To apply by fax, fax your application to 1-859-669-5780 if you live one of the 50 US states or the District of Columbia. If your business is not located in any of the 50 US states or the District of Columbia, fax your application to 1-859-669-5987. You should receive your EIN within 4 business days. To apply by mail, send your application to: Internal Revenue Service Center, ATTN: EIN Operation, Cincinnati, OH 45999 if your business is located in any of the 50 US states or the District of Columbia. If your business is not located in any of the 50 US states or the District of Columbia, mail your application to: Internal Revenue Service Center, ATTN: EIN International Operation, Cincinnati, OH 45999.

Check your mail. You should receive a letter with your EIN in approximately 4 weeks.

Re-apply for a new EIN following a change of ownership or structure. Generally, a business will need a new EIN every time its owner or physical location changes. In this case, simply apply for a new EIN as you applied for your original. Other events in the life of your business may necessitate a new EIN. See the IRS's official criteria for a complete listing that comes as part of the application. Below are common examples of events that may require an EIN change (note that this list is not exhaustive): Undergoing a bankruptcy proceeding Incorporating or adding partners to a sole proprietorship Purchasing or inheriting a business to be operated as a sole proprietorship Undergoing a merger

Obtaining an Individual Taxpayer Identification Number

Understand the Individual Taxpayer Identification Number (ITIN). The ITIN is generally issued to certain nonresident aliens who require a taxpayer identification number but do not qualify for a SSN. ITINs are issued regardless of immigration status, as both resident and nonresident aliens can have tax return and payment responsibilities. Nonresident alien spouses must have a tax ID number in order to be claimed as a part of a US citizen spouse’s tax return (married filing jointly, personal deductions, and other tax items). Any non-US citizen who has a US tax liability for any reason or can be claimed as a dependent on a US tax return, but who is not eligible for a SSN, is eligible for an ITIN.

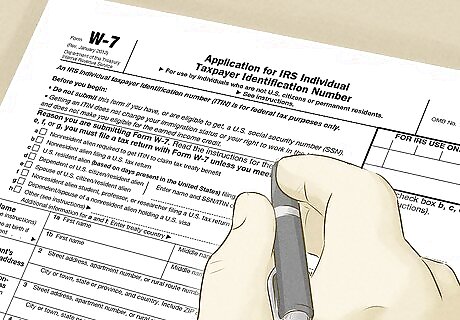

Obtain IRS Form W-7. The application for an ITIN, Form W-7, is available for download from the official IRS website at http://www.irs.gov/pub/irs-pdf/fw7.pdf. You can also hire tax-assistance businesses like H&R Block to help you through the application in person. If you qualify for a US Social Security number, you should apply for that instead of an ITIN. An ITIN is not valid for employment. Also, filing taxes with a spouse with an ITIN instead of a SSN will make an otherwise eligible tax return no longer eligible for the Earned Income Credit.

Begin filling out the form. In the first section, select the reason you are applying for an ITIN. Consult the instructions at http://www.irs.gov/pub/irs-pdf/iw7.pdf for a description of each reason. If there is a space and request for additional information beside your reason, fill in the requested information. If you choose reasons b, c, d, e, f, or g, you must submit the Form W-7 with your tax return unless you meet one of the exceptions listed in the instruction descriptions. If your reason for applying concerns a treaty between the US and a foreign country, you will need to provide treaty information in the last line in the section.

Fill in your basic information. Write your current, full, legal name in line 1a. If your name was different at birth, write your full legal name at birth in line 1b. Write your full mailing address in lines 2, including the country if outside the US. Only use a PO Box if the US Post Office will not deliver mail to your street address. Do not use a private mail box provider’s address. If you have a different foreign address than the address provided in line 2, enter it in line 3. If you are applying because of a treaty, the address in line 3 must be in that treaty country. Write your date of birth and the country in which you were born in line 4. You may, but are not required to, enter the city and state or province of your birth, as well. Your date of birth should be entered in the following format: MM/DD/YYYY format (2-digit month, 2-digit day, 4-digit year). For example, January 1, 1970, would be written as 01/01/1970. Check whether you are male or female in line 5.

Enter your citizenship and tax information. Enter all countries of which you claim citizenship in line 6a. If you have a foreign tax ID number, enter it in line 6b. Otherwise, leave this line blank. If you have a US visa, enter the number and expiration date in line 6c. If you do not have a US visa, leave this line blank.

Indicate which documents will be attached. Check which documents you will be attaching to your application and enter the requested information about it in line 6d. See the form instructions on page 2 for more information on attachments.

Provide your previous taxpayer identification number. If you have previously been issued an IRS Service Number or an EIN, check “Yes” in line 6e. If not or if you do not know, check “No/Do not know”. If you checked “Yes” in line 6e, enter that number and the name under which the number was issued in line 6f. If you did not check “Yes”, leave line 6F blank.

Enter your college or employer information. If you checked reason “f” in the initial portion of this application, you must enter the name of the college or university you are attending, as well as the city and state in which the school is located and the length of time you anticipate being there in line 6g. If you are in the US for work-related purposes, you must enter the name of the company as well as the city and state in which it is located and the length of time you anticipate working there in line 6g.

Finish the application. The applicant or someone authorized to act in the applicant’s behalf must sign he form in the “Sign Here” section. Provide the date of the signature in MM/DD/YYYY format and a daytime telephone number with area code. If the person making the application is not the applicant, but is instead the applicant’s delegate, write that person’s name in the space for “Name of delegate” and check the relationship this person has with the applicant. If the applicant is under age 18 and the delegate is the applicant’s parent, no additional documentation must be submitted. If the applicant is over age 18 and/or the delegate is a power of attorney or court-appointed guardian, the court appointment or Form 2848 (Power of Attorney and Declaration of Representative) must also be attached. If the applicant signs by mark (such as X) rather than signature, two witnesses must also sign and be identified as witnesses. Leave the section “Acceptance Agent’s Use ONLY” blank.

Gather your attachments. The instructions provided on page 3 of the application form packet provide a matrix of acceptable identification documents. Original documents must be provided but will be returned to you. You can only submit copies of documents if those copies are certified by the issuing agency or legalized/authenticated by officers at a US Embassy or consulate overseas. If your documents originate from a foreign source, you may also need certified copies to be further apostilled by the equivalent of that country’s Secretary of State. An apostille is an international treaty document that verifies the person certifying the document was authorized to do so. Not all countries are parties to this treaty, however. Contact the American Citizens Services office of the closest US Embassy or Consulate to for assistance. Acceptable documents include: a passport (the only stand-alone document accepted) or two of the following: USCIS photo identification, Visa issued by the US Department of State, driver’s license, military identification card, national identification card, US state identification card, foreign voter’s registration card, civil birth certificate, medical records (for dependents under 6), and school records (for dependents under age 14 or 18 if still a student).

Submit your application: Make copies of your application and all documents to retain for your records. You can submit your application by mail, in person at a Taxpayer Assistance Center, or through an acceptance agent. An acceptance agent is a person or business who has been approved by and contracted with the IRS to review documents and accept applications and their attachments on behalf of the IRS, forwarding those documents to the appropriate IRS office. An acceptance agent will only review, accept, copy, and return your documents to you. They have no input as to the merits of your application.

Mail in your application. Be sure to include the application and all supporting documents, including your tax return. Send US Postal service mail to: Internal Revenue Service, ITIN Operation, PO Box 149342, Austin, TX 78714-9342. If using a private delivery service (such as FedEX or UPS), mail your application and all documents to: Internal Revenue Service, ITIN Operation, Mail Stop 6090-AUSC, 3551 S. Interregional, Hwy 35, Austin, TX 78741-0000.

Apply in person. If you prefer to submit your application in person, you may do so at any IRS Taxpayer Assistance Center in the US or IRS office abroad. You can locate these offices at http://www.irs.gov/uac/TAC-Locations-Where-In-Person-Document-Verification-is-Provided. These offices will only verify your documents, returning them to you immediately, and forward the application with copies of verified documents to the ITIN Operation office in Austin. Apply through an acceptance agent. You can locate an approved Certified Acceptance Agent at http://www.irs.gov/Individuals/Acceptance-Agent-Program. An acceptance agent will also verify your documents, return them to you immediately, and forward the application with these copies of verified documents to the ITIN Operation office in Austin.

Check your mail. You should receive a letter with your ITIN in the mail within 6 weeks of applying. If you apply during peak tax season (January through April 15), you may have to wait up to 10 weeks. If your application is denied, follow the instructions on the letter you receive telling you the reasons for the denial.

Obtaining an Adoption Taxpayer Identification Number

Understand the Adoption Taxpayer Identification Number (ATIN). The ATIN is a temporary number for children in the process of adoption who will not qualify for a SSN by the time the first tax return of the adoptive parents will be due. The ATIN is only valid for 2 years without an extension, and it not valid for claiming the Earned Income Credit on your taxes. If you are eligible for the EIN, but are disqualified by the use of an ATIN, you can amend the appropriate taxes once the adopted child has been issued a SSN. (See how to amend a tax return at https://www.wikihow.com/Amend-a-Federal-Tax-Return.) The application process for an ATIN is similar to that for an ITIN but requires relevant adoption documents.

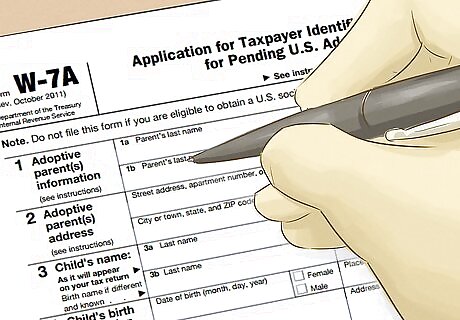

Obtain IRS Form W-7A. Receiving an ATIN requires completing the Application for Taxpayer Identification Number for Pending U.S. Adoptions (W-7A). This fairly short form is available online for downloading and printing on the IRS's official website at http://www.irs.gov/pub/irs-pdf/fw7a.pdf.

Begin filling out the form. Write legibly in blue or black ink or type the answers on the form. Enter the parents’ last and first names and SSN as they appear on the tax return in section 1. If the parents file a joint tax return, list the person who appears first on the tax return in line 1a. If only one parent is adopting the child, leave line 1b blank. If either parent’s name is changing between the time you file this form and the last tax return, ensure you have officially changed your name with the Social Security Administration. If names and SSNs do not match SSA records, processing of your form will be delayed.

Enter the street address at which the parents and the child will live. Only enter a PO Box if the post office does not deliver mail to your street address. If this address is different than the address on your most recent tax return, you should also file Form 8822, Change of Address.

Provide information about the child. Enter the child’s name as it will appear on your tax return in line 3a. If you know the child’s birth name, and it is different than the name the child will be using on your tax return, enter that birth name in line 3b. Enter the child’s date of birth MM/DD/YYYY format (2-digit month, 2-digit day, 4-digit year) in the appropriate space. Then check whether the child is male or female in section 4. Enter the child’s place of birth in the appropriate space in section 4. If the child was born in the US, enter the city and state. If the child was born in a foreign country, enter the city, province/state, and country of birth. Do not abbreviate in this block.

Finish the form. Enter the name and address of the adoption placement agency as well as the date they placed the child with the new parents for adoption in section 5. Both parents must sign and date this form. Include a daytime telephone number with area code. #*By signing the form, the parents swear that the information included is true and correct to the best of their knowledge. Knowingly providing incorrect information can subject them to criminal penalties, including perjury.

Gather documents. Documentation proving that the child has been placed with you for the purpose of adoption must accompany this application. If it is a foreign adoption, contact the IRS at 512-460-7989 to see if your foreign documents will require an apostille or consulate legalization. The following are common examples of appropriate documents, but you may contact the IRS to see if other documents will satisfy the requirement: A copy of the placement agreement entered into between you and an authorized placement agency A copy of the document signed by a hospital office authorizing the release of a newborn child from the hospital to you for legal adoption A copy of the court order or other court document ordering or approving the placement of a child with you for legal adoption An affidavit signed by the adoption attorney or government official who paced he child with you for legal adoption pursuant to state law If you adopt a foreign child who will be accompanying you to the US, you will also need to provide proof the child can/has entered the US legally with one of the following: The child’s permanent resident card The child’s certificate of Citizenship The child’s passport with “I-551” stamp

Submit your application. Make a copy of all attached documents and the application for your records. Mail the original application and original documents to: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0066.

Check your mail. It usually takes 4-8 weeks to get an ATIN. If you have not received a letter with your ATIN within 8 weeks, call the number above to check on your application. If your application is denied, follow the instructions on the letter telling you why it was denied.

Obtaining a Preparer Tax Identification Number

Understand a Preparer Tax Identification Number (PTIN). PTINs are assigned to people who legally prepare another person's taxes (in full or in part) for compensation. Anyone over 18 years of old who wishes to prepare another person's taxes for money (including enrolled IRS agents) must be assigned a PTIN to do so legally. A PTIN must be renewed annually to remain valid. Be aware that you do not need a PTIN to prepare some forms. Refer to the list at https://www.irs.gov/tax-professionals/frequently-asked-questions-do-i-need-a-ptin to determine if the forms you will be preparing and filing require a PTIN. For additional assistance, call 8-877-613-PTIN(7846). The international number is 1-915-342-5655.

Obtain the Form W-12. You can apply online at https://rpr.irs.gov/datamart/mainMenuUSIRS.do;jsessionid=36E3D37CC086F168E5BEBD20CDC86611.bm9kZTR or you can download the current year’s Form W-12 at http://www.irs.gov/Tax-Professionals/PTIN-Requirements-for-Tax-Return-Preparers.

Begin completing the form. Print your entries in blue or black ink or type them onto the form. Enter your first, middle, and last name in the space provided in block 1. Also check whether this is an initial or renewal application. If it is a renewal application, enter the PTIN you are renewing in the space provided. Indicate whether an initial PTIN application is for the current calendar year or the upcoming calendar year in block 2. For instance, if you are applying in October 2014 to be able to prepare taxes in 2015 for the 2014 tax year, check “Next calendar year”. If you are applying in October 2014 to begin preparing taxes prior to December 31, 2014 for any tax year, check “Current calendar year,” and remember to renew your PTIN if you want to continue preparing taxes in 2015. If you are renewing your PTIN and need to also renew a prior year, enter those prior years in the appropriate space in block 2. (If your PTIN has not been renewed in over a year, you will need to renew for the years between the last year you had a PTIN and the current year unless you were inactive during that time.) If your PTIN has been expired or you have been inactive for more than 3 years consecutively, you must file for a new PTIN, not a renewal.

Provide your personal information. Enter your Social Security number and date of birth (in MM/DD/YYYY format) in block 3. Enter your personal mailing address and telephone number with area code in block 4. Only use a PO Box if your post office will not deliver mail to your street address. Include the country (not abbreviated) if you are outside the United States. If your business address is different than your personal address, enter the address and telephone number(s) in block 5a. Only use a PO Box if your post office will not deliver to the street address, and if your business address is in a foreign country, do not abbreviate the country name. In block 5b, you may enter the business name and website address, but you may also leave this block blank if you choose not to provide that information. Enter the email address at which you would prefer to be contacted in block 6.

Provide information about your criminal history or tax delinquencies. If you have been convicted of a felony in the past 10 years, check “Yes” and list the date and convicted offenses in block 7. If you have not been convicted of a felony in the past 10 years, check “No” and leave the remainder of block 7 blank. If you are not current on any individual, business, corporate, and/or employer tax obligations, check “No” and provide an explanation for any delinquencies in block 8. If you are current in all of those obligations or have never been subject to those obligations, check “Yes” and leave the remainder of block 8 blank.

List your credentials and service information. In block 9, check all credentials that you hold and enter the additional information about each. If you do not hold any of the listed credentials, check “None”. If you do not prepare Form 1040 series tax returns or you only prepare Forms 1040-PR or 1040-SS for residents of Puerto Rico, check “No” in block 10. If you do prepare Form 1040 series tax returns other than Forms 1040-PR or 1040-SS for residents of Puerto Rico, check “Yes” in block 10. If you are an attorney, CPA, or Enrolled Agent (and checked the appropriate box in block 9), leave block 10 blank. If you are self-employed or an owner, partner, or officer of a tax preparation business, check “Yes” in block 11 and enter the information requested if you have those numbers. A CAF is a Centralized Authorization File number that is issued by the IRS when someone files a third-party authorization. An EFIN is an Electronic Filing Identification Number, and is issued to Authorized IRS e-file Providers. An EIN is an Employer Identification Number and is issued to businesses for various reasons.

Provide additional information. If this is a renewal application, leave blocks 12 and 13 blank. If this is an initial application, enter the address used on your last US individual income tax form in block 12. If you legally have never filed a US federal income tax return, check the box, and you will be required to submit additional documents. If this is an initial application, check the filing status you used on the last individual income tax return you filed. If your last individual income tax return was filed more than 4 years ago, you will be required to submit additional documents.

Finish the application. Block 14 is informational and identifies the amount you will owe for PTIN fees. You will need to attach a check or money order to your application. Sign and date your application at the bottom. By signing the application, you are swearing that the information provided in it is true and correct to the best of your knowledge and ability. Knowingly submitting incorrect information can subject you to criminal penalties, including perjury, as well as denial or revocation of your PTIN.

Gather attachments. All applications must be accompanied by a check or money order for the appropriate fee. If you have not filed a US federal income tax return within the last 4 years (including checking the box in block 12), you will need to attach 2 additional documents. One of those documents will need to be an original, certified, or notarized copy of your Social Security card. The other will be the original, certified, or notarized copy of one other government-issued document that contains a current photo ID. Common examples of this second document are: Passport/Passport card Driver’s license US state ID card Military ID card National ID card

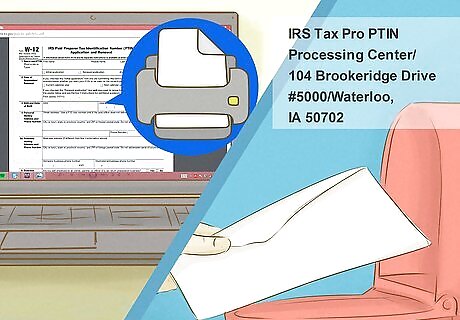

Submit your application. Make a copy of the application and all attachments for your records. Mail your application and all attachments to: IRS Tax Pro PTIN Processing Center, 104 Brookridge Drive #5000, Waterloo, IA 50702.

Check the mail. You should receive a letter with your PTIN in 4 to 6 weeks. If your application is denied, follow the instructions on the letter that tells you why the application was denied. Alternatively, if you applied online, you should receive your PTIN immediately after completing the application and paying your fee.

Comments

0 comment