views

X

Research source

Designing Your Portfolio

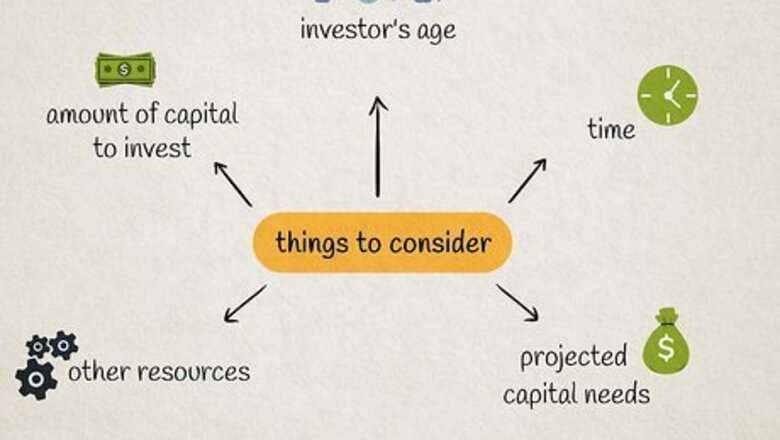

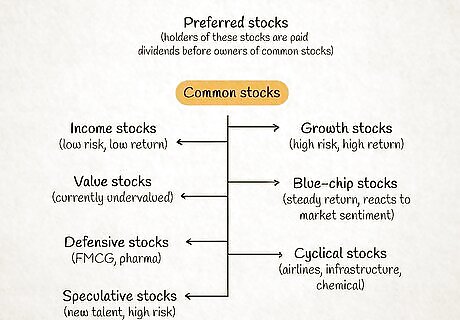

Know what you're willing to invest. As you invest, you'll need to balance your potential risks against your potential rewards. A portfolio's assets are typically determined by the investor's goals, willingness to take risks, and the length of time the investor intends to hold his portfolio. Some of the most important factors to consider in making these decisions are: The investor's age. How much time the investor is willing to spend allowing his investments to grow. Amount of capital the investor is willing to invest. Projected capital needs for the future. Other resources investor may have.

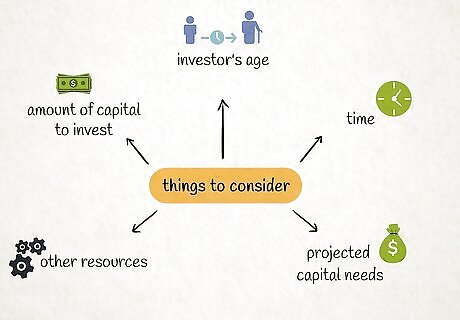

Decide what kind of investor you'll be. Portfolios usually fall somewhere in the spectrum between aggressive, or high-risk portfolios, and conservative, or low-risk portfolios. Conservative investors simply try to protect and maintain the value of a portfolio, while aggressive investors tend to take risks with the expectation that some of those risks will pay off. There are various online risk assessment tools you can utilize to help assess your risk tolerance. Understand that your financial goals may change over time, and adjust your portfolio accordingly. Generally, the younger you are, the more risk you can afford or are willing to take. You may be better served with a growth-oriented portfolio. The older you become, the more you'll think about retirement income, and may be better served with an income-oriented portfolio. Even during retirement, many still need some portion of their portfolio for growth, as many people are living 20, 30 or more years beyond their retirement date.

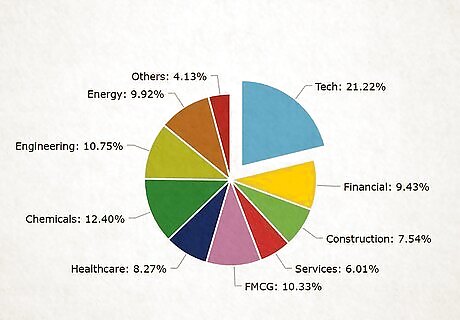

Divide your capital. Once you've decided what kind of investor you'd like to be and what type of portfolio you want to build, you'll need to determine how you intend to allocate (spread around) your capital. Most investors who are new to the market don't know how to pick stocks. Some important factors include: Determining which sector(s) to invest in. A sector is the category a given industry is placed in. Examples include telecommunications, financial, information technology, transportation and utilities. Knowing the market capitalization (aka market cap), which is determined by multiplying a given company's outstanding shares by the current price of one share on the market (large-cap, mid-cap, small-cap, etc.). It is important to diversify holdings across a variety of sectors and market capitalization to lower a portfolio's overall risk.

Making Investments

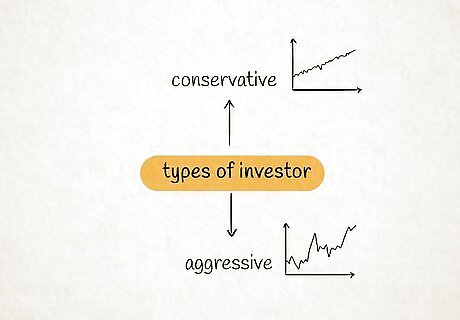

Understand the different kinds of stocks. Stocks represent an ownership stake in the company that issues them. The money generated from the sale of stock is used by the company for its capital projects, and the profits generated by the company's operation may be returned to investors in the form of dividends. Stocks come in two varieties: common and preferred. Preferred stocks are so called because holders of these stocks are paid dividends before owners of common stocks. Most stocks, however, are common stocks, which can be subdivided into the categories below: Growth stocks are those projected to increase in value faster than the rest of the market, based on their prior performance record. They may entail more risk over time but offer greater potential rewards in the end. Income stocks are those that do not fluctuate much but have a history of paying out better dividends than other stocks. This category can include both common and preferred stocks. Value stocks are those that are "undervalued" by the market and can be purchased at a price lower than the underlying worth of the company would suggest. The theory is that when the market "comes to its senses," the owner of such a stock would stand to make a lot of money. Blue-chip stocks are those that have performed well for a long enough period of time that they are considered fairly stable investments. They may not grow as rapidly as growth stocks or pay as well as income stocks, but they can be depended upon for steady growth or steady income. They are not, however, immune from the fortunes of the market. Defensive stocks are shares in companies whose products and services people buy, no matter what the economy is doing. They include the stocks of food and beverage companies, pharmaceutical companies and utilities (among others). Cyclical stocks, in contrast, rise and fall with the economy. They include stocks in such industries as airlines, chemicals, home building and steel manufacturers. Speculative stocks include the offerings of young companies with new technologies and older companies with new executive talent. They draw investors looking for something new or a way to beat the market. The performance of these stocks is especially unpredictable, and they are sometimes considered to be a high-risk investment.

Analyze stock fundamentals. Fundamentals is the term given to the pool of qualitative and quantitative data that are used to determine whether or not a stock is a worthwhile investment in a long-term analysis of the market. Analyzing a company's fundamentals is usually the first step in determining whether or not an investor will buy shares in that company. It is imperative to analyze fundamentals in order to arrive at a company's intrinsic value - that is, the company's actual value as based on perception of all the tangible and intangible aspects of the business, beyond the current market value. In analyzing the fundamentals of a company, the investor is trying to determine the future value of a company, with all of its projected profits and losses factored in.

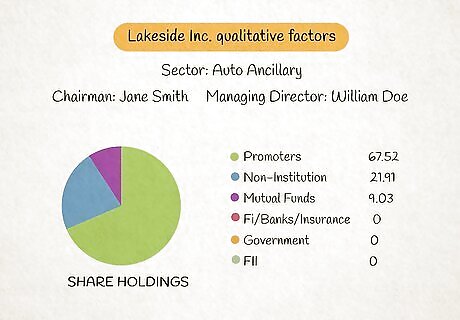

Analyze qualitative factors. Qualitative factors, such as the expertise and experience of a company's management, various courses of industry cycles, the strength of a company's research and development incentives, and a company's relationship with its workers, are important to take into account when deciding whether or not to invest in a company's stock. It's also important to understand how the company generates its profits and what that company's business model look like in order to have a broad spectrum of qualitative information about that company's stock options. Try researching companies online before you invest. You should be able to find information about the company's managers, CEO, and board of directors.

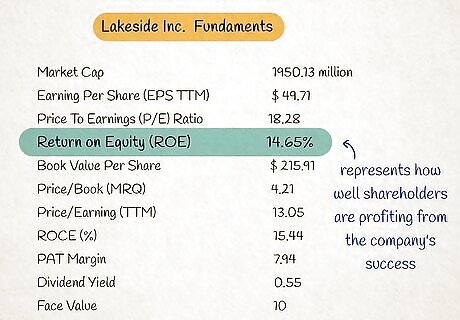

Look at the price-to-earnings ratio. The P/E ratio can be figured as either the stock's current price against its earnings per share for the last 12 months ("trailing P/E") or its projected earnings for the next 12 months ("anticipated P/E"). A stock selling for $10 per share that earns 10 cents per share has a P/E ratio of 10 divided by 0.1 or 100; a stock selling for $50 per share that earns $2 per share has a P/E ratio of 50 divided by 2 or 25. You want to buy stock with a relatively low P/E ratio. When looking at P/E ratio, figure the ratio for the stock for several years and compare it to the P/E ratio for other companies in the same industry as well as for indexes representing the entire market, such as the Dow Jones Industrial Average or the Standard and Poor's (S&P) 500. Comparing the P/E of a stock in one sector to that of a stock in another sector is however, not informative since P/E's vary widely from industry to industry.

Look at the return on equity. Also called return on book value, this figure is the company's income after taxes as a percentage of its total book value. It represents how well shareholders are profiting from the company's success. As with P/E ratio, you need to look at several years' worth of returns on equity to get an accurate picture.

Look at total return. Total return includes earnings from dividends as well as changes in the value of the stock. This provides a means of comparing the stock with other types of investments.

Try investing in companies trading below their current worth. While a broad spectrum of stock investments is important, analysts often recommend buying stock in companies that are trading for lower than they are worth. This sort of value investing does not, however, mean buying "junk" stocks, or stocks that are steadily declining. Value investments are determined by comparing intrinsic market value against the company's current stock share price, without looking at the short-term market fluctuations.

Try investing in growth stocks. Growth stocks are investments in companies that exhibit or are predicted to grow significantly faster than other stocks in the market. This involves analyzing a given company's present performance against its past performance amid the industry's ever-fluctuating climate.

Maintaining Your Portfolio

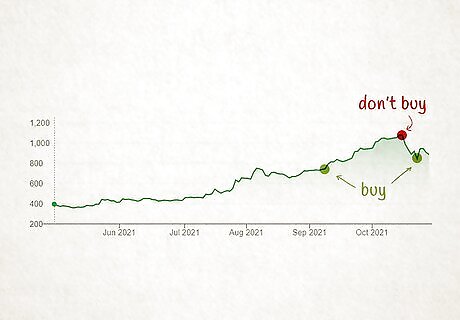

Avoid dipping into investments. Once you've invested capital in a stock, it's important to let the stock grow for at least a year without selling your shares. Consider for all intents and purposes that this money cannot be withdrawn and spent elsewhere. As part of investing for the long term, determine the amount of money you can afford to commit to the stock market for five years or longer, and set that aside for investing. Money you'll need in a shorter period of time should be invested in shorter-term investments such as money-market accounts, CDs or U.S. Treasury bonds, bills or notes.

Diversify your portfolio. No matter how well a stock might be doing at the moment, the price and value of stocks are bound to fluctuate. Diversifying your investment portfolio can help you avoid this pitfall by spreading around your money to a number of stocks. A well-diversified portfolio is important because in the event that one or more sectors of the economy start to decline, it will remain strong over time and reduce the likelihood of taking a significant hit as the market fluctuates. Don't just diversify across the spectrum of asset classes. Some experts recommend you should also diversify your stock picks within each asset class represented in your portfolio.

Review your portfolio (but not too often). Anticipate that the market will fluctuate. If you check your stocks every day, you might end up feeling anxious over the value of your investments as things go up or down. But by the same token, you should check on your investments periodically. Checking your portfolio at least once or twice a year is a good idea but research has shown that making rebalancing changes (selling the gains from those holdings which have been profitable and buying shares of those which have lost value) more than twice per year does not offer any benefit. Some experts recommend checking on the quarterly earnings reports of a given company to see if your predictions for that company are holding true. Make changes as necessary, but don't jump ship every time a share reports a minor decrease in value. Also important to keep in mind is tax implications of selling: if this is an account into which you've invested after-tax dollars (non-IRA or similar type of brokerage account), then try not to sell anything at a gain for at least one year in order to receive long-term capital gains rather than ordinary income tax treatment on your profits. For most people, the capital gains rate is more favorable than their income tax rate.

Comments

0 comment