views

New Delhi: Finance Minister Nirmala Sitharaman has proposed a new optional tax regime in the Union Budget 2020 for the financial year 2020-2021 under which income can be taxed at new lower rates.

However, under new optional tax regime, benefit of different popular deductions like sections 80C and 80D and home loan benefits under Section 24 will not be available.

The slabs and tax rates under the new regime are as follows:

Up to Rs 2,50,000 – Nil

From Rs 2,50,001 to Rs 5,00,000 – 5%

From Rs 5,00,001 to Rs 7,50,000 – 10%

From Rs 7,50,001 to Rs 10,00,000 – 15%

From Rs 10,00,001 to Rs 12,50,000 – 20%

From Rs 12,50,001 to Rs 15,00,000 – 25%

Above 15 lakh – 30%

Taxpayers now will have the option to pay tax either as per the old system, under which different deduction schemes are available, or under the new one, in which most of the popular deductions are not allowed.

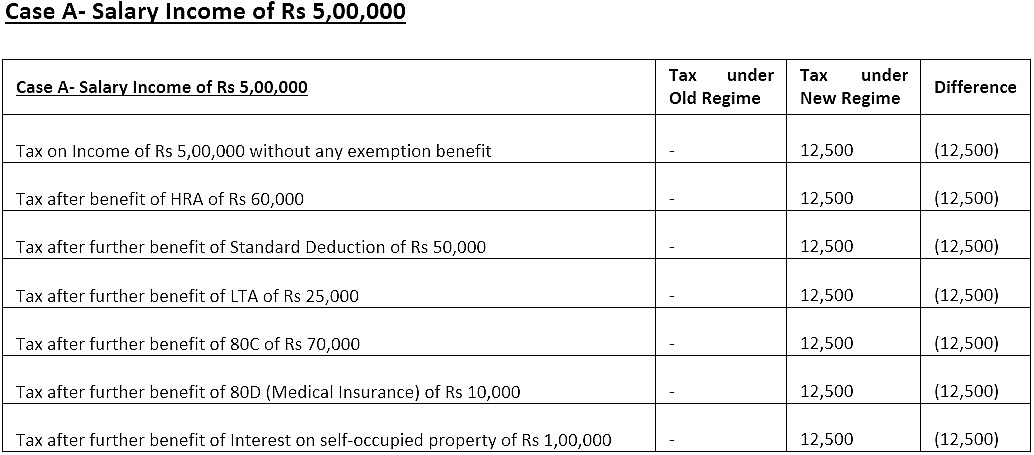

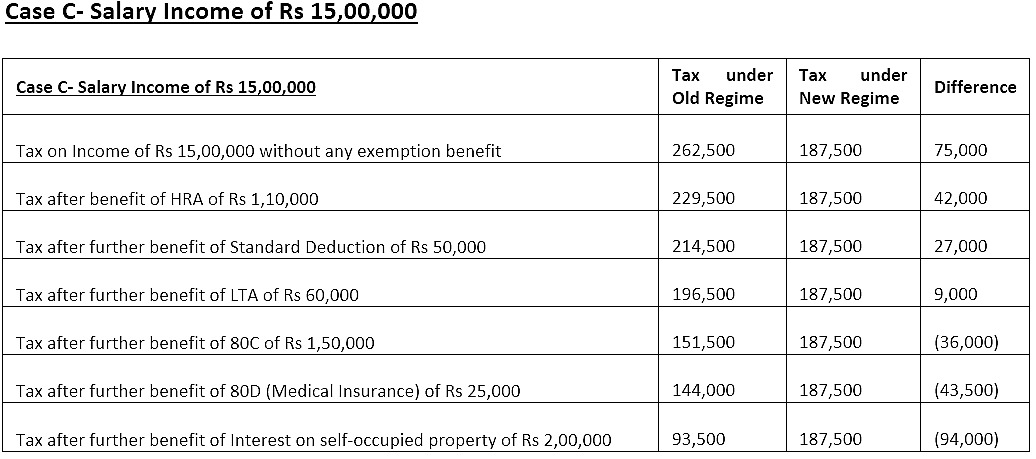

The new tax slabs will impact the salaried individuals differently considering their investment amount and other types of deductions claimed by them. This can be understood under different scenarios with the help of the following tables:

From the above tables, it is clear the new tax regime will not be beneficial to salaried persons if they are availing several deductions under different income tax schemes. However, if they are not availing any or very few tax deduction schemes, the new system will be beneficial.

(The author is a chartered accountant.)

Comments

0 comment