views

Mumbai: Following are the highlights of the RBI's third quarter monetary policy review:

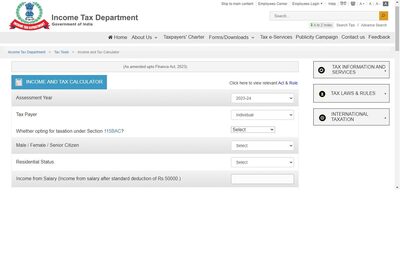

* Short-term lending rate or repo rate reduced by 0.25 per cent to 7.75 per cent, first time in nine months.

* Reverse repo rate stands adjusted to 6.75 per cent.

* Reduces cash reserve ratio (CRR) by 0.25 per cent to 4 per cent.

* CRR cut to infuse Rs 18,000 crore in system from February 9

* RBI trims growth for fiscal 2012-13 to 5.5 per cent from 5.8 per cent.

* Policy action aimed at aiding growth by encouraging investment and improving liquidity to support credit flow.

* Review intends to contain inflation and anchor inflation expectations.

* RBI says inflation has come off its peak.

* Revises downward March-end inflation projection to 6.8 per cent from 7.5 per cent.

* Q3 CAD likely to widen beyond 5.4 per cent of GDP.

* Bank rate stands adjusted to 8.75 per cent with immediate effect.

* Next mid-quarter review of monetary policy on March 19.

Comments

0 comment