views

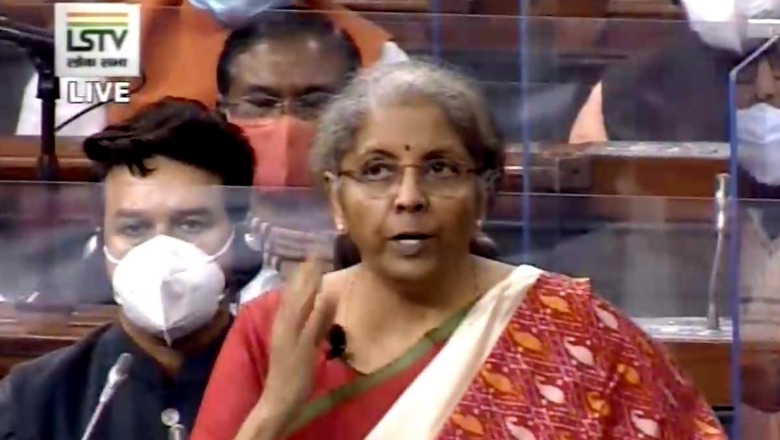

Finance Minister Nirmala Sitharaman on Monday while presenting the Union Budget announced that the much awaited LIC IPO will be launched within the next financial year.

Sitharaman added that legislative amendments to this effect will be launched in the Parliament in the Budget session. The government plans to eventually offload 25 percent of its stake in LIC through multiple tranches.

Ahead of the IPO, if LIC is able to pare its stake in IDBI Bank, this would lead to unlocking of value and help increase the embedded value and consequently its valuation in the market.

The first step prior to the IPO is determining LIC’s embedded value, following which the insurer will have to bring down its stake in other listed companies to below 15 percent. The LIC Act will then be amended in Parliament. The government is yet to appoint an actuarial firm to determine LIC’s embedded value. The insurer had a balance sheet of Rs 32.8 lakh crore as of Q1FY21.

Sitharaman said CPSEs in all but four sectors will be eventually privatised.

Two public sector banks and one general insurance company could be privatised during the coming financial year, it was announced.

India has 249 functional CPSEs (54 of them listed) with a combined turnover and net worth of Rs 24 lakh crore and Rs 12 lakh crore, respectively.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment