views

India’s efforts for the adoption of electric vehicles is more serious than ever. In addition to the FAME II scheme by the central government several states and Union Territories are putting their own schemes and subsidies to encourage it further. Hence, here is a complete rundown of all the vehicle.

What’s the problem, one might ask?

– First, the initial cost of owning an electric vehicle is higher than the conventional automobiles

– Infrastructure is one issue that is further suppressing the sales of EVs in India

– Electric Vehicles are relatively new in terms of technology and any new thing takes time to penetrate in society

While government in India is working aggressively to put out a credible infrastructure for electric vehicles, technology is also fast evolving and the EVs of today are akin an IC-engine vehicle with same creature comfort, same driving dynamics and hat not.

So it all boils down to pricing of a vehicles. You see, no matter what yardstick you take to compare the two machines, EVs are not at all pocket friendly as compared to conventional petrol/ diesel vehicles, at least when it comes to initial cost of ownership. One might argue the overall lifetime cost of EVs is less than a petrol car, for example, but we don’t compare prices when we buy any new thinking what will happen 10 years down the line. Do we?

And so, the onus is both on manufacturers and governments to take this pricing issue seriously for pushing the EV penetration in India. This is where our Federal structure works beautifully. While central government is putting efforts by offering subsidies under FAME II scheme, state governments are further helping buyers by offering additional benefits.

These incentives vary depending on which Indian state you live in and so, we have compiled a list of all the states and their schemes to help you buy an electric vehicle –

FAME II by Central Government

Now before we move to state gave incentives, let’s first decode what is FAME and what benefits you get under the policy. FAME is a policy by the Department of Heavy Industries and is an acronym for Faster Adoption and Manufacturing of Hybrid and Electric vehicles. Initially, it was FAME and then in 2019, it was updated as FAME-II. These incentives are over and above the state incentives and are applicable throughout India-

– For two-wheelers: Rs 15,000 per kWh of battery capacity (Maximum up to 40 per cent of the vehicle cost)

– For four-wheelers: Rs 10,000 per kWh of battery capacity (Maximum up to Rs 1.5 lakh)

Further, there are schemes by Ministry of Finance to ease burden of owning an EV. These schemes are not under FAME II.

– All EVs are currently subjected to a lower rate of the Goods and Services Tax (GST) at 5 per cent

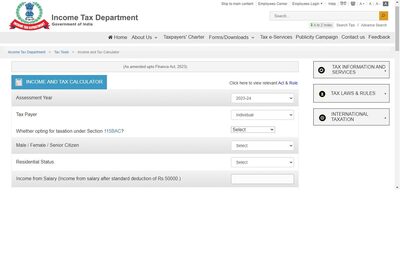

– First-time buyers can take a loan and get tax benefits of up to Rs 1.5 lakh under Section 80EEB of the Income Tax Act.

Now let’s discuss the incentives by various state governments over and above benefits from the central government –

Chandigarh The Chandigarh Administration has approved the city’s first electric vehicle policy. The policy has been drafted for five years and will come into effect from April this year. The policy aims to make Chandigarh a Model EV City. The draft of the policy will be in the public domain for 30 days in order to record suggestions and comments from all the stakeholders as well as the general public of the union territory before the policy is cleared. The policy will incentivise the adoption of a wide arena of electric vehicles including electric bicycles, two-wheelers, three-wheelers, electric cargo vehicles as well as four-wheelers, passenger and commercial. The incentives will be over and above the central government’s FAME II subsidy and customers who want to avail have to register their vehicle in Chandigarh. Delhi Delhi was among the first few states to announce a comprehensive EV policy. Delhi is also the state with maximum density of EVs per square kilometer. – For two-wheelers: Rs 5,000 per kWh of battery capacity (Maximum up to Rs 30,000) + scrappage benefiets upto Rs 5,000 – For four-wheelers: Rs 10,000 per kWh of battery capacity (Maximum up to Rs 1.5 lakh) – For three-wheelers, rickshaws and freight carriers – Benefits upto Rs 30,000 – In addition, the state government has waived off the registration fees and road tax on all types of electric vehicles Gujarat Gujarat blew the roof away when they announced their 2021 EV policy, making is the state offering higher per-kWh subsidy for EVs. – For two-wheelers: Rs 10,000 per kWh of battery capacity (Maximum up to Rs 20,000) – For four-wheelers: Rs 10,000 per kWh of battery capacity (Maximum up to Rs 1.5 lakh) – For three-wheelers and rickshaws – Rs 50,000 – Additionally, registration and road tax exemption on all vehicles. Maharashtra Maharashtra, very recently, revised its EV policy and now offers some hefty benefits for owning an EV, especially some early bird discounts to limited buyers. Maharashtra is also offering a direct subsidy of Rs 1.5 Lakh on the first 10,000 electric cars to be registered under this policy until 2023. – For two-wheelers: Rs 10,000 per KwH + Rs 15,000 early bird incentive + Rs 7,000 scrappage + Rs 12,000 other incentives – For four-wheelers: Rs 1.50 lakh total discount + Rs 25,000 scrappage + Rs 1.5 lakh early bird incentive – For three-wheelers and rickshaws – Upt Rs 30,000 – Registration and road tax exemption on all electric vehicles. Rajasthan Rajasthan is the latest state to announce its EV policy, which is bit different from other states. Under the EV policy, no direct benefit will be given to the buyer on purchase, but a benefit against State Goods and Sevice Tax will be provided (SGST). As per the state government’s Transport Department, government will reimburse SGST (State Goods and Service Tax) amount on purchase on an EV. A lump sum grant amount will be payable on all electric two- and three-wheelers, as per their battery capacity and this grant amount is payable on vehicles purchased from April 1, 2021 to March 31, 2022 and registered till March 2022. – For two-wheelers – Rs 5,000 for battery capacity upto Rs 2 kWH and upto Rs 10,000 for battery capacity more than 5 Kwh – For three wheeler – Rs 10,000 for battery capacity less than 3 kwH and upto Rs 20,000 with more than 5 kWH battery capacity. Meghalaya Meghalaya also announced its EV policy in 2021 and has set a quota for number of vehicles applicable under the scheme. Also, Meghalaya is the only state to expedite the RTO paperwork of EVs. – For two-wheelers: Rs 10,000 per kWh of battery capacity – For cars: Rs 4,000 per kWh of battery capacity – Additionally, registration and road tax exemption for all EVs. Karnataka Karnataka is offering no direct subsidy to EV owners but is offering full exemption from road tax and registration fees for electric vehicles. Also Watch: Andhra Pradesh Like Karnataka, Andhra Pradesh is also offering exemption from registration fees and road taxes in the state to all electric vehicles. Telangana Telangana grants registration fee and road tax exemption for all electric vehicles. Read all the Latest Auto News here

Comments

0 comment