views

From his bilateral with US President Joe Biden, mega diaspora address to meeting with global CEOs, Prime Minister Narendra Modi was clear about his top priority for India — winning the semiconductor race.

In his meeting with Biden, PM Modi discussed the setting up of a new semiconductor fabrication plant in Kolkata. Later, while addressing leaders of US tech giants, he underscored India’s potential to become a global partner in the semiconductor sector and highlighted how technological advancements in the country can drive innovation. He also touched upon his pet project of ‘Make in India’ during the diaspora event, saying it wasn’t long before US would have Indian-made semiconductors. “India is a launching pad for all sorts of technologies. We are not going to stop or slow down. Our goal is to have more devices worldwide running on Made in India chips.”

So, why exactly are semiconductors in focus globally and have the potential to tilt the global power balance?

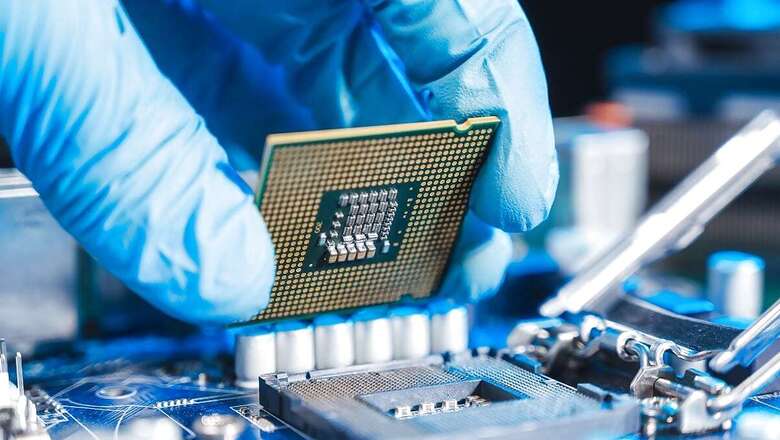

Today, semiconductors are everywhere — cars, laptops, coffee machines, phones, etc. Semiconductors have become the main pivot of the global economy and a key part of diplomacy in government and defence sectors. They form the bedrock of processing the data behind the surge in generative artificial intelligence models and the cloud.

Oil, which was once considered the key driver of geopolitics, is now replaced by semiconductors in the modern technological landscape. The market size of semiconductors is expected to reach $1 trillion by 2030, due to their ubiquity in the development of AI, 5G, quantum computing, and industrial automation.

What are Semiconductors and What Does The Industry Offer?

The scale of use of semiconductors is massive as they are used as:

Microprocessors: The brains of computers and digital devices, executing instructions and calculations

Memory chips: Store data and programme instructions, including RAM for temporary storage and ROM for permanent storage

Graphics Processing Units: Specialised chips for high-performance graphics rendering in gaming consoles and computers, also used in the development of GenAI LLMs (large language models)

Application-specific integrated circuits: Custom-designed chips optimized for specific tasks like cryptocurrency mining and networking

Field-programmable gate arrays: Programmable chips offering flexibility for rapid development and specialised tasks

Analog integrated circuits: Process continuous signals like audio and sensor data, used in amplifiers and power management

Digital signal processors: Efficiently process digital signals in multimedia and communication systems

Sensor chips: Integrate sensors for measuring physical quantities and environmental conditions in various devices and systems

System on a chip: Integrated circuits integrating most or all components of multiple types of semiconductors like power management, connectivity, storage, or processing.

NVIDIA, which claims to design the most advanced AI chips, sold 2.5 million AI chips in 2023, and its market cap now exceeds $2 trillion. Google is spending up to $3 billion to build its AI chips, while Amazon is budgeting over $200 million for AI-centric chips. Others are going further: Apple, Meta, and Microsoft are embarking on efforts to design chips optimised for their environment and workloads, according to HFS Research.

How Semiconductors are Transforming Supply Chain Landscape

Japan is home to prominent tech companies and electronic giants and leads the world with 102 semiconductor fabrication plants. Taiwan follows closely with 77 plants, including the world’s largest independent semiconductor foundry, while the US has 76 plants.

The Taiwan Semiconductor Manufacturing Company Limited (TSMC) has built its leadership position by providing the most advanced manufacturing facilities and leaving the design to its clients. TSMC produces nearly 60 per cent of all semiconductor chips used worldwide and manufactures 90 per cent of the most advanced technology chips used in phones, industrial equipment, and military systems. TSMC is also the main manufacturer of NVIDIA’s most advanced manufacturing chips.

But recent events such as cryptocurrency’s surging demand, trade barriers between the US and China, and geopolitical tensions have shown the complexity of the industry’s globalised supply chains, which resulted in production delays and shortages.

Thus, many countries are already investing significantly in semiconductor research and development and manufacturing. This will not only put them in advantageous position to control the supply chain and gain economic strength but become investment magnets and create high-tech jobs.

Emerging economic like India, Indonesia and Malaysia are positioning themselves to seize the opportunities in the global semiconductor industry.

Geopolitical Tensions Threatening The Chip Market

Disruptions from the US-China trade wars resulting in increasing usage of tariffs, the ban of Huawei from 5G rollouts and the Ukraine-Russia war and Israel-Hamas conflict are affecting the global supply chain.

In March 2017, the Chinese telecommunications firm ZTE Corporation was fined $892 million after pleading guilty to violating US sanctions law. In April 2018, it admitted that it had lied about complying with the terms of the settlement with the US government, and the Department of Commerce immediately placed a ban on American companies on selling to the company.

Additionally, the Chinese government’s declaration of “reunification” with Taiwan has frayed some nerves, with the US stating that it will defend Taiwan if it is attacked. The conflict in the region could disrupt the supply chain of the world’s advanced semiconductor manufacturer.

The shifting of supply chains is the first trend showing that a partial decoupling is underway. Samsung has announced that it will begin making semiconductor parts in Vietnam in July 2023 to diversify its manufacturing, given how China, the US, and other nations are engaged in a race to secure their supply chains, as per the Carnegie Endowment.

The Confederation of British Industry and Commerce has said that UK companies are “rethinking their supply chains” in a “world decoupled from China”.

In partnership with the Saudi Arabian government, Foxconn is investing $9 billion in establishing a foundry project in the city of Neom, which will act as a production hub for semiconductors and components for electric vehicles and other electronics.

TSMC opened its first factory in Japan in February 2024 and has announced plans to invest in a second plant, which will begin operations by 2027, bringing its investment to more than $20 billion with the help of Japanese government subsidies.

In June 2023, Intel announced plans to invest $33 billion, partially subsidized by the German government, to build two semiconductor facilities in Germany.

How is India Positioned in Global Semiconductor Industry?

India is positioned to become a major player in the global semiconductor industry, backed by its vast engineering talent, evolving technology ecosystem, and government support. The National Electronics Policy (NEP) aims to establish India as a hub for electronics system design and manufacturing (ESDM), including semiconductors. With an allocation of $363 million to the Indian Semiconductor Mission, India is poised to attract investments from global players, as per a report by Business Standard.

In December 2021, the Indian government approved a $10 billion incentive programme to promote semiconductor manufacturing.

The Tata Group is setting up two semiconductor manufacturing plants in the states of Assam and Gujarat, intending to start production by 2026. It is undertaking technology transfer with the help of Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC), the world’s seventh-largest pure-play foundry.

CG Power and Industrial Solutions is setting up a joint venture with Japan’s Renesas Electronics and Thailand’s Stars Microelectronics to operate an outsourced semiconductor assembly and test facility.

Foxconn has partnered with HCL Group for semiconductor assembly and testing as it aims to enter the chip-making space in India.

India and Singapore on September 10 signed an agreement to partner and cooperate in semiconductors. A Memorandum of Understanding (MoU) was signed during PM Modi’s two-day visit to Singapore. “Singapore and India will leverage complementary strengths in their semiconductor ecosystems and tap on opportunities to build resilience in their semiconductor supply chains,” Singapore’s trade ministry said in a statement.

Bengaluru and Hyderabad together host about two-thirds of India’s semiconductor global capability centres (GCCs), which is over two-thirds of the total 55 semiconductor GCCs in the country. With more than 95 GCC units and a specialised workforce of 50,000, this demonstrates India’s strong commitment to the semiconductor industry.

Presently, India’s semiconductor market is valued at an estimated $15 billion and is expected to reach $55 billion by 2026. Smartphones and wearables, automobile components, computers, and data storage account for more than 60 per cent of the market.

Comments

0 comment