views

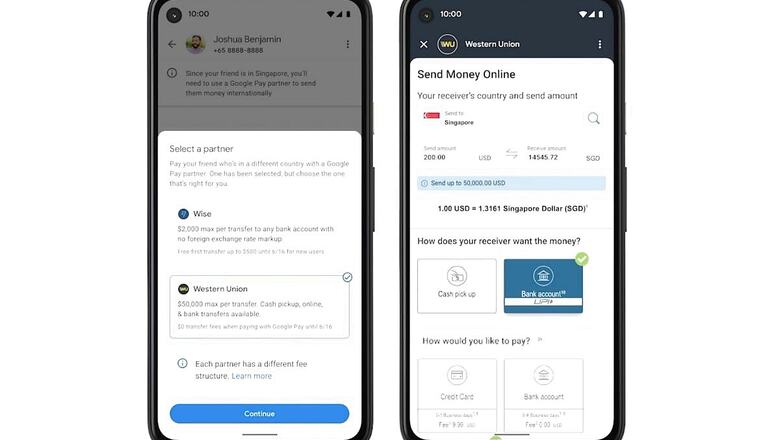

Google Pay users in the US can now transfer money to friends and family in India and Singapore. This is the latest step in the expansion for international payments and money transfers on the Google Pay app in the US. Google is partnering with financial network Western Union for these cross-border payments, and it is expected that this will allow Google Pay users to send money to contacts in more than 200 countries by the end of the year. Google is also working with another payment platform Wise, formerly known as TransferWise, to add payment options for another 80 countries. It is believed that the Google Pay international money transfers to India will be powered by Western Union at this time, though for countries that support both platforms, users will have the choice while making the transfer.

The way this works is that your friends or family in the US can search for you via your phone number on Google Pay. The same phone number has to be registered on the Google Pay app in India and linked to a bank account at an Indian bank. In India, Google Pay allows unified payments interface (UPI) transactions within India, which are essentially instant bank to bank transactions. Once the US contact has chosen your details, they can choose to enter the amount they wish to transfer to you. By default, their currency would be in US Dollar, or US$. Once they choose between Western Union and Wise, depending on availability, they’ll get to know how much time it’ll take for the transfer to happen and all currency conversions factored in, what exact amount in the local currency that’ll be transferred to the recipient, which in this case would be you sitting in India. The transferred money, once the transaction is complete, will land directly in the bank account linked with Google Pay. The US based Google Pay user can use any mode of payment to initiate the transfer—bank account, credit card or debit card, linked with their Google Pay.

There is no minimum amount stipulated for these transactions, though the maximum transaction value may depend on various factors including the payment method. Western Union says that these cross-border transactions will not attract any additional transaction charge until June 16 this year, while Wise says that they’ll offer the first transaction up to a value of $500 without any charge. These will be charged from the sender, and not the receiver. Google will not levy any charge to either the sender or the receiver, for any international transaction. At this time, while WU isn’t mentioning the international transfer charges for India, Wise indicates that transactions of $50 or $100 for instance, attract a US$ 6.49 free from the sender, while transferring $150 attracts a $7.02 fee while a $200 transaction gets a $7.28 fee—though these differ for wire transfers and are generally lesser for transactions initiated by bank debit or more in the case of credit cards. The transaction takes anywhere up to 4 days to be completed, on an average, though most transfers are instant or completed on the same day.

What happens in case of an incomplete transfer? The first port of call will be the payment method in the US (bank or card) and then the bank account in India, to check if a pending transaction is showing up in their systems. If that doesn’t help, you’ll have to connect with the payment provider you chose, either Western Union or Wise, to understand the status of the transaction. Google Pay isn’t handling the transactions at their end, though the Google Pay app will list the transaction and all the details as well as the payment status. This Google Pay international transfers feature comes at a time when a Citi report in April indicated that as much as $500 billion was transferred by more than 250 million people in 2020, but also cited that the transfer fee are still on the higher side and average around 6.5% of the transaction amount.

Last but not least—who can send and receive money using the international transactions option on Google Pay. At this time, the sender of the money in the US and the recipient of the money in India have to be registered with a person-to-person or personal Google Pay accounts. This transfer feature isn’t yet available for businesses, which means a business account cannot send or receive money and neither can an individual send money to a business account. The expansion of international transactions to India should help Google Pay as it battles rival payment platforms in India including PhonePe, Paytm and PayPal. It is PayPal in particular which had the first mover advantage but has struggled to expand its presence in India over the past few years.

Read all the Latest News, Breaking News and Coronavirus News here. Follow us on Facebook, Twitter and Telegram.

Comments

0 comment