views

Q. What is it?

A. Bitcoin is a virtual currency that is created from computer code. Unlike a real-world currency like the US dollar or the euro, it has no central bank and is not backed by any government.

Instead, its community of users control and regulate it. Advocates say this makes it an efficient alternative to traditional currencies, because it is not subject to the whims of a state that may wish to devalue its money to inflate away debt, for example.

Just like other currencies, Bitcoins can be exchanged for goods and services -- or for other currencies -- provided the other party is willing to accept them.

Q. Where does it come from?

A. Bitcoin is based on a piece of software written by an unknown person or people in 2009 under the Japanese-sounding name Satoshi Nakamoto. Other digital currencies followed but Bitcoin was by far the most popular.

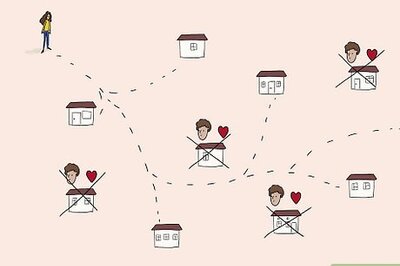

Transactions happen when heavily encrypted codes are passed across a computer network. The network as a whole monitors and verifies the transaction, in a process that is intended to ensure no single Bitcoin can be spent in more than one place simultaneously.

Users can "mine" Bitcoins - bring new ones into being - when their computers run these complicated and increasingly difficult processes.

However, the model is limited and only 21 million units will ever be created.

Q. What's it worth?

A. Like any other currency, its value fluctuates. But unlike most real-world analogues, Bitcoin's value has swung wildly in a short period.

When the unit first came into existence it was worth a few US cents. Its price topped out at well over $1,000 in 2013. Now, a single Bitcoin is worth about $240.

There are presently more than 14.5 million units in circulation. Some economists point to the fact that - because it is limited - its price will increase over the long run, making it less useful as a currency and more a vehicle to store value, like gold. But others point to Bitcoin's volatility, security issues and other weaknesses.

Q. What's the future?

A. Some commentators say that like many technological developments, the first iteration of a product will encounter difficulties, possibly terminal ones. But the trail it blazes might smooth the way for the next crypto currency.

Problems include an apparent vulnerability to theft when Bitcoins are stored in digital wallets.

The virtual currency movement also faces legitimacy issues because of the way it allows for anonymous transactions - the very thing that libertarian adopters like about it.

Detractors say Bitcoin's use on the underground Silk Road website, where users could buy drugs and guns with it, is proof that it is a bad thing.

Some governments, including Russia and China, have heavily restricted how Bitcoins can be used.

If Bitcoin does become more widely accepted, experts say, it could lead to more government regulations, which would negate the very attraction of the Bitcoin concept.

Comments

0 comment