views

The Goods and Services Tax (GST) structure has been finalized. There would be four slabs- 5%, 12%, 18% and 28%. Majority of products will fall within the 18% category; however, there is no clarity yet on individual products. White good products like large appliances including TVs are expected to fall in the higher 28% bracket. The new tax structure is planned to be effective from April 1, 2017.

It is still unclear as to which bracket will general electronics items fall, especially smartphones. While it is too early to comment, going by the pulse of the smartphone industry, it seems consumers should not foresee any drastic drop or increase in prices of handsets immediately. The big focus on smartphones

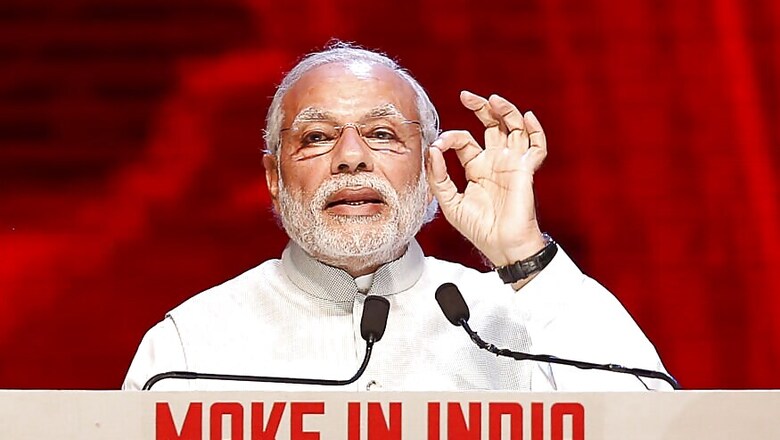

Two flagship government campaigns- Make in India and Digital India- depend heavily on the mobile industry. So, putting smartphones under the general electronics category might sound unfair. And not to forget, as high as 20 mobile brands are already manufacturing in India.

With GST coming into the picture, all benefits from the respective states in the form of concessions and tax exemptions will go away and only one single GST rate will be applied across the country. The bigger question is will make in India make sense for them anymore?

In an exclusive interaction with News18 Tech, Neil Shah, Research Director at Counterpoint Research said, “Given the current differential taxation, imported mobile phones attract a 12.5 percent excise. Considering all other taxes and duties, the total amounts to around 13.5%. However, for phones that are made in India, the overall tax is between zero and 1 percent.”

Making Sense of Make in India

GST not only threatens this tax advantage, it even kills the additional benefits the companies enjoy at the state-level. There is still a lot of clarity needed and the industry is expecting the government to incentivize local manufacturing.

To keep “Make in India” alive, OEMs are suggesting a minimum tax gap of at least 10% between handsets that are made in India and those that are imported.

“If a phone is made in India, it should fall under the 5% or 12% category and those that are imported should fall under 28% bracket,” said Shah.

So, will the government opt for a dual tax structure for mobiles? Necessity vs Luxury

There are budget phones which cost less than Rs 10,000 and there are premium handsets like Samsung Galaxy S7 or iPhone 7 which can be seen as a luxury. In order to drive Digital India, smartphones needs to get cheaper to reach more people. So, will the government opt for a price-based GST to balance between luxury and necessity? For example, the necessary budget smartphone falls under the 5% category while the “luxurious” Galaxy S7 or iPhone 7 fall under the 28% bracket (even if it is made in India.)

In reply to this, Shah said, “Smartphones, in general, are no longer considered as luxury goods and are seen as a commodity. The government hasn’t proposed a horizontal tax structure (depending on prices) at this point. So, even the iPhone is seen as a luxury, it will be clubbed under general mobiles or electronics category only.”

What about Assembled in India smartphones?

Smartphones are mainly assembled in India under the badge of Make in India. With the local component ecosystem maturing going ahead, will there be any benefit for a player which procures more components locally? This is important for promoting the domestic component ecosystem.

While all these can further complicate GST, Shah felt that the government could consider this going ahead looking at real local value addition for companies making in India.

“For example, if I make in India, I get a 10 percent tax relief. But if I do not meet some criteria of adding real local value (in terms of jobs, component procurement, etc), I will not get that tax benefit. However, if I do meet the criteria, I can claim the 10% relief as a refund after paying full taxes in advance,” said

This is crucial because the real local value for products that are assembled in India under the Make in India banner is not much.

Comments

0 comment