views

Global PC shipments grew 45 percent year-on-year (YoY) to 75.6 million in the first quarter of 2021 (January to March), thanks to robust demand across different categories and a low base in the same period last year due to the COVID-19 outbreak, market analyst Counterpoint notes. Its new report that expects a continuing shortage in semi-conductors worldwide in the second half of 2021 claims that PC shipment volumes were down 14 percent sequentially from Q4 2020 due to seasonality.

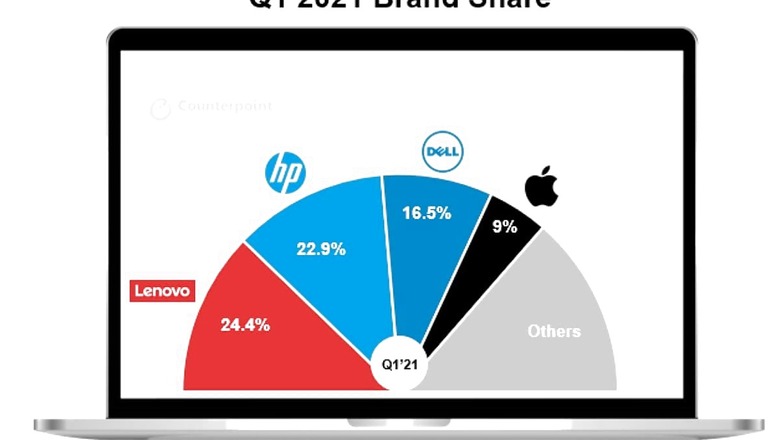

With a 24 percent market share, Lenovo took the top spot again in Q1 2021 by shipping approx 18.1 million units, securing 24 percent of the market share. HP shipped 17.3 million units in the first quarter (23 percent share), followed by Dell with 12.5 million units (17 percent share). The overall momentum of the PC market was mainly driven by the growth in gaming notebooks and surging demand from the work-from-home and study-from-home segments, which stimulated Chromebook sales. Apple shipped 6.8 million units of its MacBooks to secure 9 percent of global markets. Counterpoint adds that PC shipments would remain “resilient” with the pent-up demand from Q1 2021 extending to In Q2 2021. The report claims that the top six vendors would continue to dominate the market with over 85 percent share. “Stepping into H2 2021, the momentum from the previous half will continue and reach a peak with back-to-school (some will be virtual classes) demand as well as the pent-up demand from H1 2021. Premium models with higher ASPs could take the lead via big promotions, which may squeeze out Chromebook’s market share in H2 to some extent,” the Counterpoint added. Overall, the next quarter to expected to see a 16.3 percent YoY growth with global shipments reaching approx 333 million.

The market researcher believes that ODMs’ (original design manufacturer) component inventory levels are relatively higher, but they still CPU and other key component shortages. For PC CPUs, the components were said to be improving gently in late H1 in several sub-segment products. However, some vendors said the demand for audio codec IC and LAN chips remained unsatisfied and would continue to remain in the second half of this year. WiFi SoC also faces relatively low inventory levels, which will prove to be a drag on 2021 global PC shipments.

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment