views

July 2022 marks the fifth anniversary of the Narendra Modi government’s landmark indirect tax reform, the Goods and Services Tax (GST), which is based on the premise of “One Nation One Tax” that makes India a unified, common market.

It is a single, destination-based, multi-stage tax on the supply of goods and services, right from the manufacturing to the consumption stage. Credits of input taxes paid at each stage are available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. It is indeed the Input Tax Credit (ITC), besides a whole host of other progressive moves, which make the GST, as we know it in India, superior to any other consumption-based or Value Added Tax in any other country in the world.

GST was implemented in France for the first time in 1954 with the standard rate largely being 20%. It came into being in New Zealand in 1986 at 10%, before moving to 15%, which is applicable to all purchases, but there is no GST on residential rents and financial services. GST was initiated in Singapore at 3% in 1994 and then went up to 7%. In Indonesia, imports are subject to both Value Added Tax (VAT) and GST, with luxury tax on imports at between 10%-50%, but most exports are exempted from GST. The indirect tax rate in Indonesia is largely between 10% and 35%, while in Brazil, though the average tax rate for food products is 7%, the average VAT for most other items is between 17%-20%, with an additional cess on inter-state supplies at between 4%-25%.

There are some items that also attract a ridiculous rate of as high as 330%, which is a federal tax levied on most domestic and imported manufactured products. In China, there are three indirect tax rates, zero, 5% and 19%, but with very few items that are ‘recoverable’ or that enjoy the benefit of input tax credit.

What the aforesaid indirect taxation data pertaining to other countries highlights is the fact that there is no single kosher indirect tax and/or GST rate. In fact, there are over 40 different GST structures in 160-odd countries where it is applicable.

Hence, those who have been alleging that India’s GST is a multi-tier one and therefore inefficient, are absolutely ignorant. Indian variation of GST is unique due to the sheer array of numbers involving a country of over 1.38 billion people. From a pre-GST tax rate largely between 28%-31% and an entertainment tax rate as high as 110%, post Modi government’s path-breaking GST, 1,186 goods comprising 97.69% of the 1,214 goods that are widely used, are now taxed at well below 18%.

That clearly has to be the biggest pro-middle class move ever, by any government, in post-independent India. In fact, when GST was introduced in July 2017, after taking the Opposition into confidence, the idea was to have a revenue neutral rate (RNR) of 15.5% two-three years hence. But the RNR is merely 11.4% today, even five years after implementing GST, which shows that the Modi government is actually taxing at a far lower rate than what it had envisaged earlier.

Despite supply chain disruptions arising from Covid-19 and the Russia-Ukraine conflict, the Modi government has chosen to strike the right balance between tax base and tax rates and the low RNR reflects precisely that. Do not forget that compared to RNR of 11.4% today, under an inept Congress, the comparable tax rate was more than 19%.

In May 2014, when PM Modi took charge, over 226 items were taxed at over 28% with the effective tax rate on some items going up to as high as anywhere between 33% to 40%. Today, barely 29 items attract a tax rate of 28% and these are largely sin goods like tobacco, aerated drinks, high-end sedans etc. So without doubt, overall tax rates under the Modi government in the last eight years have come down drastically.

GST is largely pro-poor and pro-middle class and this is amply evident from the fact that a whole host of items is charged either at zero or a humble 5%. GST for all religious tours has been fixed at 5%. The GST for air travel in economy class is 5% and GST for business class air travel is 12%. GST for movie tickets costing up to Rs 100 was brought down from 18% to 12% and for those priced above Rs 100, from 28%, to 18%. GST for tyres, many auto parts and TVs up to 32 inches was brought down from 28% to 18%. GST on sanitary pads is down from 13.5% earlier to zero now. To cut to the chase, Modi’s version of GST has been progressive and middle class friendly without being a burden on the exchequer and that is commendable indeed.

No country with India’s geographical size, complexity or population could have reined in inflation amidst a choppy global environment and still effectively executed GST, but the Modi government did that with panache and much more. In effect, of the 160-odd countries that have adopted GST, only 49 follow one tax slab module, 28 countries have two slab tax modules and all others have modified and tweaked the GST structure to align it with their country’s specific needs, which essentially means there is no need to follow the “one size fits all” approach.

In fact, the seamless GST implementation by the Modi government is a glowing tribute to what political conviction of courage can achieve. Under GST, Central Excise duty, Additional Excise duty, Service Tax and additional duty of customs (equivalent to excise), State VAT, entertainment tax, taxes on lotteries, betting and gambling, and entry tax (not levied by local bodies) have been subsumed. Other taxes subsumed are Octroi, entry tax and luxury tax, thus making it a single indirect taxation system in India.

An e-Way Bill, which is an electronic permit for shipping goods similar to a waybill, is mandatory for inter-state transport of goods effective from April 1, 2018, under the GST regime. It is required to be generated for every inter-state movement of goods beyond 10 kilometres with the threshold limit being Rs. 50,000. It is a paperless technology solution and critical anti-evasion tool to check tax leakages which helps in clamping down on trade that happens on cash basis beyond a certain limit. Along with GST, the e-Way bill, with RFID tags for motor vehicles which are captured at toll plazas by sensors, have been gigantic steps in the right direction in improving tax compliance. On an average today, 70-75 million e-Way bills are generated every month, showcasing economic vibrancy.

Former Congress president Rahul Gandhi and his coterie of sycophants can keep vacillating between false bravado and sheer desperation at what they could have done with GST. But finally, an idea is only as good as its implementation. So, while the Congress built flaky castles in the air by sitting on the Kelkar committee recommendations for almost 10 long years, kudos to the Modi government that it walked the talk, sorted out thorny issues and also made the necessary alterations that eventually made GST a reality on July 1, 2017.

Close to Rs 10,000 crore is paid to states every month as revenue deficit grant (RDG). Last year, over Rs 2 lakh crore was paid to states as GST compensation, with Kerala and West Bengal getting a large share. So the allegations that states are being deprived of compensation by the Modi government hold no merit.

It is time for the Congress to stop playing the ‘martyr’ and churlishly blaming the BJP for ‘snatching’ their idea, which never was their idea to start with. In a democracy, an idea is worth its weight in gold only if executed effectively and it is indeed no mean achievement that GST collections have seen an average monthly run rate of over Rs 1 lakh crore since October 2020. In April 2022, GST revenues peaked at Rs 1.68 lakh crore.

The Modi government reduced GST on under-construction houses from 12% to 5%, and in the ‘affordable housing’ segment, it was reduced from 8% to a mere 1%, once again endorsing the pro-people approach of the BJP-led NDA government. A house with a carpet area of 60 square metres costing up to Rs 45 lakh in a metro city and a house with a carpet area of 90 square metres, costing up to Rs 45 lakh in a non-metro, would be designated as “affordable”.

Among other things, India’s fuel economy, post-GST, is more competitive by eliminating the need for truckers to wait endlessly to pay octroi and entry taxes at inter-state check-posts. A trucker on an average can now cover 325-350 kilometres in a day, versus 200-225 kilometres in the pre-GST period, thanks to lower number of halts at “toll nakas”.

In November 2017, at its 23rd meeting in Guwahati, the GST Council reduced rates for all AC and non-AC restaurants from 18% to 5%, bringing cheer all around with only starred restaurants, with a tariff of Rs. 7,500 or more, to henceforth charge higher rates. In the pre-GST era, eating out was a prohibitively expensive proposition with service tax, surcharge, cess and other taxes working out to anywhere between a hefty 28-33%, but that stands now at just 5%.

At its 31st meeting on December 22, 2018, the GST Council, among other concessions, made services rendered to all Jan Dhan accounts in the country completely tax-exempt, showcasing that the Modi government’s clarion call of “Sabka Saath, Sabka Vikas, Sabka Vishwas” is not a mere platitude, but a work ethic that it truly abides by.

To curb corruption, tax leakages and frauds using fake invoices, the Modi government brought in E-Invoicing in 2020, for those with more than Rs 500 crore turnover. The Rs 500 crore threshold was then brought down to Rs 100 crore and subsequently Rs 50 crore. By next year, it will be further reduced to Rs 5 crore, thereby putting an end to mismatching of invoices that in turn leads to delayed reconciliation of accounts.

From about 495 forms that needed to be filed in the pre-GST era, the number in the post-GST era is down to just a handful of 12-odd forms. GSTR-1 is a monthly GST return that contains details of all outward supplies. GSTR-2 is a purchase return with details of all inward supplies to be filed by every registered dealer/person. The GSTR-3B is a consolidated summary return of inward and outward supplies that the Government of India has introduced as a way to relax the requirements for businesses that have recently transitioned to GST. Again, as per Rule 80 of CGST Rules 2017, there are different types of returns under GSTR 9 form. GSTR-9A is to be filed by “Composition Scheme Taxable persons”. GSTR-9B is to be filed by “Electronic Commerce (e-comm), Operators”. GSTR-9C is to be filed by persons who are required to get their accounts audited under Section 35 of CGST Act.

The GST structure chooses to tax demerit goods at the highest rate to disincentivise “sin goods”, while keeping tax rates for items of mass consumption at zero or 5%. The GST model, under the Modi government, strikes just the right balance between the tax base and tax rates, thereby preventing the tax structure from becoming regressive.

Speaking of the recent controversy pertaining to 5% GST on pre-packaged and pre-labelled goods, it is the GST Council that recommends GST rates, not the central government. The GST Council is a truly federal body with representatives from every state government, including Union Territories with Legislatures, with the central government represented by the Union Finance Minister, who is the Chairperson of the council. The voting structure of the GST Council is such that states together have a 2/3rd weightage of the vote. The Centre has a 1/3rd weightage of the vote. Out of the multitude of decisions taken in each of the 47 GST Council meetings that have taken place so far, only a single decision has been put to a vote. In other words, the overwhelming majority of decisions taken by the GST Council have been through unanimous consensus of the states and the Centre.

The most recent rate rationalisations recommended by the GST Council following its 47th meeting were on the basis of recommendations of the Group of Ministers (GoM) on rate rationalisation. The GST Council had, in its 45th meeting on September 17, 2021, in Lucknow, decided that there was a need for the creation of a Group of Ministers to recommend on several rate-related issues, including rate rationalisation, correction of inverted duty structure, reduction in classification-related complexities and enhancement of revenue generation. The GoM included members from seven states, namely Karnataka, Bihar, Goa, Kerala, Rajasthan, Uttar Pradesh, West Bengal — many of which are ruled by the Opposition. All states, including non-BJP states (Punjab, Chhattisgarh, Rajasthan, Tamil Nadu, West Bengal, Andhra Pradesh, Telangana, Kerala) agreed with the decision. This decision of the GST Council was yet again by unanimous consensus.

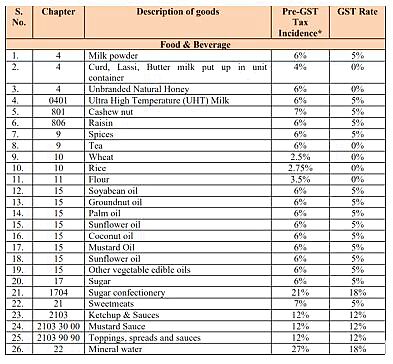

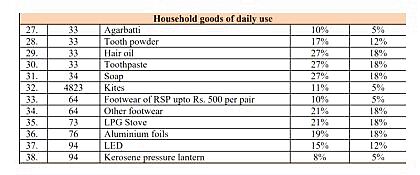

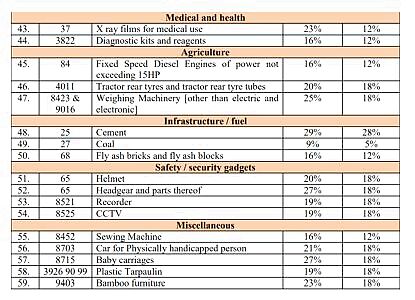

Hence, for the Congress, TMC or Left to protest against 5% GST on pre-packaged and pre-labelled food items, after approving and ratifying these at the 47th GST Council meeting, is nothing but mere hypocrisy. There have been reports that this decision of the GST Council is the first time these items are being taxed. This is again, not true. These items were taxed in the pre-GST, VAT era as well. There are also some reports doing the rounds that food items and items of daily use are being taxed higher under the GST regime than they were in the previous indirect tax regime. This is also far from the truth, as can be seen from the rate comparisons in the table here.

Source: Central Board of Indirect Taxes and Customs

Finance Minister Nirmala Sitharaman has clearly stated that no GST will be levied on 11 food items when sold loose. The items that will not attract GST when sold loose include pulses/daal, wheat, rye, oats, maize, rice, aata/flour, suji, besan, puffed rice, curd/lassi. When GST was rolled out, a tax rate of 5% was made applicable on branded cereals, pulses, and flour. Later, this was amended to tax only such items which were sold under a registered brand or brand on which enforceable right was not foregone by the supplier.

However, soon, rampant misuse of this provision was observed by reputed manufacturers and brand owners and gradually GST revenue from these items fell significantly. This was resented by suppliers and industry associations who were paying taxes on branded goods. They wrote to the government to impose GST uniformly on all packaged commodities to stop such misuse. This rampant evasion in tax was also observed by states. The Fitment Committee, consisting of officers from Rajasthan, West Bengal, Tamil Nadu, Bihar, Uttar Pradesh, Karnataka, Maharashtra, Haryana and Gujarat had also examined this issue over several meetings and made its recommendations for changing the modalities to curb misuse.

Is this the first time such food articles are being taxed? No. States were collecting significant revenue from foodgrains in the pre-GST regime. Punjab alone collected more than Rs 2,000 crore on foodgrain by way of purchase tax. UP collected Rs 700 crore. If anything, overall tax rates have come down significantly in the post GST era in a huge relief to middle class. For example, shampoos, soaps, detergents, toothpaste and sanitary ware attracted 30% tax earlier, which in post-GST era is down to 18%.

It is only to curb tax evasion that the GST Council in its 47th meeting took the decision of a 5% GST levy on pre-packaged and pre-labelled goods. However, with effect from July 18, 2022, only the modalities of imposition of GST on these goods was changed, with no change in the actual coverage of GST, except say 2-3 odd items. It has been prescribed that GST on these goods shall apply when supplied in “pre-packaged and pre-labelled” commodities, attracting the provisions of the Legal Metrology Act of 2009.

For example, items like pulses, cereals like rice, wheat, and flour etc, earlier attracted a GST of 5% when “branded and packed in a unit container”. From July 18, 2022, these items would attract GST when “pre-packaged and labelled”. It is explicitly clear that a single package containing a quantity of more than 25kg would not be considered a pre-packaged and pre-labelled commodity for the purpose of GST levy, even if declarations of the wholesale package are made as per Rule 24 of the Legal Metrology Packaged Commodity Rules, 2011. This is a welcome change and will reduce GST costs for the industry.

To conclude, this decision was a much-needed one to curb tax leakage, pilferage and was taken to safeguard interests of consumers, small traders and small industries. It was considered at various levels including by officers, the group of ministers (GoM) and was finally recommended by the GST Council with the complete consensus of all members after proper and umpteen deliberations.

The best thing about GST is that there are no hidden taxes and what you see is what you get. Efficiency gains, higher compliance, prevention of tax leakages, lower rates, wider base, export friendliness and tax neutrality have brought down the overall tax burden for the middle class and enhanced the ease of doing business, especially for small industry bodies. One Nation, One Tax, embodied by GST, is the single biggest indirect tax reform in India’s economic landscape, made possible by the conviction of Prime Minister Narendra Modi and it is truly creating a unified and integrated market in more ways than one.

Read all the Latest News and Breaking News here

Comments

0 comment