views

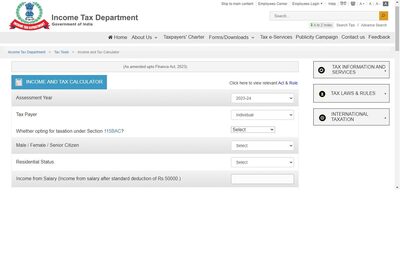

Paytm Share Price Today: Paytm shares fell over 6 per cent in early trade on Monday morning after the ED raided its offices. Despite the company denying any links with the merchants that are under the Enforcement Directorate scanner in the Chinese loan app case.

The stock fell by 6.6 per cent to Rs 681.20 per share in BSE intraday trade on Monday. At the day’s low of Rs 681.20, the share price was at a discount of 68 percent from its issue price of Rs 2,150. In 2022 (year-to-date), the stock has erased over 45 percent of investors’ wealth as against the benchmark Sensex which has fallen 0.6 percent during the period.

The stock was reacting to Enforcement Directorate raids at six premises of online payment gateways. The ED on Saturday said it conducted raids at six premises of Razorpay, Paytm and Cashfree in Bengaluru over alleged irregularities in instant app-based loans “controlled” by Chinese persons.

During the raids, the federal probe agency said it seized Rs 17 crore worth of funds kept in “merchant IDs and bank accounts of these Chinese persons-controlled entities”.

The three companies responded by saying they were cooperating with the federal agency. A Paytm spokesperson earlier said the firm was supporting the law enforcement agencies, who are investigating a specific set of merchants.

“The authorities reached out to us with directions to provide certain information about these merchants under scrutiny, to which we promptly responded. We continue to cooperate with the authorities and remain fully compliant,” said Paytm.

The company, however, on Sunday, said in a regulatory filing that none of its funds were frozen by the ED. “As a part of ongoing investigations on a specific set of merchants, the ED has sought information regarding such merchants to whom we provide payment processing solutions. We wish to clarify that these merchants are independent entities, and none of them are our group entities,” Paytm said in a regulatory filing.

The ED initiated a probe under the criminal sections of the Prevention of Money Laundering Act (PMLA) after a number of instances of gullible debtors ending their lives came to the fore from various states, with the police stating they were being coerced and harassed by these loan app (application) companies by publicising their personal details available in their phones and by undertaking high-handed methods to threaten them.

It was alleged that the companies sourced all personal data of the loan-taker at the time downloading of these apps on their phones, even as their interest rates were “usurious”, reported news agency PTI.

Read all the Latest Business News and Breaking News here

Comments

0 comment