views

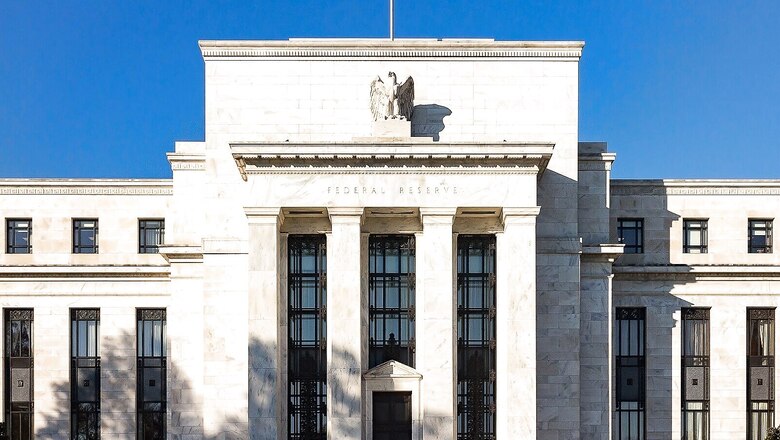

The US Federal Reserve raised interest rates by half a percentage point on Wednesday and projected at least an additional 75 basis points of increases in borrowing costs by the end of 2023 as well as a rise in unemployment and a near stalling of economic growth.

The US central bank’s projection of the target federal funds rate rising to 5.1 per cent in 2023 is slightly higher than investors expected heading into this week’s two-day policy meeting and appeared biased if anything to move higher.

Only two of 19 Fed officials saw the benchmark overnight interest rate staying below 5 per cent next year, a signal they still feel the need to lean into their battle against inflation that has been running at 40-year highs.

“The (Federal Open Market) Committee is highly attentive to inflation risks… Ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 per cent over time,” the Fed said in a statement nearly identical to the one it issued at its November meeting.

The new statement, approved unanimously, was released after a meeting at which officials scaled back from the three-quarters-of-a-percentage-point rate increases that were delivered at the last four gatherings. The Fed’s policy rate, which began the year at the near-zero level, is now in a target range of 4.25 per cent to 4.50 per cent, the highest since late 2007.

Read all the Latest Business News here

Comments

0 comment