views

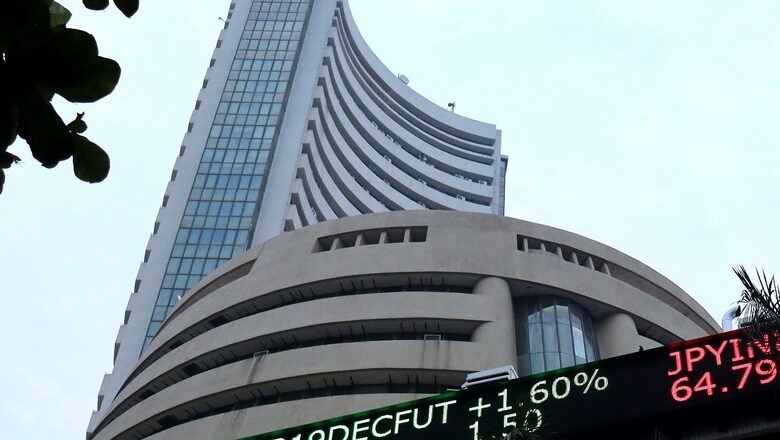

Indian benchmark indices ended lower for the second consecutive session on Monday amid global sell-off due to geopolitical tension between Russia and the West over Ukrain. At close, the Sensex was down 1,747.08 points or 3.00 per cent at 56,405.84, and the Nifty was down 532 points or 3.06 per cent at 16,842.80. About 574 shares have advanced, 2897 shares declined, and 108 shares are unchanged.

In the broader markets, the BSE MidCap and SmallCap indices cracked 3.5 per cent and 4 per cent, respectively. Sectorally, all the indices ended in the red with the Nifty PSU Bank index nosediving 5.9 per cent; Realty index 5 per cent; Private Bank, Financial Services, Bank, and Auto upwards of 4 per cent each; and Pharma and IT indices over 2 per cent.

Sellers flocked the markets today, selling almost anything and everything. Market breadth showed there were 19 declining stocks for every single advancing stock on the BSE. On the NSE, the advance-decline ratio stood at 1:14. Fear gauge, India VIX, reflected this risk-off sentiment as it surged 23 per cent.

Global markets have been jittery after US National Security Advisor Jake Sullivan said over the weekend that there were signs of Russian escalation at the Ukraine border and that it was possible that an invasion could take place during the Olympics, despite speculation to the contrary.

Vinod Nair, head of research at Geojit Financial Services, said: “Increased tension between the US and Russia over Ukraine sent oil prices rising and forced investors to dump risky assets. Risk sentiment was further dampened ahead of the Fed’s emergency meeting which heightened fears of aggressive monetary tightening. On the domestic front, the annual WPI inflation eased marginally to 12.96 per cent in January from 13.56 per cent in December, but still high, amid moderation in the fuel and power prices”

Global Cues

US stocks dropped on Friday on rising worries over escalating Ukraine-Russia tensions and the prospect of a tightened interest rate hike timeline from the U.S. Federal Reserve in response to decades-high inflation. The Dow Jones Industrial Average ended down 503.53 points, or 1.43 per cent, at 34,738.06; the S&P 500 lost 85.44 points, or 1.90 per cent, at 4,418.64; and the Nasdaq Composite dropped 394.49 points, or 2.78 per cent, to 13,791.15.

Asian shares slipped on Monday as warnings Russia could invade Ukraine at any time sent oil prices to seven-year peaks, boosted bonds and belted the euro. The United States on Sunday said Russia might create a surprise pretext for an attack, as it reaffirmed a pledge to defend “every inch” of NATO territory. The cautious mood saw MSCI’s broadest index of Asia-Pacific shares outside Japan drop 0.2%, while Japan’s Nikkei lost 2.1 per cent.

Oil prices hit their highest in more than seven years on fears that a possible invasion of Ukraine by Russia could trigger sanctions that would disrupt exports from the world’s top producer in an already tight market. Brent crude futures was at $95.56 a barrel, up $1.12, or 1.2 per cent, after earlier hitting a peak of $96.16, the highest since October 2014. US WTI crude rose $1.28, or 1.4 per cent, to $94.38 a barrel, hovering near a session-high of $94.94, the loftiest since September 2014.

Read all the Latest Business News here

Comments

0 comment