views

The cumbersome process of filing income tax returns (ITR) concerns all — even a Supreme Court judge.

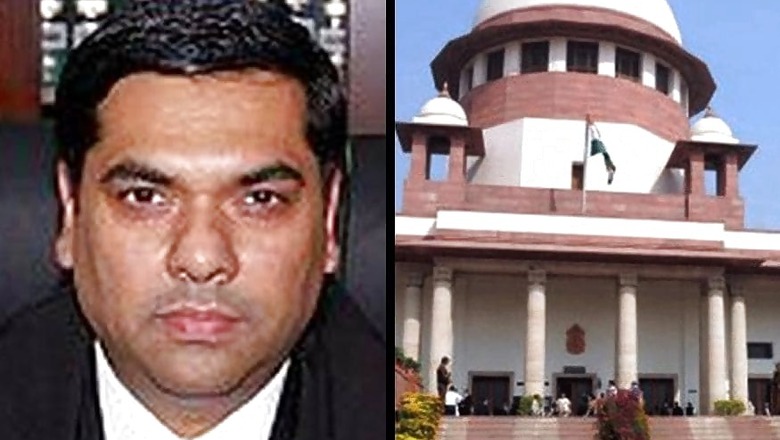

Justice Sanjiv Khanna on Friday echoed the sentiments of many a taxpayer who try to file their ITRs on their own.

"I file my income tax returns myself. And it took me one full day to do it," said the judge, while being part of a bench which was hearing a matter relating to tax credit.

The judge was emphatic that the process was such that he could not finish the job earlier. "I just could not do it before," added Justice Khanna.

The bench, headed by Justice AM Khanwilkar, was sharing its concerns with Solicitor General Tushar Mehta, who appeared for the central government in the matter.

The case related to time limit prescribed under Rule 117 of Central Goods and Services Tax Rules, 2017 (CGST Rules).

The Delhi High Court had ruled that Rule 117 is directory and not mandatory and hence time limit of 3 years under the residuary provisions of the Limitation Act 1963 (Limitation Act) would apply since credit of taxes paid on inputs is a vested right.

In order to carry forward the amount of CENVAT credit accrued till 30 June 2017, i.e. the last day before the introduction of GST, taxpayers require filile a declaration in form GST TRAN-1 (TRAN-1).

The CGST Rules prescribed a time limit of 90 days for such transition, which was extended only in case of technical glitches, and hosts of taxpayers could not do it due to various reasons, including system fault and technical glitches but did not fall within the criteria fixed by the Government.

As they laid challenges to the time limit fixed under Rule 117, the Delhi High Court ruled that transactional credit was a vested right and rued several taxpayers were unable to file the form due to inefficiencies of the GSTN portal which was beyond the control of the taxpayers.

The government challenged this order before the Supreme Court, which also asked the Solicitor General to look at various technical snags that may render a taxpayer enable to fill up TRAN-I forms.

"Shouldn't the government be more receptive when technological constraints and deficiencies deny people of the benefits they are otherwise entitled to?" the court asked Mehta.

It added: "We are of the belief when there is no negligence on the part of a party but it is due to the technical difficulties then the government should not penalize the industries."

Mehta, on his part, replied: "We have done everything. We set up an expert Committee and issued new instructions to the Commissioners as well."

The bench, however, asked the law officer to look into these issues and impress upon the authorities to examine it.

It issued notices to Brand Equity Treaties Limited, and tagged this matter with a bunch of other cases where similar issues have been raised.

The apex court noted that different high courts have taken different views in the interpretation of the impugned rule, and hence an authoritative decision will be required.

Comments

0 comment