views

Bangalore: Rumors of the death of the portable navigation device may have been exaggerated after all.

It is true that with the rise of navigation-based smartphones and the birth of devices like the Apple iPad, the PND has quickly descended from being a must-have in the consumer electronics space to another technology has-been.

But despite sophisticated smartphones eating their lunch, PNDs will not become obsolete and experts predict that eventually a niche market will remain for them.

It is not clear how small a market - dominated by Garmin and Dutch rival TomTom - it will shrink to as that will depend on the extent people use smartphones for their navigation needs and whether a killer device from a company like Apple appears on the horizon.

"There's still a decent-sized PND market out there," Deutsche Bank analyst Jonathan Goldberg said. "Some people think it's going to go away in a year. Some people think it's going to go away in five years."

"Until we get through a year or so, we won't know how much life there is left in the business."

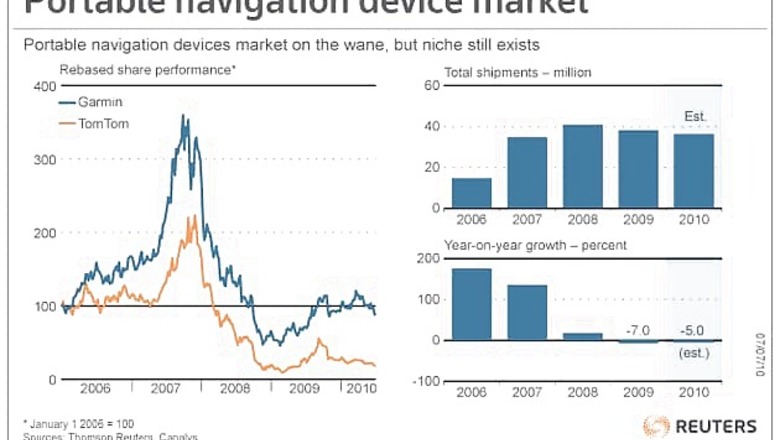

The global PND market grew 176 percent in 2006 and 136 percent in 2007, figures from Canalys show. In 2009, it fell 7 percent and is expected to drop 5 percent in 2010, according to the market researcher.

Garmin shares have shed 76 percent of their value since they hit an all-time high of $ 125.68 in 2007, compared with a 34 drop in the broader S&P 500 market.

TomTom stock has lost 92 percent of its value since its peak, also in 2007.

"We don't believe PNDs will disappear per se," MKM Partners analyst Pablo Perez-Fernandez said. "We think that PNDs are going to be around a lot longer than people think."

Major wireless carriers in North America and Europe such as AT&T and Telefonica's O2 have said they will stop unlimited pricing plans for some new subscribers to their mobile data services, Perez-Fernandez pointed out. He expects more carriers to follow suit.

This will make consumers think twice before using their smartphones for navigation, which is bandwidth-intensive.

Despite this, there is no doubt that the future of portable navigation devices is in question.

"The global PND market peaked in 2008," said Canalys analyst Caroline Chow. Global PND shipment rose to a high of about 41 million units in 2008, and has been falling since then. "I doubt if there will be a recovery," Chow added.

"The consumer market is getting more crowded. People are not just looking for PNDs. They're looking for anything that increases their mobility, ranging from a phone to a netbook to a PC or an iPad," she said.

Another category, in-dash navigation systems, which come pre-installed in cars, has also been growing, further relegating PNDs to the sidelines.

Charting new paths

So Garmin and TomTom have been forced to chart new paths to survive. It is no longer enough for them to wait to see how it will all play out.

"Thinking that the market itself will just turn around and consumers will rediscover their love for PNDs is not going to happen," Gartner analyst Thilo Koslowski said.

To fight fire with fire, Garmin has bet on navigation-based smartphones it launched with Taiwanese PC maker Asustek. The move is not expected to impact the fiercely competitive smartphone market, dominated by giants like Nokia, Research in Motion and Apple.

TomTom, on the other hand, has put its money on a software-based strategy. The company has, among other things, launched a navigation application for the iPhone.

As a result, TomTom has cut its exposure to PND devices. In the first quarter, PNDs made up about half of TomTom's sales compared with 2009, when they contributed 70 percent.

"TomTom has realized quicker that the market is changing," Koslowski said.

For the precious few who still want a PND, it couldn't be better. Pricing has been dropping and could slide further.

"In 2004/2005, you paid a lot of money - about $ 400 to $ 500 - for a PND. I predict that five years from now, you will probably pay about $ 49 for that same device," Koslowski said.

For Garmin and TomTom, this will mean lower margins.

There is a bright spot for these two companies, though.

The weakness in the PND market - declining revenue, falling average selling prices, lower margins - has made it less attractive for most companies.

Smaller companies have started to fall by the wayside as it is too difficult to invest in a distribution network when they don't have the scale of the market leaders.

Hence, TomTom and Garmin have been gaining market share.

The combined market share of the two in North America will grow to 85 percent by the end of the year, compared with 77 percent in the first quarter of 2009, Perez-Fernandez said. In Europe, he expects it to climb to 71 percent from 59 percent.

Comments

0 comment