views

X

Research source

[2]

X

Research source

Assessing the Damage

Find out exactly what happened. Before you can figure out how to respond to a motion for sanctions alleging your business violated an automatic stay, you need to know exactly when and how the debtor was contacted. Read the allegations the debtor has set forth in their motion for sanctions, and check those allegations against your own company records. At this stage give the debtor the benefit of the doubt. Assume everything they've stated in their motion is true, so you can figure out how to mitigate the potential damage to your business. If the debtor is a client or customer of yours, look over their account and review their payment history and record of business with your company. If you know the debtor personally, it may be tempting to try to reach out to them yourself to smooth over the situation. This is not a good idea when they've already filed a motion for sanctions against you.

Consult an attorney. While you may have a business attorney, you need to talk to an experienced bankruptcy attorney about what your options are if you've been served with a motion for sanctions. If you have a regular business attorney, you might ask them for recommendations. They may know an experienced bankruptcy attorney who could work with you on this situation. You need a bankruptcy attorney who practices in the same jurisdiction where your client or customer has filed their motion and who has experience representing businesses that have been accused of violating an automatic stay. Automatic-stay litigation is a specialized practice, so an attorney with experience representing businesses filing for bankruptcy, for example, may not have much experience defending against an automatic stay from the creditor's side.

Return any seized property promptly. If you seized any property that was pledged as collateral for the debt, you must return it to the debtor. Any act you committed in violation of an automatic stay is void if the court concludes that you did in fact violate the stay. Any actions you've taken are without legal effect, so even if no physical property was seized, you'll want to withdraw any lawsuits you've filed against the debtor. This proactive step can send a signal to the debtor that you recognize your actions were inappropriate and are willing to make things right. If reversing an action would require you to come into contact with the debtor, such as returning seized property, you may want to do it through your attorney.

Attempt to negotiate a resolution. You may believe you have a strong defense to the debtor's allegations. Nonetheless, negotiating to resolve the situation can save you a lot of money. You also save valuable time and resources. Have your attorney contact the debtor's attorney and arrange a meeting to discuss a settlement. Keep in mind that going to court to defend your business may cost you far more money than any settlement you could negotiate – not to mention time and harm to your business's reputation. Your attorney will work with you to build a settlement strategy for negotiation that will best protect your business after violating the automatic stay of a client or customer in bankruptcy. If the debt to you is included in the bankruptcy, consider offering to forgive all or part of the debt. The debtor may be willing to drop the motion for sanctions in exchange. If you play this angle well, you may be able to get away without paying the debtor anything specifically for the violation of the automatic stay. If you suspect the debt you're owed would be discharged anyway, this can be a good way to protect your business.

Offer to pay the debtor's damages. If the motion goes before a judge, you may end up having to pay more than the specific amount identified by the debtor as damages. Offering to pay this amount in full may end the problem for you. This strategy is an attempt to minimize sanctions and preserve your business's reputation, which could be harmed if a sanctions order is entered against you in court. Generally speaking, you don't want to put yourself or your business in a situation where you are ordered to pay court-imposed sanctions for violation of an automatic stay. If the debtor refuses your offer, you'll have to go to court to defend your business's actions.

Mounting Your Defense

Read the debtor's motion carefully. Go over the motion with your attorney and look for problems or errors made by the debtor. You can use these to your advantage when defending your business against the motion. Generally the debtor must prove that they filed for bankruptcy, that your business was notified of that bankruptcy, and that you contacted the debtor or otherwise took actions to pursue collection of their debt anyway. If the motion doesn't prove any of these elements, you can fight the sanctions on the basis that the debtor has not proved everything necessary to establish a violation. There are certain types of debt that cannot be discharged in bankruptcy. If the money the debtor owes you falls into one of these special categories, you can't be charged with violating the automatic stay for the simple reason that the automatic stay does not apply to you. This is an issue to discuss with the attorney you've hired to represent you in your defense against the motion for sanctions.

Check your own records. For the court to impose sanctions, your violation of the automatic stay must be willful, meaning that you knew about the stay and contacted the debtor anyway. Much of the debtor's case that you violated the automatic stay hinges on the fact that you had notice of their bankruptcy. Courts have held that certain kinds of contact don't actually violate an automatic stay. For example, you might have sent a letter to the debtor asking if they would be willing to reaffirm their debt to you rather than including it in the bankruptcy. Generally such a letter does not violate an automatic stay as long as it doesn't include any threatening or high-pressure language. Carefully review the allegations in the motion for sanctions, and confirm them if you can by referring to your own records. For example, if the debtor alleges that you sent five emails of the "final notice" type, check your business records for copies of these emails and when they were sent.

Speak to your employees. Particularly if the debtor alleges that they were contacted directly over the phone or in person, it is imperative that you identify which employee talked to the debtor. You need to get their side of the story and find out what they did and why. If one of your employees said they were not aware that the person had filed for bankruptcy, this is not an excuse you can use to get out of sanctions. However, the judge may decide not to impose punitive damages under such circumstances. As an employer it is your job to keep any employees who collect debts informed of when a client or customer files for bankruptcy.

Appear at the hearing. If you wish to defend against sanctions for violating an automatic stay, you must appear in court and argue your case to the bankruptcy judge. Your strongest defense typically will be to demonstrate that the debtor has not proven the essential elements of an automatic stay violation. Generally a good-faith mistake is not a defense against a violation of an automatic stay. But there may be other weaknesses in the debtor's case that you can exploit. For example, if you sent a final notice to collect the debt before the debtor actually filed for bankruptcy, you may be able to avoid sanctions. In that situation, even though you had notice of the debtor's bankruptcy, the letter in question was sent before you could possibly have had any notice. Typically if you appear in court, you're trying to avoid being hit with punitive damages in addition to actual damages incurred by the debtor as a result of your violation. In this situation, a good-faith defense may help you. This includes arguments that the employee who contacted the debtor did not know about the bankruptcy, or that you honestly believed whatever communication you made wasn't a violation of the automatic stay.

Preventing Future Violations

Do not contact debtors who've filed for bankruptcy. It may seem obvious, but if you receive notice that a client or customer has filed for bankruptcy, you should immediately cease all contact with them. There are some types of contact that don't violate automatic stays. For example, a simple statement of a customer or client's account that is not a demand for payment may not violate an automatic stay. Similarly, you can send a client or customer who has filed for bankruptcy a letter politely asking them to consider reaffirming their debt to you. If you're thinking about undertaking any of these communications, direct them to the debtor's attorney. Don't attempt to communicate directly with the debtor.

Establish a policy to notify all employees. Sometimes it's not good enough that you stop contacting a debtor. If they remain on your rolls as a client or customer who owes your business money, your employees may take it upon themselves to contact them. The fact that an employee was unaware of the bankruptcy is not an excuse for violating an automatic stay. It is your responsibility as a business owner to notify your employees and control their actions in this regard. Your employees also need to understand the basics of the bankruptcy process and the automatic stay. Help them recognize that an automatic stay not only protects debtors from harassment, it also protects your business as well. Respecting an automatic stay means that your business will receive the same consideration accorded all of the debtor's other creditors. Without an automatic stay, aggressive creditors could push their way to the front of the line and get paid while debts to other creditors are discharged.

Put systems in place to stop computer-generated notices. The billing software or system your company uses may automatically generate payment reminders and past-due notices and send or email them to your clients or customers. Many businesses have attempted to defend themselves against a motion for sanctions by arguing that they did not personally contact the debtor -- that, in fact, whatever email or letter the debtor received was automatically generated by a computer system. Bankruptcy judges have taken a dim view of this argument. Regardless of how a notice is generated, you're responsible for controlling all aspects of your business. Thus, if you receive notice that a client or customer has filed for bankruptcy, remove their contact information from any programs that generate automatic notices.

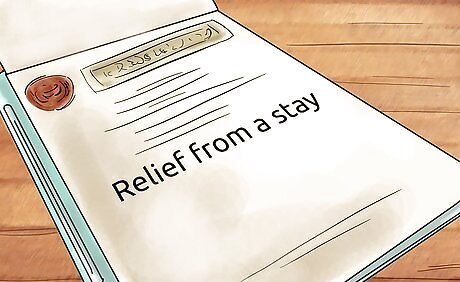

Seek relief from a stay where appropriate. If you receive notice that a client or customer has filed for bankruptcy, there are some situations in which you can get relief from a stay and continue to pursue collections. To request relief from a stay, file a motion with the bankruptcy court where the client or customer at issue filed their bankruptcy petition. Your motion will discuss the reasons you believe you are entitled to relief from the stay so you can continue to pursue collection of the debt. For example, suppose you have a contract with a client or customer who has filed for bankruptcy, and you want to modify that contract. The client or customer may argue that your proposed modification would violate the automatic stay. In that situation you can file a motion for relief and explain to the court the reasons you want to modify the contract. There are many situations in which you could possibly obtain relief from the automatic stay. Talk to an experienced bankruptcy attorney if you have a client or customer who files for bankruptcy and you believe you are entitled to relief from the stay.

Negotiate security agreements with new clients or customers. In the future refrain from offering new clients or customers unsecured credit. Require deposits or advance payment from anyone with whom you do not have an established relationship. You may want to check the credit report for each new client or customer. You can set a high threshold score, requiring payment in advance or a significant deposit for anyone whose credit score falls below that threshold. Another way to avoid violating an automatic stay is to require clients or customers to pledge collateral. A secured sales agreement does not guarantee you'll be paid if the client or customer files for bankruptcy. However, it does mean you'll be toward the front of the line when the debtor's estate is assessed.

Comments

0 comment