views

Applying for a Basic Joint Account

Pick a bank or credit union together. Agree on a place that meets both of your needs. If you are opening an account with somebody you live with, think about a place nearby. If you are opening an account with someone who lives far off, such as a teenager in college, for instance, you'll want to open an account with ATMs they can access. If you already bank at the same institution, you may want to open your joint account with them for ease of transfer. If you both want to keep your old accounts, but also invest in your community, consider opening a joint account with a local credit union.

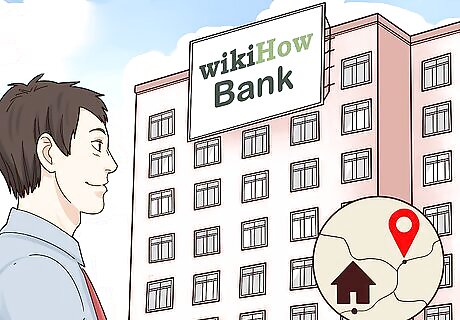

Gather your documents. To open a joint banking account, you will need to bring an ID that includes your name, your date of birth, and your address. Documents that may work include: A driver's license A state ID A passport

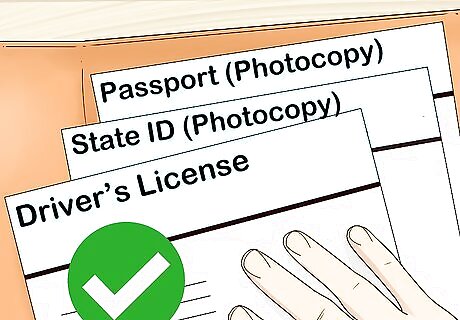

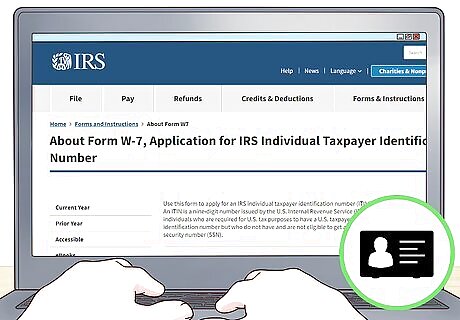

Have both of your IDs ready. Some form of ID number will also be required for both of you. Make sure you know your government issued ID. In the United States, you'll need your Social Security Number if you have one. If you don't have one, you'll need an Individual Taxpayer Identification Number. Apply for an Individual Taxpayer Identification Number with the IRS: https://www.irs.gov/forms-pubs/about-form-w7

Fill out the forms at the bank of your choice together. Check your bank's website to find out if you need to go in in person, call, or just fill out forms online to start your account. Go to the bank together to sign the paperwork agreeing to open a joint bank account. If you're just signing up online, you'll need to have the paperwork for both of you on hand. If you are opening an account with a minor for whom you are the guardian, you may be asked to sign a permission form allowing them to open the account.

Make your first deposit together. Ascertain the minimum amount you will need to start an account at your bank of choice. Decide how much each of you will deposit. Call, go online, or visit your bank will take a deposit in person or via electronic transfer. For instance, if your bank requires a minimum of $300, and you're opening the account with a partner, you will both put in $150.

Picking a Type of Joint Account

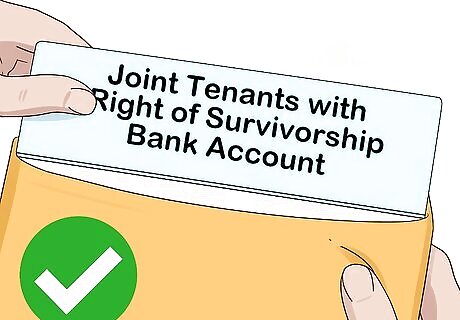

Consider a "joint tenants with right of survivorship" account. These accounts are the most common type of joint account. They are available to everyone, but popular with couples. With a "joint tenants with rights of survivorship" bank account, owners have equal access and equal responsibility for the account. If one partner dies, all of the funds pass on to the surviving owner. This account is not subject to probate after an owner dies. Creditors can collect against this account, no matter which of you deposited the balance.

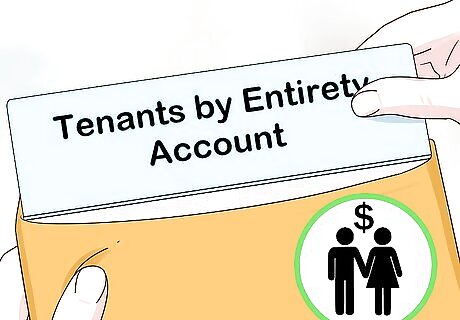

Opt for a "tenants by the entirety" account to sign off on each transaction. This option is only available to couples, whether by marriage, civil union, or domestic partnership. Neither of you may withdraw money without the permission of the other. Creditors cannot collect on the total balance of the account, but only on funds acquired by the couple and only with permission of both owners. This account is not subject to probate. If one owner dies, the entirety of the balance becomes the property of the surviving owner.

Open a "convenience" account to manage money for another person. If you have an elderly or incapacitated relative who needs you to manage their money, you can open a convenience account with them and act as their agent. The funds in the account belong to the owner. As the agent, you use the funds to pay the owner's bills and manage their transactions. After the owner's death, funds will be distributed according to their will. Creditors may be allowed to collect against the account. If you are the agent, your creditors may ask you to prove that you do not have ownership over the bank account.

Get a "joint tenants in common" account if one of you wants to will your money elsewhere. These are popular with couples and with business partners, but anyone can open them. You may divide your ownership equally or give one owner more responsibility and access. You will each be entitled to a predetermined percentage of the account. If one owner dies, an estate will distribute their share of the balance according to their will or trust. This type of account is subject to probate. If there's no will or trust, the funds of the deceased will be distributed to their closest relatives. Creditors may still collect against the entire account, however, even if one partner deposits more money.

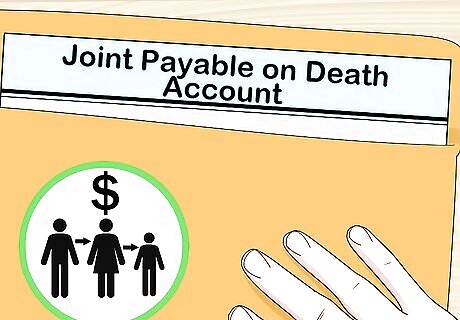

Get a "Joint POD/ITF" account if you both want to leave your money to another. A "joint payable-on-death" or "in-trust-for" account allows you to leave your money to a third party when you have both passed on. When one partner dies, the balance of the account belongs to the other owner. However, when that owner dies, the balance goes to a previously agreed upon beneficiary. This account is not subject to probate upon the death of an owner. Creditors will be able to collect against the account, no matter which one of you deposited the balance.

Create a joint bank account with Power of Attorney (POA). Meet with a lawyer to draft a financial POA, which gives a specified person permission to manage your finances. Whenever you go to the bank, take along a copy of the financial POA so your representative can handle your account without any issues.

Agreeing to Fair Use of Your Joint Banking Account

Agree how much you'll put in each month. Whether you are contributing equal or unequal amounts, you both need to know how much money to deposit each month. It's important for you both to be able to rely on the balance staying at a certain level, as you will both be liable for any overdraft fees. Consider depositing the same amount each month. Another way to be fair when incomes are different is to each deposit a set amount of the money you make each month. This only works as long as the balance remains above the minimum required. If this will be your only bank account, you will simply deposit all your money into it.

Decide what expenses you will pay from your joint banking account. Communicate openly, clearly, and frequently about what expenses may be paid from your bank account. Consider writing it down so that neither of you forgets. If one of you is in charge of bills, you may pay them all from the account. Cancel the joint account if one owner is using it for purchases that were not agreed upon, or switch to a "tenants by the entirety" account.

Protect your balance in case the relationship changes. If your relationship with the person who co-owns the account sours, contact the bank to make sure that neither of you can withdraw the money without consulting the other. Explain that you want to cancel the joint account mandate. If you have a "tenants by the entirety" account, you don't have to worry about this, as your account co-owner will not be able to withdraw any money without your permission.

Comments

0 comment