views

Gathering Required Information

Gather the required documents. In order to open a checking account, you generally need to present to the bank a copy of the death certificate as well as your legal appointment paperwork, e.g., a certificate of qualification or Letters Testamentary. You should gather these ahead of time before going to the bank.

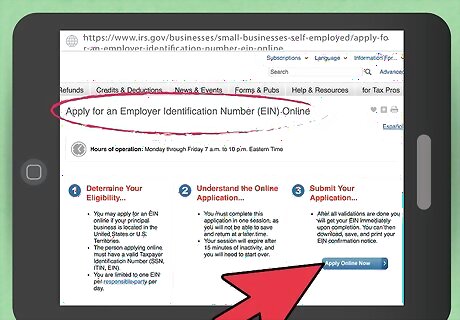

Get a taxpayer ID. You need a tax identification number from the Internal Revenue Service in order to open the bank account. The ID number should be for the estate. You can apply for this number by completing IRS Form SS-4, which is available at the agency’s website. You may also apply online by visiting the IRS website.

Think about alternatives to a checking account. Checking accounts are ideal if you think you can administer the estate in a year or less. Relatively simple estates often don’t need more time. However, if you think that it might take a year or more to administer the estate, then you could look into getting combined brokerage and cash accounts. Many different companies offer them, including Vanguard, Fidelity, Charles Schwab, and others.

Opening the Account

Find a bank in the right state. You might not live in the same state as the estate you are administering. For example, you might live in Missouri but the estate is in Arkansas. In this situation, you shouldn’t open a checking account in Missouri. Instead, you want to open the account in the state where the estate is located.

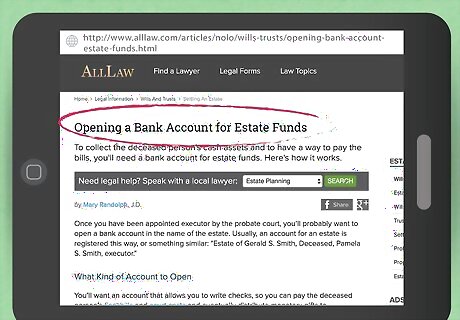

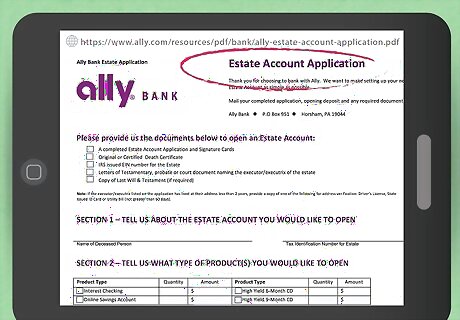

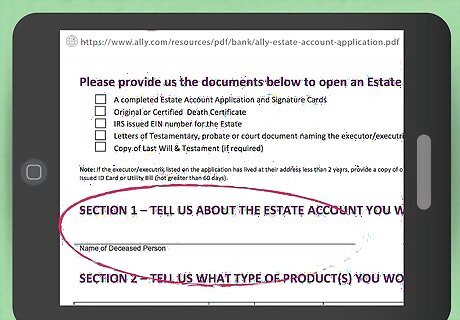

Open a checking account. Call up the bank and ask what paperwork you need to present. Tell the person you want to open an estate checking account. The bank should send you any forms you need to fill out ahead of time. Take everything with you to the bank and ask to open the account. You may have to fill out an application. There could be a minimum amount you need to deposit in order to open the account. If you don’t have any estate funds to open the account with, then you can open it with your own personal funds. As soon as you get estate funds, write a check to yourself in the amount of your initial deposit.

Create a name for the account. You shouldn’t put the account in your name. Instead, you can name it something like, “Estate of Joy A. Smith, Deceased, Michael B. Smith, executor.”

Using the Checking Account Appropriately

Transfer funds to the account. You can transfer the deceased’s bank accounts into the estate account, as well as other cash or checks made out to the deceased. Remember not to transfer the following: Joint tenancy accounts. For example, a joint savings account belongs to the joint owner. The deceased’s ownership interest disappeared at death. Payable on death accounts, such as life insurance proceeds. These go to the beneficiary named on the policy.

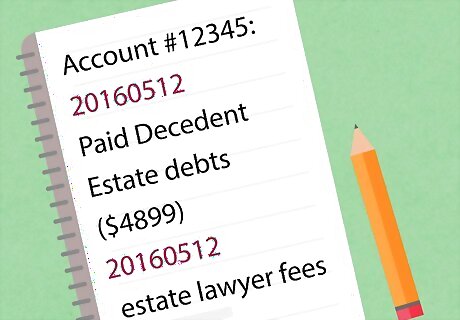

Use the account. You should use the account to deposit money paid into the estate. For example, businesses or individuals might have owed the deceased money. You can collect this money as part of your duties as the executor and deposit it into the checking account. You also will need to write checks to pay estate debts. Remember to keep detailed records of every transaction involving the checking account. Always note the payee, the amount paid, and the purpose of each check written. Also note the source and amount of each deposit into the account. You have to provide an accounting to the beneficiaries of all amounts deposited and spent.

Transfer surplus money out of the checking account. Money might pile up in the checking account as you begin collecting money owed to the estate. If you find that you have a lot more in the checking account than you need, you should think about transferring the surplus to a federally insured interest-bearing account. As the executor, you have a duty to the beneficiaries not to waste assets. Transferring a surplus to an interest-bearing account can help maintain the value of the estate. Don’t take surplus and invest it in stocks or other investments which could lose value. You have to manage the estate in a reasonable and prudent manner.

Avoid mixing personal and estate funds. One way to avoid accidentally mixing accounts is to make sure that your accounts are in separate banks. Although it might be more convenient to pen the estate checking account with your current bank, you might slip up and deposit estate assets in your personal account. You can avoid this by keeping accounts at different banks. If you accidentally need to use your personal checkbook to pay for estate business, then keep detailed records (and a receipt) before reimbursing yourself.

Comments

0 comment