views

Choosing Your Method of Payment

Identify your auto loan lender. If you got pre-approved for financing before you bought your car, the bank, credit union, or other lender who pre-approved your loan is your lender. Otherwise, your paperwork when you bought your car should list the name of your lender. Sometimes dealers finance vehicles directly. If you purchased a dealer-financed vehicle, you should have payment information included with the paperwork you received when you bought your car. If your dealer arranged financing through a third-party lender, you'll likely find their name on your bill of sale.

Consult your welcome letter for payment information. If your dealer arranged financing, your lender will typically send you a welcome letter within a couple of weeks after you complete the purchase. The welcome letter will include information on how to make your payments each month. If you don't receive a welcome letter, you should still be able to set up an account online to manage all of your loan information.Tip: Keep your welcome letter with your records as long as you have the loan. It provides important information that you might need to know, including the terms of your loan, the amount of your monthly payment, the interest rate, and the amount of any late fees or penalties.

Visit your lender's website to make online payments. Most lenders have an online payment option available through their website. Once you set up an account, you can go to the website each month to make your payment or sign up for automatic payments. Most lenders prefer a direct draft from your bank account. You will need your account number and your bank's routing number to set this up. These numbers are at the bottom of your personal checks. If you don't have personal checks, you can find this information on your bank's website. Some lenders allow you to make payments using a debit or credit card. However, before you set this up, make sure you won't be charged any extra fees. Debit or credit card payments also may take additional processing time.

Use the payment stub attached to your monthly statement. Most auto lenders no longer give out payment coupon books to make your monthly payments. Rather, there will be a payment stub attached to your monthly statement. If you prefer to send a physical check rather than paying online, detach the stub and mail it back to your lender along with your payment. If you don't have personal checks, you can also use a money order or cashier's check to make your payment through the mail. If you mail in your payment, make sure you mail it in plenty of time for it to get there before the due date or it might be considered late. Most auto lenders process payments as of the date they're received, not the postmark date on the envelope.

Make your payments in person for dealer-financed vehicles. If you bought your car at a "buy-here, pay-here" lot, you'll likely have to go to the dealer at least once a month to make your payment in person. Most dealers require you to make your payments either in cash or in certified funds (a cashier's check or money order). Some dealers may require you to make weekly or bi-weekly payments. If payments are scheduled more than once a month, this is typically based on how often you get paid. For example, if you get paid every other week, the dealer may expect you to make a car payment every payday instead of just once a month.Warning: Dealer-financed cars can be tempting if you have poor credit, but they may end up costing you more in interest and may not do anything to help improve your credit. Read the terms of the loan carefully before using this method of financing.

Paying Your Loan Off Early

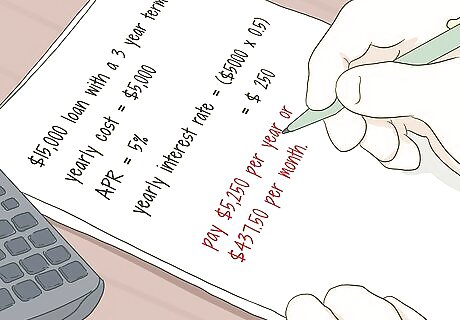

Determine how interest is computed on your loan. Most car loans are simple-interest loans, which means you'll pay less interest if you pay your loan off early. However, if the interest on your loan is fixed from the start of the loan, you'll still pay the same amount of money regardless of when you pay off the loan. If your car loan has fixed interest, you may be better off simply making the monthly payments on time through the end of the loan — especially if those on-time payments are reported on your credit report. If you have extra money to put toward the loan, deposit it in a savings account instead so you can earn interest off of that money in the meantime. To find out how interest is computed on your loan, check the welcome letter you got from the lender when you bought your car. You can also find this information on your online account or by calling your lender's customer service number. Beth Kobliner Beth Kobliner, Personal Finance Journalist When financing a car, opt for the shortest loan term you can afford to pay off the principal faster and minimize interest charges. Make payments on time every month to avoid late fees and credit damage.

Make 2 payments each month if you don't have extra cash. Even if you don't have extra funds each month, you can still pay off your car loan early by splitting your monthly payment into 2 payments. If you have a simple-interest loan, you'll pay less in interest than you would if you only made a single payment. Making a half-payment every 2 weeks equates to 26 payments in total, or 13 monthly payments a year. For example, if you have a 60-month loan for $10,000, you'll pay off your loan in 54 months instead of 60. You'll also save a little on your interest, depending on the rate. Contact your lender and make sure they'll allow you to do this. Most lenders will allow you to make payments for smaller than the payment amount online, provided you make them before the due date for the regular monthly payment.Tip: If you get paid every 2 weeks, splitting up your car payment like this can also be easier to budget.

Round up your car payment to the nearest $50. You'll pay off your car loan more quickly if you're able to make more than the payment due. Think of your monthly payment as a minimum payment, and round it up when you can. For example, if your car payment is $215 a month, you would pay $250 a month instead. Depending on the interest rate and the total amount you financed, you could end up paying off your loan up to a year early, saving hundreds in interest.Tip: If you plan on making incremental extra payments to pay your loan off early, call your lender and make sure the extra payments are going to your principal, not interest.

Get a payoff quote and make a lump-sum payment. If you know you're close to paying your car off and you have a little extra cash, contact your lender for a payoff quote. This amount will be less than the amount you owe since that amount tells you what you would pay if you paid through the end of the loan. For example, if you recently got a tax return, you might decide to use that money to pay off your car. Even if you can't pay it off in full, you can still make a large lump-sum payment that would decrease the amount you paid in interest and help you pay off your loan earlier. Payoff quotes are typically only good for 30 days, or until the date your next monthly payment is due, so don't request one until you're ready to make a lump-sum payment.

Use certified funds for your final payment. When you make your final payment on your car loan, your lender will release the lien on your title and send the title to you. Sending your payment in certified funds, such as with a cashier's check or money order, ensures you'll get your title as soon as possible. On the memo line of the cashier's check or money order, write "payment in full" or "final payment" along with the account number for your loan. Getting a cashier's check or money order also provides you with physical proof of payment.

Refinancing Your Loan

Contact your lender as soon as possible. If you're having difficulty making your car payments, call your lender's customer service number immediately. You'll have more options available if you talk to them before you've missed a payment. If you're already behind a couple of payments, it may be too late to refinance your loan. Most car lenders don't refinance car loans themselves. However, they may be able to change your due date or spread out your payments. That would give you a lower payment each month. However, it would take you longer to pay off your loan. Working out something with your current lender is a good idea if you're facing a temporary financial hardship but know your situation will improve within a few months.

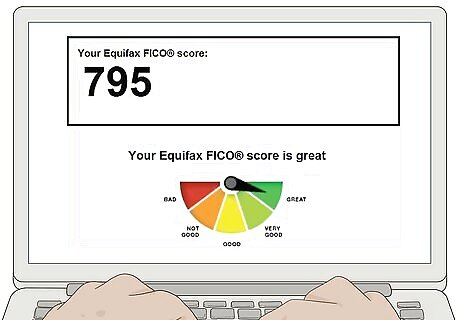

Check your credit score. Your ability to refinance your car loan depends on your credit score. While you're entitled to a free credit report from each of the 3 main bureaus each year, that free credit report does not include your credit score. To get your credit score, you'll have to work with Equifax, Experian, or TransUnion directly. Free websites or smartphone apps such as WalletHub, CreditKarma, and CreditSesame provide you with access to your credit score for free. While your true FICO score might be a few points higher or lower than the score provided on these websites, they can give you a good idea of what your credit score is without costing you any money.Tip: Refinancing is more likely to help you if your credit score has improved significantly since you first took out your car loan.

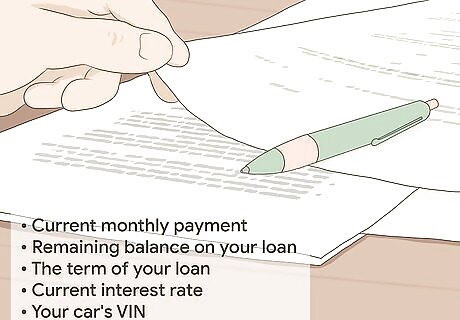

Gather information about your current loan. To apply for refinancing, you'll need to provide some basic information about the loan you currently have. Much of this information will be included in the welcome letter you got when you bought your car. You can also find it through your account on your lender's website. Some of the information you'll need includes: Your current monthly payment and the remaining balance on your loan The term of your loan (total time you have to repay the loan in months) Your current interest rate Your car's VINTip: Some car loan refinance companies also want you to get a payoff quote from your current lender since you'll be paying off your current loan with the new loan.

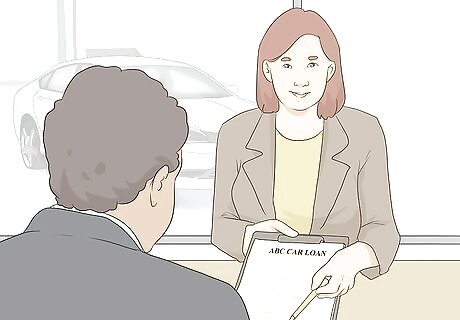

Apply with several car loan refinance companies. Look up car loan refinance companies online and read about the types of loans they offer. Most companies also give information about their minimum credit score requirements, which can help you narrow down your choices. Free credit report websites often have tools that will help you find car loan refinance companies and compare rates before you apply. They may even analyze how likely you are to be approved, given your current credit score and credit history. Typically, you can do a "pre-approval" application that only does a soft-pull on your credit.

Compare offers to your current loan. If you're pre-approved to have your car loan refinanced, the refinance companies will give you terms and interest rates. If you can't find an interest rate that is lower than the one you currently pay on your car loan, it probably doesn't make sense to refinance the loan, even if you're paying a lower monthly payment. You also want to look at the length of time you'll have to make payments if you refinance. Think about this term compared to the age of your car and what its value will likely be at the end of the term. If your car is worth less than you'd be paying to refinance it, the refinance is probably not worth it.

Complete the paperwork to refinance your car. If you've found a refinance offer that you like and that offers you savings over your current loan, contact that lender to complete the transaction. That lender will likely have paperwork for you to fill out and sign. Typically, you can complete this paperwork online. If you're refinancing through a bank or credit union, you may need to visit a branch in person to finalize the loan. Once your car is refinanced, your original lender will remove their lien off of your title and send the title to the company that's refinancing your car. You should get a letter in the mail stating that the lien has been removed. Keep this letter for your records.

Comments

0 comment