views

Reporting Identity Theft to Local Police

Complete an identity theft report with the Federal Trade Commission (FTC). Go to https://www.identitytheft.gov or call 1-877-438-4338 to file an identity theft report with the FTC. This report will help you organize your information. Once you complete the report online, the FTC will give you a step-by-step recovery plan and checklist based on the information you provided. You can provide the report to local police, and it will help them with details as they prepare the local police report for you.

Gather documents to support your claim. If you have evidence of the identity theft on bank account or credit card statements, or on your credit report, print these out to provide to the police. If you received any email notifications or other information from your bank or credit card company, print off copies of those as well. You also may have bills or collection notices that include charges you didn't make.

Visit your local police station. You may be able to file a police report online or over the phone. However, when you're reporting identity theft, it's typically better to go to the police station and talk to an officer in person. If you have documents you've gathered with evidence of the identity theft, bring copies of these along with you. You also want to bring documents that will prove your identity and address. In addition to a driver's license or other government-issued ID, you may want to bring along your birth certificate or Social Security card. Use utility bills to prove your address.

Talk to an officer. At the police station, tell the desk officer that you want to file a police report for identity theft. They may take basic information from you or give you some paperwork to complete while you wait for an officer. Some local police may be reluctant to take your report, or may insist that identity theft is not a local matter. If this happens, ask to speak to their supervisor. Keep going up the chain of command until you find someone willing to take your report. Give the officer as many specific details and information as you know. For example, if a credit card number was stolen, you need to be able to tell the officer all of the places where you recently used that card. You can get this information from an up-to-date credit card statement or from the transaction report on your online account.

Get a copy of the completed report. After you've spoken to an officer, they may give you the written report immediately. You also may have to wait a couple days for the written report to be generated. If you don't get a copy of the written report immediately, get the report number and keep it somewhere safe. You'll need the report number to get a copy of the report later, or if you need to provide additional information.

Follow up with additional information. After you file your police report, you may become aware of additional charges or other activity on your credit report related to the initial identity theft. Providing this information to the police can help them in their investigation. Call the police station and find out the name of the officer who has been assigned to your case. Get a direct number for that officer, if possible, so you can contact them when you need to update your report.

Replacing Lost or Stolen Identification

Contact all agencies that issued you photo identification. Your identity may be stolen if your wallet or purse is taken from you, or if you lose them. To replace photo identification, contact the department of motor vehicles or any other agency, such as a school or place of employment, that issued you identification. If your license was stolen, you want to have another license number issued for your name as soon as possible and have the other one cancelled. That way the thief won't be able to use that information to get credit or take other actions using your identification. A work or school ID that provided you with access also should be replaced as soon as possible, before the thief can use them.

Gather other documentation to prove your identity. If your driver's license or other photo ID is lost or stolen, you must rely on other documents to prove who you are. These could include your birth certificate, Social Security card, or passport. It may also be a good idea to take along a copy of your police report or FTC identity theft report. You also may need to prove your place of residence. Contact the department of motor vehicles or other agency to find out what documents are acceptable to prove your residency. For example, a utility bill with your name and address on it may be sufficient. A mortgage statement or copy of your lease agreement is also typically acceptable.

Calculate the fees for ID replacement. You may have to pay to have your identification cards replaced. Find out in advance how much it will cost to replace everything you have to replace, so you have a total for budgeting purposes. You typically won't have to pay any fees to replace some identification, such as your work ID. However, you will have to pay a replacement fee for any government-issued ID, such as your driver's license.

Apply for a replacement license. You'll have to fill out an application form to replace your license or other photo identification. When you complete the form and pay any fees, you'll receive your new license. You may want to call ahead and make an appointment to decrease your wait time, especially if you live in a more populated area. You also may need to get a new photo taken, especially if you're requesting a different license number.

Protecting Your Identity

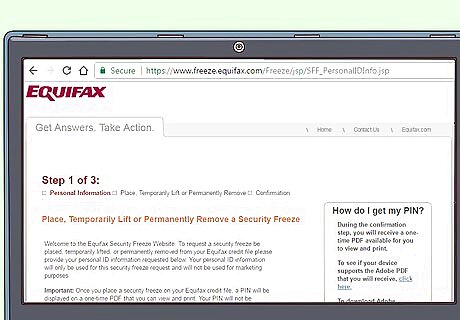

Put a fraud alert or freeze on your credit reports. A fraud alert advises potential creditors to take additional steps to verify your identity before issuing credit in your name. A freeze prevents any additional credit accounts from being opened. Getting a fraud alert is a relatively simple process and is free of charge. Requesting one from any of the 3 credit bureaus means the alert will automatically be placed on all of your credit reports. A credit freeze must be done through each of the 3 credit bureaus separately. Although you typically have to pay a fee, that fee may be waived if you provide a copy of your police report to show you are a victim of identity theft. If the thief has already attempted to open new credit accounts in your name, a freeze may offer you more protection than a fraud alert.

Close all accounts that have been accessed. When you find out a particular account has been accessed by an identity thief, take action immediately to shut down that account so that they can't access it again. Contact the bank or lender and let them know that you are a victim of identity theft. Request that your account be locked or closed. They also may issue you new debit or credit cards, or a new account number. Some banks and lenders require a copy of your police report if you want to take other actions, such as disputing fraudulent charges.

Put your name on your state's identity theft database. Some states, including California, have identity theft databases. These databases protect you if someone who stole your identity commits a crime in your name. Once your identity is confirmed, your name in the database alerts law enforcement agencies and others doing a background check that you were not responsible for the crime committed. Law enforcement agencies serving warrants will take additional steps to verify your identity.

Change your passwords and PINs. If you believe your identity was stolen as the result of a hack or an online transaction, immediately create new passwords for all of your financial accounts online. Choose a secure password that's completely unlike the one you used before. Use a random combination of letters, numbers, and special characters (if possible) that isn't easy to guess.

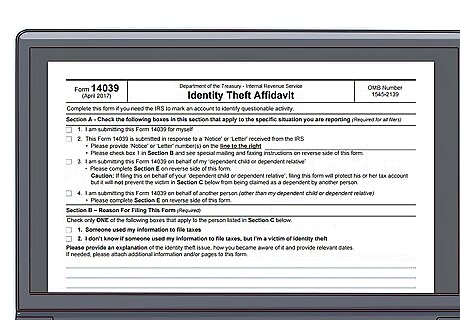

Report potential tax identity theft to the IRS. If your Social Security number has been compromised or stolen, the thief can use it to get a job or tax refund. You will get a notice from the IRS if two returns are filed under your Social Security number, which indicates potential tax identity theft. Go to https://www.irs.gov/pub/irs-pdf/f14039.pdf to download IRS Form 14039, the IRS's Identity Theft Affidavit. Fill it out and follow the instructions on the form to submit it to the IRS. Continue to file your own taxes as you normally would.

Contact your state consumer protection office. Your state's consumer protection office, typically part of your state's Secretary of State office, has resources that can help you dispute transactions, deal with creditors, and recover from identity theft. Start by looking up the website to read about the resources and information available. You can find it by searching for the Secretary of State's website. It typically will have a link to the department or office dedicated to consumer protection.

Comments

0 comment