views

X

Research source

Pawn shops are also a great place to buy used goods for a cheaper price. Some pawn shops sell items for up to 70 percent cheaper than retail prices. Learning how to make a transaction with a pawn shop can get you fast cash, a temporary loan, or just a bargain purchase.

Getting Cash From a Pawn Shop

Find valuable items. Before you can go to a pawn shop to get cash, you'll need to find and gather valuable items in your home. Some experts recommend checking the quality of certain items at home to ensure that only high-quality items are brought in. If bringing in glass items, look for brand names like Baccarat and Limoge as a good indication of the item's value. Jewelry that is stamped with "HGE" (heavy gold electroplate), "GP" (gold plated), or "RPG" (rolled gold plated) is virtually worthless in a pawn transaction. These pieces of jewelry are typically a baser metal coated with a thin plate to look more valuable. Look for jewelry stamped with "750," "750/1000," "PT," or "18k." These indicate that the items are 18 karat gold or platinum, which means they will fetch a high price at a pawn shop. Be sure to make your item look as appealing as possible. This may entail a simple dusting, or polishing off the tarnish on a piece of jewelry. Think about how the item would look to a consumer - if you were thinking of buying that item, would it look appealing in its current state?

Decide between pawning and selling. Your transaction doesn't necessarily have to end when you walk out of the pawn shop. Pawn shops typically let you either sell an item outright, or pawn the item. Pawning an item means that you leave that item in the store's care in exchange for a short-term loan. If you pay off the loan plus its accrued interest by a predetermined date, you can get your item back. If not, the item becomes the store's property, and the owner of that pawn shop can sell your item to the public. The typical time span of a pawn shop loan is between 90 and 120 days. After that point, the item becomes the legal property of the pawn shop owner. The interest rates and fees applied to your loan are generally regulated by the state in which that pawn shop operates.

Research your item(s). Before you hand over your valuables to pawn or sell at a pawn shop, it's important to know the actual value of that item. Pawn shop proprietors will typically try to cut you down to the lowest possible price when you pawn or sell an item, so you'll need to know the value of each item beforehand. Consider having your items appraised by a professional. Having a jeweler's (for example) written appraisal may help you bargain for a better deal on your items at the pawn shop. Don't expect to get the full value. Pawn shops are in the business to make money, so you will never get the resale value of your items at a pawn shop. Typically you can expect to get somewhere between 30 and 60 percent of the value of your items. Consider selling your items online instead. There are numerous online pawn shops, as well as online bidding sites like ebay. These options can fetch a higher price for your goods, but the downside is that you will not walk away with cash in-hand the same day like you would with a pawn shop.

Look for the best pawn shop. Every pawn shop is different. Some shop owners will be more understanding and willing to work with customers than other shop owners. Rather than blindly walking into the nearest pawn shop, it's worth your time and effort to research a number of pawn shops in your area to find one where you'll have a better experience. Some pawn shops specialize in certain goods, like antiques or electronics. You might have better luck selling/pawning with one of these specialized locations instead of a general pawn shop. Read customer reviews online. By searching around and comparing reviews, you'll get a fairly decent feel for how honest, helpful, and fair a given pawn shop is. Look for pawn shops that have been around for several years or that operate out of multiple locations. If the pawnshop is a so-called fly-by-night operation and closes its doors before you're through with your loan terms, you may be out of luck.

Ask the proprietor for details. Once you've chosen a pawn shop and walked in through the door, you'll want to ask the store's owner or operator some basic questions about how your pawn or sale will go. You should certainly ask about the price, of course, but there are other things to consider as well. Some good questions to ask include: What is the monthly interest rate? What additional fees (ticket fee, storage fee, lost receipt fee, etc.) are imposed by the store? Do you have insurance for items that are lost or stolen from the store? (Your copy of the paperwork you sign should detail the store's insurance policy, if any. Read it through before you sign and make sure it matches what the store operator has told you about their insurance policies.) Do you require any necessary documentation? (Pawn shop laws vary from state to state, but all shops are legally obligated to require at least proper identification from a pawner/seller. If they don't, you're probably in a shop that you don't want to do business with.) Where will you keep my items? (Small items like jewelry can easily be kept behind the counter, but bigger items like a boat or appliance may require outside storage. Make sure that your items will be kept in an insured, climate-controlled warehouse that won't expose your items to the elements.) Will you send me notifications/reminders that a payment will be due soon?

Know when to walk away. If the pawn shop seems to operate with questionable business practices, offers you an unreasonably low payment, or has unfair loan terms, simply walk away. You have every right to turn down their offer. If you're walking away over the sum of money they're offering you, it may even convince the proprietor to make you a better offer. If you're walking away because of unfair terms or questionable business practices, do not change your mind no matter how much money the proprietor offers you. You're better off going elsewhere and finding a more trustworthy place to do business with.

Pay your loan off on time. If you pawned your item in exchange for a loan, you'll have a certain agreed-upon time frame in which to pay back the loan, plus interest and fees. Make sure that you keep track of when your payments are due (not all pawn shops offer reminders, though some do send notifications by mail), as well as how much you'll owe after interest and fees. If you can pay everything back, you should be able to walk away with your valuable item in-hand once again.

Buying From a Pawn Shop

Research pawn shops online. Researching a given pawn shop for online customer reviews is just as important for a buyer as it is for a seller. You want to ensure that you're getting a reasonable deal, but you also want to ensure that the item you're buying matches the level of quality and performance you'd expect from such a purchase. If people say that items break fairly quickly after purchase, are badly damaged, or are simply overpriced, it's best to keep looking.

Know what you want. Before you wander into a pawn shop, it's best to know what you're looking for and what that item typically retails for. Be aware of the item's condition when you view it in-store, as this may significantly change the value of that item.

Negotiate for a better deal. Most pawn shops are willing to negotiate on the sale price of an item. However, the actual cost you end up paying will depend on the pawn shop owner/operator, the item's condition, and how long the item has been in the store. Items that have been on the shelf for a long period of time are typically more negotiable. The store's operator knows that regular visitors will recognize that certain items aren't moving and may be willing to offer some kind of deal. Know your limit. If you absolutely know that you are being ripped off, it's not worth it no matter how much you might like to own it.

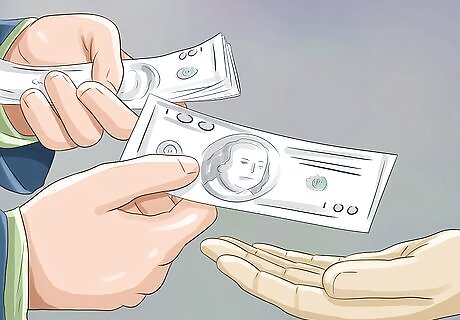

Bring cash. Paying in cash has numerous benefits for you as a consumer. It can help ensure that you stay within your budget, reduce the chances of credit card debt, and get you a better deal. Many pawn shop owners are more willing to negotiate with someone paying cash instead of with a credit card, as cash signifies a budget on the consumer's part and a guaranteed payment for the proprietor.

Don't be afraid to walk away. Don't forget that as a consumer, you have the ultimate last word. If you're not being offered a fair deal, or if you can tell the items are of poor quality, just walk away. It might get you a better offer from the proprietor, or at the very least it will ensure that you don't get ripped off.

Comments

0 comment