views

Determine How the Value of the Estate is Calculated

Select the date of calculation for a living person’s estate. The value of assets, such as a house or car can go up and down over time, so when calculating the value of an estate you need to give a specific date that you are using. Items are valued according to a fair market value, which may be higher or lower than the price originally paid. If you are calculating the value of a living person’s estate, you may choose any date of calculation you wish.

Choose a date of calculation for a decedent’s estate. If the estate you are valuing is that of somebody who has died, a decedent, you may choose to use the date of death for the calculation. Alternatively, you can use the date six months after the date of death as the date of calculation. The date six months after the date of death is referred to as the "alternate valuation date." If you select the date of death, value all assets at that date. If the “alternate valuation date” is selected, and any asset is sold or distributed during the first six months following the date of death, the estate's assets are valued in one of two ways. Either, all assets not sold or distributed during the six months after the date of death are valued as of the alternate date. Or alternatively, all assets sold or distributed within the six months after the date of death are valued as of the date of sale or distribution.

Determine assets that contribute to the value of the estate. Estate taxes are imposed on what is known as a person’s gross estate, before some reductions are allowed, and you reach your “taxable estate.” You need to get a clear picture of what assets are included in your gross estate in order to be able to calculate its value. Your gross estate equals everything the estate holder owns or has certain interests in. This includes real estate, mortgages, and any jointly owned property or property which the estate holder retained a significant interest in. It also includes the value of bank accounts, pensions, savings and life insurance policies.

Gather all financial account statements as of the date of calculation. Financial accounts include bank or credit union checking, savings, and CD accounts, retirement accounts, such as 401(k) and 403(b) accounts, certain annuities payable to your estate or to your heirs, and all stocks, bonds, and mutual funds. Only annuities receivable by a beneficiary, by reason of surviving the decedent, under certain agreements or plans, should be included in the valuation of the estate. For more information on which annuities this includes, consult a tax or estate attorney or a certified public accountant.

Calculating the Value of the Estate

Determine the value of financial accounts. To calculate the gross estate you need to add together the values of all the component parts. Start by determining the value of the financial accounts that are attributable to the estate. In some instances, the entire balance of a financial account may not be attributable to the estate. To decide what part of any financial account is attributable to the estate, follow these guidelines: If the account is owned individually, the entirety of its value should be attributed to the estate. If the account is owned jointly with a spouse with rights of survivorship, 50% of its value should be attributed to the estate. If the account is owned jointly with any party who has rights of survivorship, other than a spouse, 100% of its value should be attributed to the estate. This may be altered if you can prove that the other party contributed more than half of the value to the account. If you are in any doubt or uncertainty, hire a qualified expert in estate planning and law to help you determine what is attributable to the estate.

Calculate the value of all real property as of the date of calculation. Real property is real estate owned by the decedent or the living person whose estate value you are calculating, and includes home, business, or rental property. The Internal Revenue Service, and most state’s departments of revenue, require real property values to be determined by a licensed appraiser for tax purposes. If there is an outstanding mortgage on the property, that is deductible as part of the decedent’s debt. If the decedent was contracted to buy real property and died before the deal was closed, that property can be included subject to the contract.

Include jointly owned property. If the decedent owned a property as a joint tenant with rights of survivorship, in most instances the full value of the property will be included in the estate. If the surviving tenant wishes to purchase the house in full, the full inclusion can be reduced by the amount he contributed to the purchase. For example, two men, John and Michael, bought a property together for $500,000 with John contributing $300,000 and Michael $200,000. If John died, the full $500,000 would be included in his estate, but if Michael can prove he paid $200,000, only the remaining $300,000 would be included in John’s estate. If the other owner is the spouse, only 50% of the property is included in the gross estate regardless of how much each person contributed.

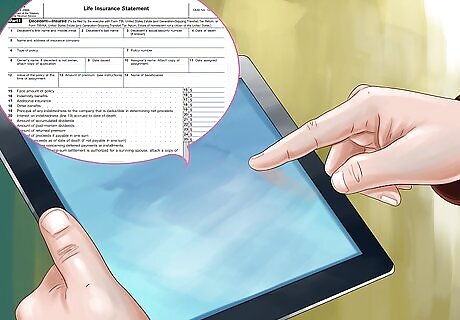

Calculate the value of life insurance policies. Life insurance policies are included in the gross estate if the decedent’s estate is the beneficiary of the policy, They are also included if the beneficiary is legally obliged to use the proceeds of the policy for benefit of the estate. Regardless of who owns the policies, if they are payable to the estate they will be included. The policies are also included if the decedent possessed any “incidents of ownership” which could have been exercised at the time of death. In order to calculate the value of a policy for estate tax purposes, use Internal Revenue Service Form 712, located on the IRS’s website at http://www.irs.gov/pub/irs-pdf/f712.pdf. You can use the fair market value of the policy if you are calculating the value of the estate for estimation purposes only. Life insurance paid to a named beneficiary (excluding estate) is not included in estate value.

Determine the value of all other property attributable to the estate. Other than financial and property assets, numerous other things are included in the calculation of the value of the estate. One of the most valuable of these is likely to be any vehicles which are attributable to the estate. Often you can use the value listed in Kelly Blue Book (“the Blue Book”) for vehicles. As with other assets, that percentage of the value of the vehicle included in the estate can vary depending on joint or single ownership. If the property is owned individually, all of its value should be attributed to the estate. If the property is owned jointly with a spouse, with rights of survivorship, half of its value will be attributed to the estate. This property could include things such as household furnishings, artworks and annuities.

Calculate all allowable deductions. Once you calculated the value of the components of the gross estate, you need to take account of the allowable deductions used in determining the taxable estate. These deductions include the debts owed by reason of the decedent’s death, which includes funeral expenses, as well as attorney and court fees, and any other fees associated with the administration of the estate. The deductions also include: Debts owed at the time of death, or as of the date of calculation. This includes all utilities, credit card accounts, loans, mortgages, medical bills and expenses, and any other accounts due or incurred before the date of death or date of calculation. Any charitable deduction. Generally, this is the value of any property that passes from the estate to the United States, any state, a political subdivision of a state, or to any qualifying charity for exclusively charitable purposes. The state death tax deduction. This includes any estate, inheritance, legacy, or succession taxes paid as the result of the decedent's death to any state.

Calculate the total taxable estate. Do this by adding together the value of all assets attributable to the estate, and then subtracting the total allowed deductions. This can give you an approximation of the value of the estate, but it is advisable to work with an estate attorney to ensure you have covered everything. Any mistakes can be time consuming and potentially costly to rectify. A good estate attorney will help you plan ahead, and enact as much control over your estate as possible.

Comments

0 comment