views

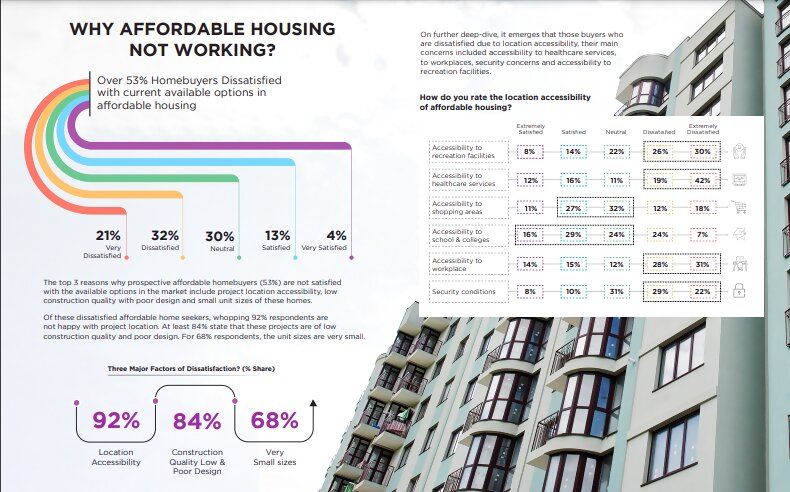

Demand for affordable homes has nosedived since Covid-19, initially because this segment’s target clientele was financially impacted by the pandemic. However, the Anarock -FICCI Homebuyer Sentiment Survey – H1 2024 has identified other pain points. At least 53% of homebuyers are dissatisfied with the currently available options in this vital segment across cities.

Declining Demand for Affordable Housing

Declining demand for affordable housing has had a cascading impact on its supply in the last year. Anarock data highlights the shrinking supply of affordable housing in major cities, dropping from 26% of total launches in 2021 to just 17% by 9M in 2024. Before the pandemic in 2019, affordable homes made up 40% of new projects.

Reasons for Disenchantment with Affordable Housing

Anuj Puri, Chairman of Anarock Group, explained the top reasons for the disenchantment of prospective affordable homebuyers. The major issues include:

- Poor project location accessibility: 92% of dissatisfied buyers identified project location as their biggest concern.

- Low construction quality and poor design: 84% of respondents cited this as a deterrent.

- Constricted unit sizes: 68% of buyers found the available unit sizes unattractive

“The top three reasons why prospective affordable homebuyers’ disenchantment with the currently available affordable housing supply are bad project location accessibility, questionable construction quality and poor design, and constricted unit sizes,” Puri said.

Of the dissatisfied affordable home seekers polled in the survey, a whopping 92% of respondents identify project location as the biggest grouse, while 84% state low construction quality and inferior design elements as major deterrents. 68% of respondents find the available unit sizes too small to be attractive.

Preference for Bigger Homes

“Bigger homes continue to dominate buyer preferences despite spiralling prices in the last one year,” added Puri.

“Over 51% of the current survey respondents prefer 3BHK units and just 39% will settle for 2BHK options. City-wise analysis indicates that the demand for 3BHKs is particularly high in Chennai, Hyderabad, Delhi-NCR, and Bengaluru, where over 50% of respondents prefer it over other flat sizes. Conversely, over 40% of participants in Kolkata, MMR and Pune name 2BHKs as their preferred option.”

Patience is the New Black

In terms of preferred stages of construction, the H1 2024 survey shows a significant trend reversal. The demand ratio of ready-to-move-in homes to new launches now stands at 20:25. In H1 2020, the RTM-to-new launches demand ratio was 46:18.

One major reason for this shift is that most homebuyers favour projects by large and listed developers, who they are confident will deliver their homes on time.

Investors Seek Steady Rental Income

Another key highlight of the H1 2024 survey is that at least 57% of residential real estate investors are focused on steady rental income. This is far from surprising since there has been a remarkable surge in rental rates across cities in the last two years (over 70% in prominent micro markets). Rental earning potential has therefore taken centre stage as an investment motivator.

While interest in the currently available affordable housing supply continues to decline, premium and luxury homes continue to dominate demand – at least 45% of survey respondents now prefer homes priced >Rs 90 lakh. In the survey’s pre-Covid 2019 edition, just 27% of respondents were interested in properties in or above this price bracket.

The Plot Thickens

The latest survey also identifies a growing preference for residential plots, which 20% of property seekers name as desirable options across cities. City-wise data highlights that this preference is most pronounced in the major Southern cities – 30% of buyers in Chennai prefer it, 29% in Bengaluru, and 27% in Hyderabad. Several large and branded developers have launched residential plot projects in these cities over the last few years and continue to find ready-takers.

Villas and row houses are also markedly in demand in these southern cities. Contrastingly, more than 70% of survey participants in MMR, NCR and Pune prefer apartments.

Other Survey Highlights

- Real estate is the most preferred asset class for investment for over 59% of respondents, up 2% from the previous survey

- 66% of millennials & 42% of Gen-X respondents will use their investment gains to purchase a home in the future

- Over 67% of buyers seeking property for end-use vs 64% in H2 2023 survey

- Top homebuyer demands today include timely project completion assurance, construction quality improvement/assurance, and well-ventilated homes.

Comments

0 comment