views

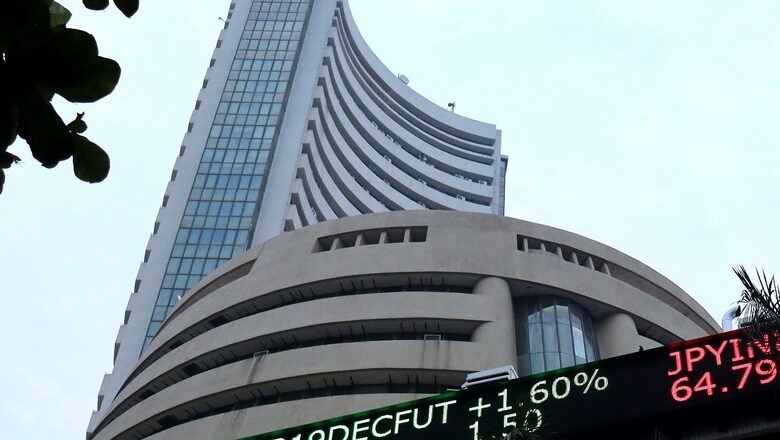

The benchmark BSE Sensex closed in the green at 55,949.10, up 4.89 points or 0.01 per cent. While the blue-chip NSE Nifty50 too ended in the positive territory at 16,636.90, up 2.20 points or 0.01 per cent. Britannia Industries, Tata Consumer Products, HDFC Life, BPCL and Reliance Industries were the top Nifty gainers. Bharti Airtel, JSW Steel, Maruti Suzuki, Hindalco Industries and Power Grid were among the top losers.

“Indian markets started flat to marginally negative following negative Asian market cues as South Korea’s central bank hiked interest rates, making it the first developed economy to do so in the pandemic era. During the afternoon session markets attempted a comeback to trade in positive buying in blue chip stocks from across various sectors. Sentiments were positive with private report stating that the Indian economic growth likely to touch record high in the quarter through June, reflecting a very weak base last year and a rebound in consumer spending. However, markets trimmed their gains in closing session as report from rating agency Moody’s stating that the India’s second Coronavirus (Covid-19) wave is increasing asset risks for banks in retail and the SME loan segment,” Narendra Solanki, head- equity research (Fundamental), Anand Rathi Shares & Stock Brokers said.

Among sectors, metal index shed over 1 percent, while selling was also seen in the auto, pharma and PSU banking stocks. However, FMCG, oil & gas, realty and power indices ended in the green. BSE midcap and smallcap indices added 0.3 percent each.

India’s Volatility gauge India Vix edges higher by 0.29% to 13.54.

“After opening in red, the benchmark index continued to trade in a narrow range with a positive bias ahead of the expiry of the August series. Although, the losses were capped in the indices amid the gains in heavyweight Reliance Industries & IT, FMCG counters on the expiry day. Consequently, the Nifty index closed flat at 16633.50 levels while Bank Nifty settled at 35617.55 levels with a marginal gain of 31 points. The broader market remained mixed wherein Small Cap & Mid Cap indices ended with gains of 0.3. All the key indicators are supporting the positive trend in the index,”Mohit Nigam, head – PMS, Hem Securities said.

The BSE Sensex and Nifty50, both in early trade, opened on a choppy note amid weak market cues. The Benchmark BSE Sensex opened at 55,988, down 44,2 points or 0.08 percent while the Nifty50 index opened at 16,627.95, down 6.70 points, or 0.04 percent. Broader markets, midcap and smallcap indices opened higher.

“China and US along with the fear of rise in the Delta variant capped the gains in the Asian market. Investors globally are awaiting the Fed Reserve’s Jackson Hole Economic Symposium on Friday to gain insights on asset tapering plans and economic outlook, “ Vinod Nair, head of Research at Geojit Financial services said.

On Thursday, Asian stock markets also behaved in a mixed manner, as they await more clarity on Federal Reserve’s tapering of stimulus and regulatory outlook in China.

The S&P 500 and Nasdaq set another record yesterday. Among emerging markets in Asia Japan’s Nikkei gained 0.04%, Korea’s Kopsi was little affected by the central bank hike, falling 0.31%, Hong Kong’s Hang Seng index ends down 0.13%, China’s Enterprises index HSCE falls 0.25% on Thursday. At 0707 IST, Nifty future was trading at 16,650, down 30 points or 0.18 per cent. The Chinese ban on private industries is still weighing on the equity markets across the globe.

Now, at close, all eyes are on the GDP data that will be released on August 31, clarity on regulatory outlook in China, clarity on US Fed’s tapering of $120 billion of asset purchase that can come tomorrow from Jackson Hole Symposium.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment