views

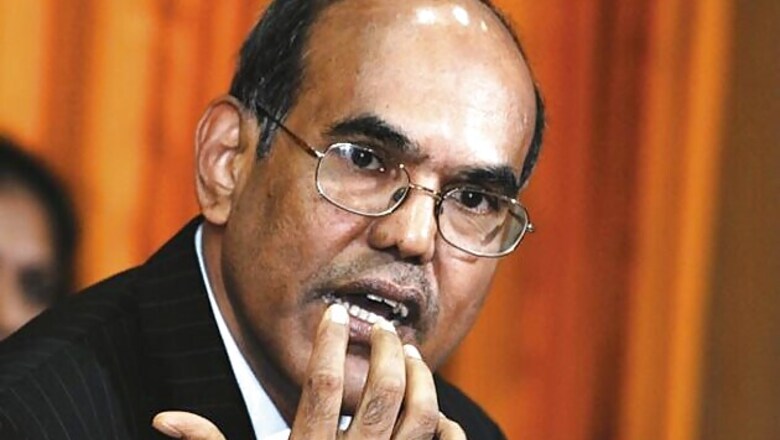

Hyderabad: Ruling out a repeat of 1991 crisis situation in 2012, RBI Governor D Subbarao on Wednesday said the current economic situation is different from what it was two decades ago as rupee is market-determined, forex reserves is good and financial markets are "resilient".

Unlike 1991, the rupee's exchange rate is market determined "which is our great strength", he said.

India now has a $ 280 billion foreign exchange reserves and financial markets are resilient and robust, he added.

These are the reasons "we will not have a crisis of 1991 type," Subbarao said.

"It is highly improbable we will have a 1991 crisis but I'm not saying we have no problems. There is quite a lot of development in the macro-economic sector," he added.

"Today people ask me is 2012 a repeat of 1991, my answer is no... 2012 is not a repeat of 1991 because today we are in different sort of economy," Subbarao said delivering the K Obayya Memorial Lecture.

After expanding by 8.4 per cent for two consecutive financial years, the GDP slumped to 6.5 per cent in 2011-12.

The country is now also grappling with high inflation, slowing industrial growth, sliding rupee and declining exports.

On current account deficit, Subbarao said, "We want capital inflows to fill the deficit... But how much capital flows we want? Ideally we want just enough capital flow to finance our current account deficit. Not too much, not too little..."

India's current account deficit in 2011-12 is estimated at about 4 per cent of the GDP, up from 2.7 per cent in the previous year.

Talking about the banking system, Subbaro said, "Making banks safe is good, making banks safe is also costly. We can ask banks to be safe by holding a lot of capital and a lot of reserves, so that all our money is safe."

If banks give 4 per cent on savings bank accounts and if I regulate too much, they will give only 2 per cent, he said, adding that it is important to be mindful of the costs and benefits of regulation.

Comments

0 comment