views

Mumbai: The RBI on Wednesday expectedly kept interest rates unchanged on concerns of a possible price rise but left the door ajar for a rate cut in future.

It also retained the economic growth estimates for the current fiscal at 6.7 percent, while raising inflation target marginally at the upper end to 4.7 per cent by March.

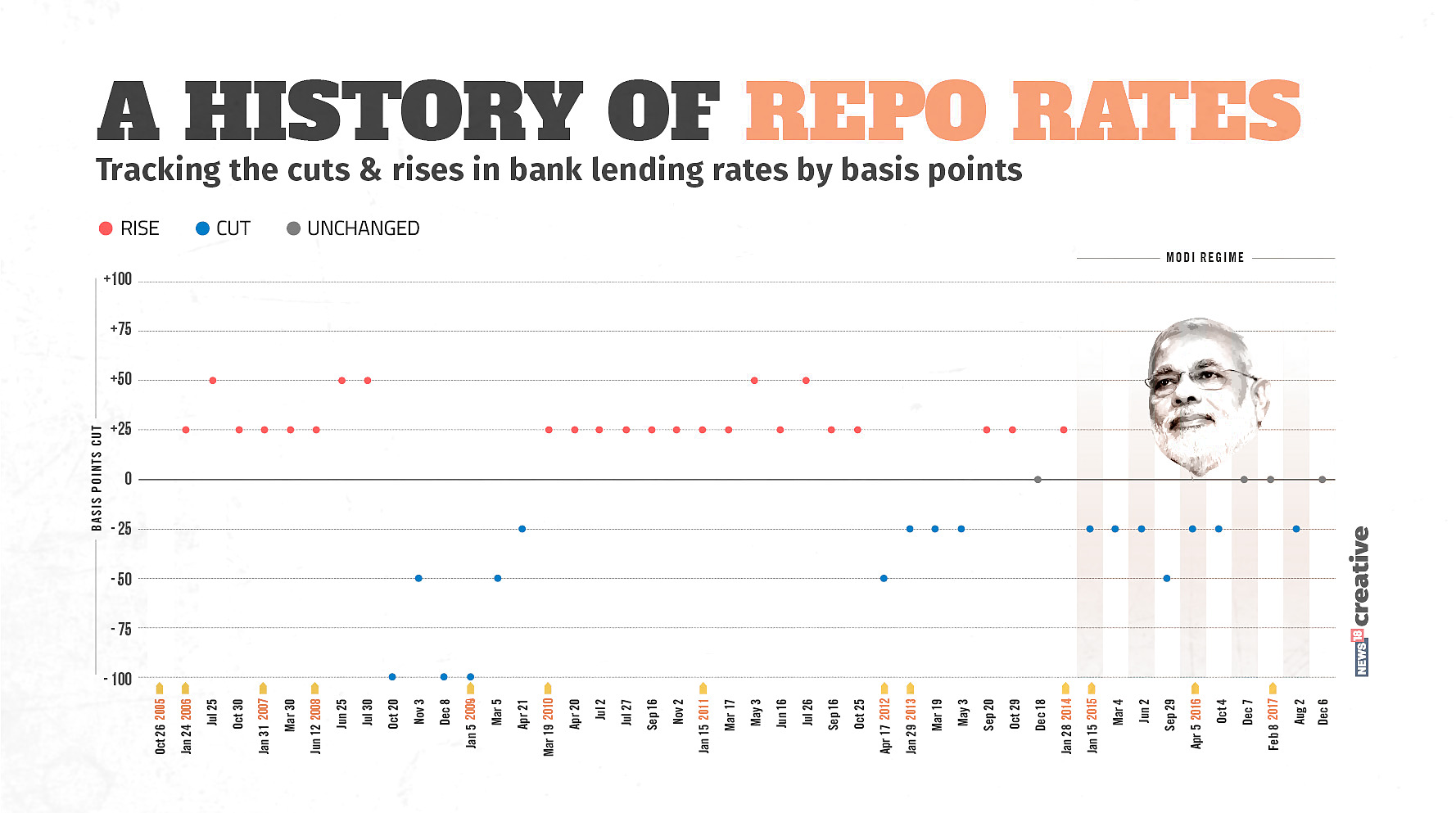

With five of its six members voting for the status quo, the Monetary Policy Committee, headed by Reserve Bank of India Governor Urjit Patel, for the second straight meeting kept the benchmark repurchase or repo rate at 6 percent, its lowest since November 2010.

The RBI also kept the reverse repo rate unchanged at 5.75 percent and left its policy stance "neutral" that may leave door open for a rate change in next meeting in February.

With inflation accelerating to a seven-month high of 3.58 percent in October, driven by higher food and oil prices, the status quo decision reflected RBI's concern about price pressures that are nearing its medium-term target.

"The MPC remains committed to keeping headline inflation close to 4 percent on a durable basis," RBI said in the Fifth Bi-Monthly Monetary Policy statement of 2017-18.

It raised inflation forecast to 4.3-4.7 percent for October-March, from 4.2-4.6 percent earlier, and noted that food and fuel price-gains edged up last month and risks to government revenue and any global financial instability could stoke inflation.

While five members of the MPC voted for the status quo, government nominee Ravindra H Dholakia wanted a 25 basis points cut.

RBI retained gross value added (GAV) -- key economic growth measure -- at 6.7 per cent for the fiscal year ending March 31. The government responded to the RBI decision with caution saying it has "taken note of the MPC statement".

Finance Ministry in a statement said that MPC has "recognised that inflation remains firmly under control, retaining its inflation projection for the second half of FY 2018 and assessing that the risks to this projection are evenly balanced".

"For that reason, it has maintained a neutral policy stance," it said, adding that the MPC retaining its annual GVA forecast for 2017-18 at 6.7 percent recognised several significant developments and emphasised the government's reform efforts such as GST, bank recapitalisation package and improving Ease of Doing Business Ranking.

GDP growth picked up to 6.3 per cent in the July-September period from 5.7 percent of the previous three months, halting a five-quarter deceleration. GVA increased 6.1 percent.

The neutral monetary stance means that all "possibilities are there on the table", Patel said, adding that RBI will monitor inflation and growth data in the coming months.

"In arriving at (today's) decision, the MPC took note of the upside pressures from food and fuel prices on the cost of living condition and inflation expectations. Our surveys indicate that corporates are also struggling with rising input costs and higher risks of pass-through to retail prices in the near-term," he said.

Patel said the hectic activity in the primary share issuances, recent reform measures by government, a climb-up in the ease of doing business ranking by the World Bank, recapitalisation of state-run banks and efforts to resolve the issue of bad assets under the provisions of the insolvency code bode well for the economy in the short to medium-term.

A healthy IPO market will add to demand for credit in the short-run and boost the growth potential in the medium- term, ease of doing business rankings will help attract foreign direct investment and bank recapitalisation will help enhance allocative efficiency of resources, he said.

"In the view of MPC (monetary policy committee), all these factors should help to create conducive financial conditions for nurturing higher growth," Patel said.

On growth, RBI executive director Michael Patra said: "It is going to be 7 and 7.8 (percent in the third and fourth quarters, respectively). So, we are on an uptick from now."

Patel said the latest credit data suggests that there is already an uptick. "As the economy picks up, the demand for credit will go up. There is enough supply to ensure that lack of credit is not on the way in supporting higher growth."

Deputy governor Viral Acharya said liquidity conditions have continued to normalise gradually during the year. The overhang of liquidity surplus in the system after the note-ban last November, which had touched a peak of close to Rs 7.96 trillion (Rs 7.96 lakh crore) at the beginning of the year, has since come down, he said.

Banking system liquidity has been moving towards neutrality as the currency in circulation has expanded by Rs 7.6 trillion during January 6 to November 24, 2017.

"It is expected that the liquidity condition would be marginally still in surplus by March 2018. Given the trends in currency in circulation, it is expected that liquidity may reach neutrality in the first half of 2018," Acharya said.

He said the RBI will continue to manage the evolving liquidity conditions through a mix of variable rate repo and reverse repo operations of various maturities, for handling short-term fluctuations.

"We will consider open market operations in case the liquidity is required to be injected or absorbed on a durable basis," he said.

Comments

0 comment