views

New Delhi: Promoters and directors of a listed company are required to disclose details about shares received by way of gift and through off-market transactions, according to regulator Sebi.

The clarifications have been given as part of an informal guidance sought by Kotak Mahindra Bank regarding certain aspects of the Prohibition of Insider Trading (PIT) regulations.

"... off market transaction or gift disclosure must be made in accordance with provisions of PIT (Prohibition of Insider Trading) regulations," it added.

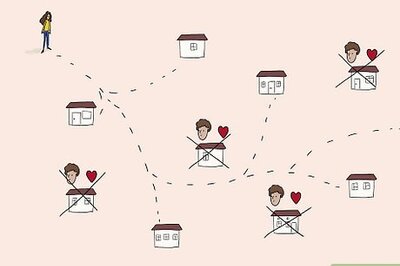

Off market transactions include transfer of shares to a family trust account.

According to Sebi norms, promoters, employees and directors of a firm is required to disclose about the number of shares acquired or disposed, in case the value of such shares aggregates to over Rs 10 lakh during a quarter, to the company and exchanges within two trading days of such transaction.

The number of shares acquired or disposed beyond this threshold has to be disclosed irrespective of the mode of acquisition or disposal.

The regulator further said that the value of securities would be calculated on the prevailing market value -- the day they were acquired or disposed of.

Noting that this position is based on the information furnished, Sebi said, "different facts or conditions might lead to a different result".

Comments

0 comment