views

TReDS related settlements.

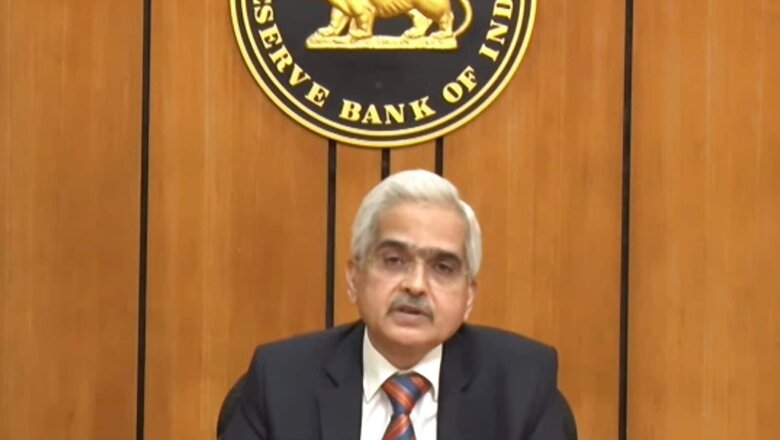

RBI MPC Meet: Reserve Bank of India governor Shaktikanta Das on Thursday, February 10, proposed to hike the NACH mandate limit. Das proposed to increase the NACH mandate limit from Rs 1 crore at present to Rs 3 crore for TReDS related settlements.

“The Trade Receivables Discounting System (TReDS) facilitates the financing of trade receivables of Micro, Small and Medium Enterprises (MSMEs). Transactions in TReDS are settled through the National Automated Clearing House (NACH) system,” said the RBI governor during his statement on Thursday.

“Keeping in view the requests received from stakeholders and to further enhance the ease of financing the growing liquidity requirements of MSMEs, it is proposed to increase the NACH mandate limit from Rs 1 crore at present to R 3 crore for TReDS related settlements,” he added.

What is NACH?

NACH (National Automated Clearing House) system can be used for making bulk transactions towards distribution of subsidies, dividends, interest, salary, pension etc. and also for bulk transactions towards collection of payments pertaining to telephone, electricity, water, loans, investments in mutual funds, insurance premium etc.

The system, implemented by the National Payments Corporation of India, for banks, financial institutions, corporates and government is a web based solution to facilitate interbank, high volume, electronic transactions which are repetitive and periodic in nature.

Significance of RBI Decision

Analysts in an earlier statement had highlighted the need for more policies to support MSMEs and startups, which have become a significant contributor to the economy of India.

“The age of digital finance offers fresh hopes and promise to bridge the unmet credit needs of micro, small and medium enterprises (MSMEs), who contribute 30% to India’s GDP, 45% to manufacturing and 48 per cent to merchandise exports of India. As Government of India aims to enhance the share of MSMEs to GDP to 50 per cent in the coming years, there is a need for policy thrust to address the roadblocks in meeting the credit needs of MSMEs,” the MVIRDC WTC Mumbai Research Study had said in a release.

The government had in January expressed concern about the poor uptake of the electronic invoice discounting platform TReDS (Trade Receivables Discounting System) by public sector undertakings (PSUs) and had asked stakeholders to discuss it. The RBI’s decision comes days after that.

What Analysts Say

“We hope the RBI’s move to enhance the settlement limit under NACH for TReDS transactions will promote volume in the three electronic bill discounting platforms.,” said Vijay Kalantri, chairman at MVIRDC World Trade Center Mumbai.

He added that in future, the government and RBI may take steps to address some of the concerns related to slow uptake of volume in these platforms.

“We also suggest RBI and government to encourage reverse factoring and revising capital adequacy norms for banks’ exposure to invoice financing under TReDS platform,” Kalantri added.

Read all the Latest Business News here

Comments

0 comment