views

Shares of Lupin slumped around 5 per cent in early trade on May 7 after the company reported a lower-than-expected rise in its Q4 FY24 net profit, dragged by a spike in raw material costs.

Pharma company Lupin reported a 52 per cent year-on-year (YoY) growth in its consolidated net profit at Rs 368 crore for the quarter ended March 2024. The same stood at Rs 242 crore in the last year quarter.

Revenue from operations in the same period jumped 12 per cent YoY to Rs 4,961 crore as against Rs 4430 crore in the corresponding period of last year.

The company’s Board has also declared a dividend of Rs 8 per share on the face value of Rs 2 each for the financial year ended March 2024.

EBITDA for the reporting quarter rose by a robust 67 per cent YoY to Rs 1,026 crore. It was Rs 615 crore a year ago. EBITDA margins, meanwhile, expanded 680 basis points compared with the year-ago period to 21 per cent.

What Should Investor’s Do Now?

Brokerage Nomura noted that the sharp margin expansion, outstripping its estimates by 8 percent, was impressive especially as it came in despite a seasonally weak quarter and higher R&D spending.

Going ahead, the management also paints a solid growth picture for the drugmaker.

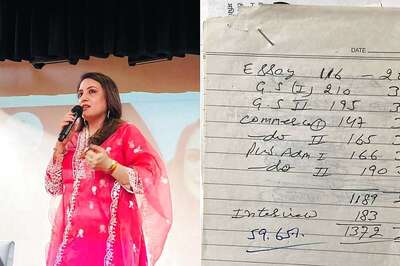

“While FY24 has been a year of resurgence for the company, we look forward to an even stronger FY25 driven by growth across our key geographies and consistent improvement in our margins,” said Nilesh Gupta, Managing Director, Lupin in a press statement.

Nomura also believes that US product launches and a tight leash on costs could present upside potential for Lupin, as compared to the brokerage’s current earnings estimates. Nomura has a ‘buy’ call on the stock with a price target of Rs 1,949.

Macquarie continued with an ‘outperform’ rating and gave a target of Rs 1,530. Citi maintained a ‘sell’ call on the stock and gave a target of Rs 1,380.

Comments

0 comment